Pep Boys 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

Table of contents

-

Page 1

-

Page 2

-

Page 3

... size and business model allow us to buy quality parts at lower prices and pass those savings onto our customers. We opened 25 new stores in 2009 - 24 Service & Tire Centers and one smaller prototype Supercenter. Our plans call for 40 more new locations in 2010, followed by 80 in 2011. This growth...

-

Page 4

... bays and $1 million in expected sales. Our Supercenters were built to be destination stores. Our Service & Tire Centers offer customer convenience, allowing us to be close to our customers' home or work. They are also lower in cost and more efficient. Establish a differentiated Retail experience by...

-

Page 5

...The election of the full Board of Directors for a one-year term. The ratification of the appointment of our independent registered public accounting firm. The approval of the amendment and restatement of our 2009 Stock Incentive Plan to allow grants of performance-based awards to be deductible under...

-

Page 6

......23 Outstanding Equity Awards at Fiscal Year-End Table ...24 Option Exercises and Stock Vested Table ...25 Pension Plans ...25 Nonqualified Defined Contribution and Other Nonqualified Deferred Compensation Plans ...25 Employment Agreements with the Named Executive Officers ...26 Potential Payments...

-

Page 7

... by the Board of Directors for use at this year's Annual Meeting. The meeting will be held on Thursday, June 17, 2010, at the Hilton Philadelphia City Avenue, 4200 City Avenue, Philadelphia, Pennsylvania and will begin promptly at 9:00 a.m. The Company's Proxy Statement and 2009 Annual Report are...

-

Page 8

.... Simply complete and sign the proxy card and return it in the postage-paid envelope included in the materials. If you hold your shares through a bank or brokerage account, please complete and mail the voting instruction form in the envelope provided. • Ballot at the Annual Meeting. You may vote...

-

Page 9

...of Directors. The Board of Directors will then accept or reject the resignation, or take other appropriate action, based upon the best interests of Pep Boys and our shareholders and will publicly disclose its decision and rationale within 90 days. In contested elections, the nominees who receive the...

-

Page 10

... Who are Pep Boys' largest shareholders? Based solely on a review of filings with the SEC, the following table provides information about those shareholders that beneficially own more than 5% of the outstanding shares of Pep Boys Stock. Name Dimensional Fund Advisors LP Palisades West, Building One...

-

Page 11

...do Pep Boys' directors and executive officers own? The following table shows how many shares our directors and executive officers named in the Summary Compensation Table beneficially owned on April 9, 2010. The business address for each of such individuals is 3111 West Allegheny Avenue, Philadelphia...

-

Page 12

.... Ms. Scaccetti currently serves as a director of Nutrition Management Services Company and, during the past five years, served as a director of Di Giorgio Corporation. Ms. Scacetti's financial expertise, public-company director experience, familiarity with Pep Boys' business garnered through her...

-

Page 13

... five years, served as a director of Dynabazaar, Inc. and L Q Corporation, Inc. Mr. Mitarotonda's status as a significant shareholder, financial and corporate governance expertise, experiences as a chief executive officer, public-company director experience and familiarity with Pep Boys' business...

-

Page 14

...Westlake Chemical Corporation and, during the past five years, served as a director of NCI Building Systems Inc. Mr. Lukens' experiences as a chief executive officer, service industry and financial expertise, public-company director experience and familiarity with Pep Boys' business garnered through...

-

Page 15

...the current members of our Compensation Committee. None of these members is or has been an officer or employee of Pep Boys or has any relationship with Pep Boys requiring disclosure under Item 404 of SEC Regulation S-K. No executive officer of Pep Boys serves as a member of the board of directors or...

-

Page 16

... such meeting, then a shareholder's notice received at our principal executive offices within ten days of the date of such public announcement will be considered timely. The shareholder's notice must also set forth all of the following information: • the name and address of the shareholder making...

-

Page 17

... Plan provides for an annual equity grant having an aggregate value of $45,000 to non-management directors. The Stock Incentive Plan is administered, interpreted and implemented by the Compensation Committee of the Board of Directors. The table details the compensation paid to non-employee directors...

-

Page 18

... as a focal point for communication among the Board of Directors, the independent registered public accounting firm, management and Pep Boys' internal audit function, as the respective duties of such groups, or their constituent members, relate to Pep Boys' financial accounting and reporting and to...

