Pep Boys 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

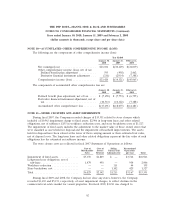

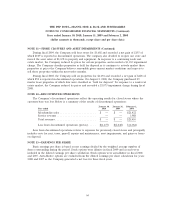

NOTE 8—INCOME TAXES (Continued)

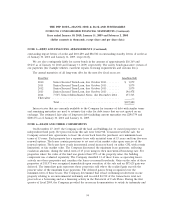

Items that gave rise to significant portions of the deferred tax accounts are as follows:

January 30, January 31,

2010 2009

Deferred tax assets:

Employee compensation ......................... $ 3,293 $ 3,649

Store closing reserves ........................... 1,741 576

Legal reserve ................................. 769 1,826

Benefit accruals ............................... 4,628 4,998

Net operating loss carryforwards—Federal ............ 911 8,608

Net operating loss carryforwards—State .............. 105,375 104,671

Tax credit carryforwards .......................... 18,503 18,243

Accrued leases ................................ 12,078 13,588

Interest rate derivatives .......................... 5,872 4,861

Deferred gain on sale leaseback .................... 66,613 69,746

Other ....................................... 2,183 5,668

Gross deferred tax assets ......................... 221,966 236,434

Valuation allowance ............................ (108,416) (107,212)

$ 113,550 $ 129,222

Deferred tax liabilities:

Depreciation .................................. $ 34,601 $ 35,153

Inventories ................................... 45,879 47,403

Real estate tax ................................ 2,885 2,946

Insurance and other ............................ 1,998 1,860

$ 85,363 $ 87,362

Net deferred tax asset ............................. $ 28,187 $ 41,860

As of January 30, 2010 and January 31, 2009, the Company had available tax net operating losses

that can be carried forward to future years. The Company has $911 of federal net operating loss

carryforwards (tax effected) which begin to expire in 2026. The Company has $4,410 of state tax net

operating loss carryforwards (tax effected) related to unitary filings of which 10% will expire in the next

five years beginning in 2010. The balance of the Company’s net operating loss carryforwards relate to

separate company filing jurisdictions that will expire in various years beginning in 2010 and have full

valuation allowances against them.

The tax credit carryforward at January 30, 2010 consists of $7,232 of alternative minimum tax

credits, $3,267 of work opportunity credits and $8,004 of state and Puerto Rico tax credits. The tax

credit carryforward at January 30, 2009 consists of $6,970 of alternative minimum tax credits, $3,064 of

work opportunity credits, $8,152 of state and Puerto Rico tax credits, and $57 of charitable contribution

carryforward.

59