Pep Boys 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

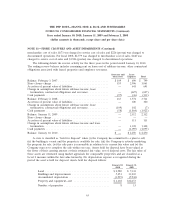

NOTE 11—STORE CLOSURES AND ASSET IMPAIRMENTS (Continued)

During fiscal 2009, the Company sold four stores for $3,602 and recorded a net gain of $155 of

which $109 is reported in discontinued operations. The company also decided to reopen one store and

moved the asset value of $1,658 to property and equipment. In response to a continuing weak real

estate market, the Company reduced its prices for certain properties and recorded a $3,110 impairment

charge. The Company classifies properties as held for disposal as it continues to actively market these

properties at prices the Company believes reasonable given current market conditions and expects to

sell these properties within the next twelve months.

During fiscal 2008, the Company sold six properties for $6,694 and recorded a net gain of $428 of

which $52 is reported in discontinued operations. On August 2, 2008, the Company purchased 29

master lease properties of which four were classified as ‘‘held for disposal.’’ In response to a weak real

estate market, the Company reduced its prices and recorded a $3,075 impairment charge during fiscal

2008.

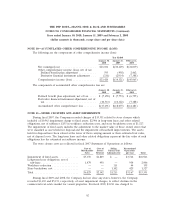

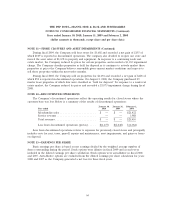

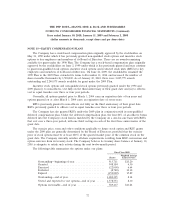

NOTE 12—DISCONTINUED OPERATIONS

The Company’s discontinued operations reflect the operating results for closed stores where the

customer base was lost. Below is a summary of the results of discontinued operations:

January 30, January 31, February 2,

Year ended 2010 2009 2008

Merchandise sales ....................... $ — $ — $21,422

Service revenue ......................... — — 3,988

Total revenues .......................... $ — $ — $25,410

Loss from discontinued operations (pretax) ..... $(1,657) $(2,448) $(6,064)

Loss from discontinued operations relates to expenses for previously closed stores and principally

includes costs for rent, taxes, payroll, repairs and maintenance, asset impairments, and gains or losses

on disposal.

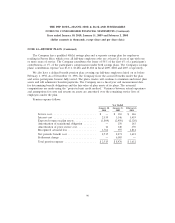

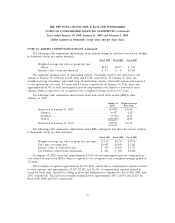

NOTE 13—EARNINGS PER SHARE

Basic earnings per share is based on net earnings divided by the weighted average number of

shares outstanding during the period. Stock options were dilutive in fiscal 2009 and as such were

included in the diluted earnings per share calculation. Stock options were anti-dilutive in fiscal 2008

and 2007. Anti-dilutive options are excluded from the diluted earnings per share calculation for years

2008 and 2007 as the Company generated a net loss for these fiscal years.

64