-

Page 19

... Audit Committee annually engages Pep Boys' independent registered public accounting firm and preapproves, for the following fiscal year, their services related to the annual audit and interim quarterly reviews of Pep Boys' financial statements and all reasonably related assurance and services. All...

-

Page 20

... subheading "2010 Update." Unless otherwise indicated, all other discussion and analysis relates to our compensation policies and practices in place during, and compensation paid in consideration of service rendered in, fiscal 2009. Summary. The compensation provided to the executives listed in the...

-

Page 21

... of current and/or expected future company performance levels; Support Pep Boys' long-range business strategy; Establish a clear linkage between individual performance objectives and corporate or business unit financial performance objectives; and Align executive compensation with shareholder...

-

Page 22

... with Pep Boys stated fiscal 2009 goal to return to profitability, no percentage increase for officers as a group was budgeted, and no named executive officer was awarded a merit-based increase to their base salary, for fiscal 2009. 2010 Update. Towers Watson provided the Compensation Committee...

-

Page 23

... years if the applicable named executive officer remains employed by the Company. Mr. Odell declined $150,000 of his fiscal 2009 short-term incentive plan compensation that he was otherwise entitled to receive, which amount, at Mr. Odell's request, was allocated to an account set aside by Pep Boys...

-

Page 24

... be placed into a Pep Boys Stock account, rather than a money market account. Long-Term Incentives. Compensation through equity grants directly aligns the interests of management with that of its shareholders. The Stock Incentive Plan provides for the grant of stock options, at exercise prices equal...

-

Page 25

... to make annual refunds of contributions made by our "highly compensated employees" (including the named executive officers) under the savings plan. Beginning in 2004, we limited our officers' contributions to the savings plan to ½% of their salary per year. In order to assist our officers with...

-

Page 26

... such payments are in the best interests of Pep Boys and our shareholders. All compensation paid to the named executive officers in fiscal 2009 was fully deductible. Compensation Committee Report We have reviewed and discussed the foregoing Compensation Discussion and Analysis with management. Based...

-

Page 27

...retirement plan contributions and heath and welfare benefits.

Fiscal Name and Principal Position Year Michael R. Odell CEO(e) Raymond L. Arthur EVP - CFO(f) Joseph A. Cirelli SVP - Corporate Development William E. Shull III SVP-Stores(g) Scott A. Webb SVP - Merch. & Marketing(h) 2009 2008 2007 2009...

-

Page 28

(d) For fiscal 2009, consists of the following dollar amounts: Odell Contributed under our Account Plan Contributed (company match) under our Deferred Compensation Plan Contributed (company match) in connection with Pep Boys 401(k) Savings Plan Paid as dividend equivalents on time-based vesting RSUs...

-

Page 29

...customary annual equity grants made at the beginning of fiscal 2009 in respect of fiscal 2008 service. Estimated Potential Payouts Under Non-Equity Incentive Plan Awards(a) All Other Option Awards: Number of Securities Underlying Options (#) 400,000 40,000 22,500 40,000 40,000

Name Michael R. Odell...

-

Page 30

Outstanding Equity Awards at Fiscal Year-End Table The following table shows information regarding unexercised stock options and unvested RSUs held by the named executive officers as of January 30, 2010. Option Awards Stock Awards Market Value of Shares or Units of Stock Number of That Have Not ...

-

Page 31

... by Pep Boys and the number of years of participation in the plan. Benefits payable under this plan are not subject to deduction for Social Security or other offset amounts. The maximum annual benefit for any employee under this plan is $20,000. Mr. Cirelli is the only named executive officer who...

-

Page 32

... liquidation or dissolution of Pep Boys; or • such other events as the Board may designate. Non-Competition Agreements. In exchange for a severance payment equal to one year's base salary upon the termination of their employment without cause, each of our named executive officers has agreed to...

-

Page 33

...The following table shows information regarding the payments and benefits that each named executive officer would have received under his Non-Competition Agreement assuming that he was terminated without cause as of January 30, 2010.

Name Michael R. Odell Raymond L. Arthur Joseph A. Cirelli William...

-

Page 34

... statements of Pep Boys and its subsidiaries for fiscal 2010. Deloitte & Touche LLP served as our independent registered public accounting firm for fiscal 2009. A representative of Deloitte & Touche LLP is expected to be present at the meeting and will have the opportunity to make a statement if...

-

Page 35

... 162(m) of the Code. While the Board of Directors believes that time-based awards granted under the 2009 Plan align the interests of management with that of our shareholders -- long-term growth in the price of Pep Boys Stock -- the Board of Directors believes that the issuance of performance-based...

-

Page 36

... determine the key employees and members of the Board of Directors (including directors who are not employees) to whom and the times and the prices at which awards will be granted, (ii) determine the type of award to be granted and the number of shares of Pep Boys Stock subject to such awards, (iii...

-

Page 37

...of fair market value on a particular date, which will continue to be applicable immediately following adoption of the 2009 Stock Incentive Plan, is the mean between the highest and lowest quoted selling prices of the shares of Pep Boys Stock on the day of grant. The Compensation Committee determines...

-

Page 38

... the discretion to make additional awards under the 2009 Stock Incentive Plan to non-employee directors. "RSU Annualized Value" means, as of the date an award is granted, the average fair market value of a share of Pep Boys Stock during the immediately preceding year. "Option Annualized Value" means...

-

Page 39

... other equity compensation plans for which awards can be issued pursuant to future grants. It is not currently possible to predict the number of shares of Pep Boys Stock that will be granted to key employees or who will receive grants under the 2009 Stock Incentive Plan after the 2010 Annual Meeting...

-

Page 40

... goals over a three-year period for return on invested capital and/or total shareholder return. If such performance goals are not achieved, the awards will automatically be forfeited. On April 9, 2010, the closing price of a share of Pep Boys Stock on the New York Stock Exchange was $10.87...

-

Page 41

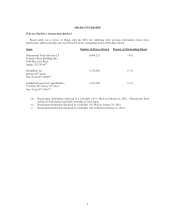

... in connection with an award, a number of shares of Pep Boys Stock equal to such tax liability. EQUITY COMPENSATION PLAN INFORMATION The following chart provides information regarding all of our equity compensation plans as of April 9, 2010. Number of securities remaining available for future...

-

Page 42

..., NY 12528, holder of 200 shares of Pep Boys Stock, has notified us that he intends to introduce the following resolution at the meeting: Adopt Simple Majority Vote Resolved: Shareholders request that our Board take the steps necessary so that each shareholder voting requirement in our charter and...

-

Page 43

... Securities Exchange Act of 1934 requires our directors, executive officers and 10% holders to file initial reports of ownership and reports of changes in ownership of Pep Boys Stock. Based solely upon a review of copies of such reports, we believe that during fiscal 2009, our directors, executive...

-

Page 44

... in the Board of Directors' proxy materials relating to that meeting must be received no later than December 31, 2010. Such proposals should be sent to: Pep Boys 3111 West Allegheny Avenue Philadelphia, PA 19132 Attention: Secretary Any shareholder proposal that does not comply with the applicable...

-

Page 45

... 1999 Stock Incentive Plan, and renames it as The Pep Boys - Manny, Moe & Jack 2009 Stock Incentive Plan, effective as of June 24, 2009, (the "Plan"). The Plan is intended to recognize the contributions made to the Company by key employees, and members of the Board of Directors, of the Company or...

-

Page 46

... discretion to (A) determine the key employees and members of the Board of Directors (including Non-management Directors) to whom and the times and the prices at which Awards shall be granted, (B) determine the type of Award to be granted and the number of Shares subject thereto, (C) determine the...

-

Page 47

... their initial election to the Board of Directors, each Non-management Director shall receive a pro-rata portion of an Annual Non-management Director Award based on a fraction, the numerator of which is the number of days remaining until the next scheduled Annual Meeting Date and the denominator of...

-

Page 48

... a national securities exchange, the mean between the highest and lowest quoted selling prices thereof, or, if the Shares are not so listed, the mean between the closing "bid" and "asked" prices thereof, as applicable and as the Committee determines, on the day the Option is granted, as reported in...

-

Page 49

...of the Federal Reserve Board. Furthermore, the Committee may provide in an Option Document issued to an employee (and shall provide in the case of Option Documents issued to Non-management Directors) that payment may be made all or in part in shares of the Company's Common Stock held by the Optionee...

-

Page 50

...for which the Company has not yet delivered the share certificates to the Optionee, upon refund by the Company of any option price paid by the Optionee. (vi) Immediately, without the requirement of any notice, upon the occurrence of an act by an Optionee who is a Non-management Director which act is...

-

Page 51

... upon official notice of issuance) upon each stock exchange upon which outstanding Shares of such class at the time of the Award are listed nor until there has been compliance with such laws or regulations as the Company may deem applicable, including without limitation registration or qualification...

-

Page 52

... provisions applicable to the award of Restricted Stock. (c) Criteria Used for Objective Performance Goals. The Committee shall use objectively determinable performance goals based on one or more of the following criteria: (i) return on total stockholder equity; (ii) earnings per Share; (iii...

-

Page 53

... 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company representing 20% or more of the combined voting power of the Company's then outstanding securities eligible to vote for the election of the Board of Directors (the "Voting Securities"); provided, however, that the...

-

Page 54

... than any employee benefit plan (or related trust) sponsored or maintained by the Surviving Corporation or the Parent Corporation), is or becomes the beneficial owner, directly or indirectly, of 20% or more of the total voting power of the outstanding voting securities eligible to elect directors of...

-

Page 55

...time to time in such manner as it may deem advisable. Nevertheless, the Board of Directors may not, without obtaining approval by vote of a majority of the votes cast at a duly called meeting of the shareholders at which a quorum representing a majority of all outstanding voting stock of the Company...

-

Page 56

-

Page 57

...'s definitive proxy statement, which will be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the Company's fiscal year, for the Company's 2010 Annual Meeting of Shareholders are incorporated by reference into Part III of this...

-

Page 58

... ...Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and Related Transactions and Director Independence ...Principal Accounting Fees and Services...

-

Page 59

...) customers with the highest quality service offerings and merchandise. In most of our Supercenters, we also have a commercial sales program that provides commercial credit and prompt delivery of tires, parts and other products to local, regional and national repair shops and dealers. The Company...

-

Page 60

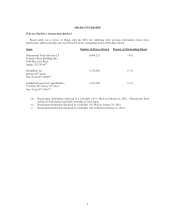

... fiscal years, and the number of stores opened and closed by the Company during each of the last four fiscal years: NUMBER OF STORES AT END OF FISCALS 2006 THROUGH 2009

2009 Year End 2008 Year End 2007 Year End 2006 Year End

State

Closed

Opened

Closed

Opened

Closed

Opened

Alabama ...Arizona...

-

Page 61

... and business model allow us to buy quality parts at lower prices and pass those savings onto our customers. Our store growth plans are centered on a ''hub and spoke'' model, which calls for adding smaller neighborhood Service & Tire Centers to our existing Supercenter store base in order to further...

-

Page 62

... and 27% of the Company's merchandise sales in fiscal 2009, 2008, and 2007, respectively. The Company's commercial automotive parts delivery program, branded PEP EXPRESS PARTS↧, is designed to increase the Company's market share with the professional installer and to leverage inventory investment...

-

Page 63

... credit card, other credit and debit card transactions and commercial credit accounts. STORE OPERATIONS AND MANAGEMENT Most Pep Boys stores are open seven days a week. Each Supercenter has a Retail Manager and Service Manager (Service & Tire Centers only have a Service Manager while Pep Express...

-

Page 64

... regulations relating to the operation of its business, including those governing the handling, storage and disposal of hazardous substances contained in the products it sells and uses in its service bays, the recycling of batteries, tires and used lubricants, the sale of small engine merchandise...

-

Page 65

... had no union employees as of January 30, 2010. At January 31, 2009, the Company employed 12,169 full-time and 6,289 part-time employees. SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS Certain statements contained herein, including in ''Item 1 Business'' and ''Item 7 Management's Discussion and...

-

Page 66

... 2007 Senior Vice President-Human Resources since July 2007 Senior Vice President-Stores since September 2008 Senior Vice President-Merchandising & Marketing since September 2007 Senior Vice President-General Counsel & Secretary since March 2009

Michael R. Odell was named Chief Executive Officer...

-

Page 67

... TBC Corporation, then the parent company of Big O Tires, Tire Kingdom and National Tire & Battery. Mr. Fee has over 20 years experience in operations and human resources in the tire and automotive service and repair business. William E. Shull III joined the Company in September 2008 as Senior Vice...

-

Page 68

...Related to Pep Boys We may not be able to successfully implement our business strategy, which could adversely affect our business, financial condition, results of operations and cash flows. In fiscal 2007, we adopted our long-term strategic plan, which includes numerous initiatives to increase sales...

-

Page 69

... in the products we sell and use in our service bays, the recycling of batteries, tires and used lubricants, the ownership and operation of real property and the sale of small engine merchandise. When we acquire or dispose of real property or enter into financings secured by real property, we...

-

Page 70

...'' customers, such as generators, power tools and canopies. Commercial • mass merchandisers, wholesalers and jobbers (some of which are associated with national parts distributors or associations). Do-It-For-Me Service • regional and local full service automotive repair shops; • automobile...

-

Page 71

...,000 square foot corporate headquarters in Philadelphia, Pennsylvania and a 60,000 square foot structure in Los Angeles, California. The Company also owns the following administrative regional offices-approximately 4,000 square feet of space in each of Melrose Park, Illinois and Bayamon, Puerto Rico...

-

Page 72

...DE, MA, MD, ME, NH, NJ, NY, PA, RI, VA DE, NJ, PA Auxiliary warehouse space

In addition to the distribution centers above, the Company leases four satellite warehouses of approximately 78,700 square feet each. These satellite warehouses stock approximately 36,000 StockKeeping Units (SKUs), serve an...

-

Page 73

financial position, any such loss could have a material adverse effect on the Company's results of operations in the period(s) during which the underlying matters are resolved. ITEM 4 (REMOVED AND RESERVED)

15

-

Page 74

... 5 MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The common stock of The Pep Boys-Manny, Moe & Jack is listed on the New York Stock Exchange under the symbol ''PBY.'' There were 4,998 registered shareholders as of April 2, 2010. The...

-

Page 75

... first column (a))

Equity compensation plans approved by security holders ...STOCK PRICE PERFORMANCE

2,005,775

$6.83

2,240,075

The following graph compares the cumulative total return on shares of Pep Boys stock over the past five years with the cumulative total return on shares of companies in...

-

Page 76

... Five Year Total Return $200

$150

$100

$50

$0 Jan-05

Jan-06

Pep Boys Peer Group

Jan-07

Jan-08

Jan-09

Jan-10

S&P SmallCap 600 Index S&P 600 Automotive Retail Index

8APR201019223557

Jan. 2010

Company/Index

Jan. 2005

Jan. 2006

Jan. 2007

Jan. 2008

Jan. 2009

Pep Boys ...S&P SmallCap...

-

Page 77

... share price range: High ...Low ...OTHER STATISTICS Return on average stockholders' equity(8) ...Common shares issued and outstanding ...Capital expenditures ...Number of stores ...Number of service bays ...(1) (2) Jan. 30, Jan. 31, Feb. 2, Feb. 3, Jan. 28, 2010 2009 2008 2007 2006 (dollar amounts...

-

Page 78

...fiscal years reflect 52 weeks. Gross profit from merchandise sales includes the cost of products sold, buying, warehousing and store occupancy costs. Gross profit from service revenue includes the cost of installed products sold, buying, warehousing, service payroll and related employee benefits and...

-

Page 79

... 30, 2010, we operated 553 Supercenters and 25 Service & Tire Centers, as well as nine legacy Pep Express (retail only) stores throughout 35 states and Puerto Rico. EXECUTIVE SUMMARY During fiscal 2009, the Company continued to focus on executing its long-term strategic plan and reported its first...

-

Page 80

... Jan 30, 2010 Jan 31, 2009 Feb 2, 2008 (Fiscal 2009) (Fiscal 2008) (Fiscal 2007) Percentage Change Fiscal 2009 vs. Fiscal 2008 vs. Fiscal 2008 Fiscal 2007

Year ended

Merchandise sales ...Service revenue(1) ...Total revenues ...Costs of merchandise sales(2) ...Costs of service revenue(2) ...Total...

-

Page 81

... Costs of merchandise sales include the cost of products sold, buying, warehousing and store occupancy costs. Costs of service revenue include service center payroll and related employee benefits and service center occupancy costs. Occupancy costs include utilities, rents, real estate and property...

-

Page 82

... increased to 9.9% for fiscal 2009 from 7.0% in fiscal 2008. Gross profit from service revenue increased by $12,362,000, or 49.6%. Both the current year and the prior year gross profit from service revenue included an asset impairment charge related to previously closed stores of $673,000 and $648...

-

Page 83

... communicates to our customers our commitment to fulfilling all of their automotive aftermarket needs. Merchandise sales declined in fiscal 2008 as compared to fiscal 2007 as a result of our decision to exit non-core and unproductive products and lower customer counts. Gross profit from merchandise...

-

Page 84

... the U.S. automotive aftermarket, which has two general lines of business: the Service Business defined as Do-It-For-Me (service labor, installed merchandise and tires) and the Retail Business defined as Do-It-Yourself (retail merchandise) and commercial. Generally, specialized automotive retailers...

-

Page 85

...and store occupancy costs. (4) Gross profit from service center revenue includes the cost of installed products sold, buying, warehousing, service center payroll and related employee benefits and service center occupancy costs. Occupancy costs include utilities, rents, real estate and property taxes...

-

Page 86

...and $34,762,000, for fiscal 2009 and fiscal 2008, respectively. Capital expenditures for the current year were for improvement of our existing stores and distribution centers, opening of new Service & Tire Centers and one prototype Supercenter. Our fiscal 2010 capital expenditures are expected to be...

-

Page 87

... $2,574 and pension obligation of $14,164 because we cannot make a reliable estimate of the timing of the related cash payments.

Commercial Commitments Total Due in less Due in Due in than 1 year 1-3 years 3-5 years (dollar amounts in thousands) Due after 5 years

Import letters of credit ...Standby...

-

Page 88

... of January 30, 2010, 126 stores collateralized the Senior Secured Term Loan. The outstanding balance under the Term loan at the end of fiscal 2009 was $149,715,000. The $1,079,000 decline in the outstanding balance was due to quarterly principal payments. Revolving Credit Agreement, through January...

-

Page 89

.... Total operating lease commitments as of January 30, 2010 were $776,285,000. Pension and Retirement Plans The Company has a Supplemental Executive Retirement Plan (SERP). This unfunded plan had a defined benefit component that provided key employees designated by the Board of Directors with

31

-

Page 90

...achievement of certain pre-established financial performance goals. The Company's savings plans' contribution expense was $3,111,000, $3,286,000 and $3,480,000 in fiscal 2009, 2008 and 2007, respectively. We also have a defined benefit pension plan covering our full-time employees hired on or before...

-

Page 91

...-going basis, management evaluates its estimates and judgments, including those related to customer incentives, product returns and warranty obligations, bad debts, inventories, income taxes, financing operations, restructuring costs, retirement benefits, share-based compensation, risk participation...

-

Page 92

...have a share-based compensation plan, which includes stock options and restricted stock units, or RSUs. We account for our share-based compensation plans on a fair value basis. We determine the fair value of our stock options at the date of the grant using the Black-Scholes option-pricing model. The...

-

Page 93

...is not more-likely-than-not, we must establish a valuation allowance. In this regard when determining whether or not we should establish a valuation allowance, the Company considers various tax planning strategies, including potential real estate transactions, as future taxable income. To the extent...

-

Page 94

... included in the Accounting Standards Codification (ASC) 715 ''Compensation-Retirement Benefits.'' The guidance requires additional disclosures about plan assets of a defined benefit pension or other postretirement plans and is effective for fiscal years ending after December 15, 2009. The adoption...

-

Page 95

... payments to a fixed rate of 5.036% and terminates in October 2013. On November 27, 2007, the Company sold the land and buildings for 34 owned properties to an independent third party. The Company used $162,558,000 of the net proceeds from the transaction to prepay a portion of the Senior Secured...

-

Page 96

... ACCOUNTING FIRM

To the Board of Directors and Stockholders of The Pep Boys-Manny, Moe & Jack Philadelphia, Pennsylvania We have audited the accompanying consolidated balance sheets of The Pep Boys-Manny, Moe & Jack and subsidiaries (the ''Company'') as of January 30, 2010 and January 31, 2009...

-

Page 97

... BALANCE SHEETS The Pep Boys-Manny, Moe & Jack and Subsidiaries (dollar amounts in thousands, except share data)

January 30, 2010 January 31, 2009

ASSETS Current assets: Cash and cash equivalents ...Accounts receivable, less allowance for $1,488 and $1,912 ...Merchandise inventories ...Prepaid...

-

Page 98

...Pep Boys-Manny, Moe & Jack and Subsidiaries (dollar amounts in thousands, except per share data)

January 30, 2010 January 31, 2009 February 2, 2008

Year ended

Merchandise sales ...Service revenue ...Total revenues ...Costs of merchandise sales ...Costs of service revenue ...Total costs... (benefit) ...

-

Page 99

... taxes ...Change in measurement date of retirement benefit effect, net of tax ...Effect of stock options and related tax benefits ...Effect of restricted stock unit conversions . Stock compensation expense ...Repurchase of common stock ...Dividend reinvestment plan ...68,557 1,752 (4,818) 9,756 (41...

-

Page 100

... on trade payable program liability ...Payments on trade payable program liability ...Payments for finance issuance costs ...Proceeds from lease financing ...Long-term debt and capital lease obligation payments Dividends paid ...Repurchase of common stock ...Other ...

Net cash used in financing...

-

Page 101

... in the sale of automotive tires, parts and accessories through a chain of stores. The Company currently operates stores in 35 states and Puerto Rico. FISCAL YEAR END The Company's fiscal year ends on the Saturday nearest to January 31. Fiscal 2009, which ended January 30, 2010, fiscal 2008, which...

-

Page 102

...) Years ended January 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 1-SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) The Company also records adjustments for potentially excess and obsolete inventories based on current...

-

Page 103

... net of an allowance for estimated future returns. The Company establishes reserves for sales returns and allowances based on current sales levels and historical return rates. Gift cards are recorded as deferred revenue until redeemed for product or services. The Company does not record any revenue...

-

Page 104

...Costs of merchandise sales include the cost of products sold, buying, warehousing and store occupancy costs. Costs of service revenue include service center payroll and related employee benefits, service center occupancy costs and cost of providing free or discounted towing services to our customers...

-

Page 105

... exercise of dilutive stock options. ACCOUNTING FOR STOCK-BASED COMPENSATION At January 30, 2010, the Company has two stock-based employee compensation plans, which are described in Note 15, ''Equity Compensation Plans.'' Compensation costs relating to share-based payment transactions are recognized...

-

Page 106

... SIGNIFICANT ACCOUNTING POLICIES (Continued) business. The Company aggregates all of its operating segments and has one reportable segment. Sales by major product categories are as follows:

Year ended January 30, 2010 January 31, 2009 February 2, 2008

Parts and accessories ...Tires ...Service labor...

-

Page 107

..., 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 1-SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) • Recognize, through comprehensive income, certain changes in the funded status of a defined benefit and post retirement plan...

-

Page 108

... (Continued) Years ended January 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 1-SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) December 15, 2009. The adoption did not have a material impact on the Company's consolidated...

-

Page 109

...taxes receivable ...Other ...Total ...NOTE 4-ACCRUED EXPENSES The following are the components of accrued expenses:

$61,599 3,600 229 $65,428

$62,014 163 244 $62,421

January 30, 2010

January 31, 2009

Casualty and medical risk insurance ...Accrued compensation and related taxes Sales tax payable...

-

Page 110

... Senior Notes due June 1, 2007. On February 15, 2007, we further amended the Senior Secured Term Loan facility to reduce the interest rate from LIBOR plus 2.75% to LIBOR plus 2.00%. On November 27, 2007, we sold the land and buildings for 34 owned properties to an independent third party. We used...

-

Page 111

... account receivables owed by us directly from our vendors. There was an outstanding balance of $34,099 and $31,930 under these programs as of January 30, 2010 and January 31, 2009, respectively. We have letter of credit arrangements in connection with our risk management, import merchandising...

-

Page 112

...are not quoted on an exchange. The estimated fair value of long-term debt including current maturities was $290,754 and $200,276 as of January 30, 2010 and January 31, 2009. NOTE 6-LEASE AND OTHER COMMITMENTS On November 27, 2007, the Company sold the land and buildings for 34 owned properties to an...

-

Page 113

...) Years ended January 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 6-LEASE AND OTHER COMMITMENTS (Continued) removed its continuing involvement with this property. The Company then recorded the sale of this property as a sale...

-

Page 114

... 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 6-LEASE AND OTHER COMMITMENTS (Continued) Assets accounted for under the financing method are summarized as follows:

January 30, 2010 January 31, 2009

Land ...Buildings ...Equipment...

-

Page 115

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended January 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 7-ASSET RETIREMENT OBLIGATIONS (Continued) The Company has ...

-

Page 116

... (benefit) follows:

January 30, 2010 Year Ended January 31, 2009 February 2, 2008

Statutory tax rate ...State income taxes, net of federal tax ...Job credits ...Texas law change impact ...Tax uncertainty adjustment ...Valuation allowance ...Non deductible expenses ...Stock compensation ...Foreign...

-

Page 117

... 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 8-INCOME TAXES (Continued) Items that gave rise to significant portions of the deferred tax accounts are as follows:

January 30, 2010 January 31, 2009

Deferred tax assets: Employee compensation ...Store closing reserves...

-

Page 118

... a valuation allowance. To establish this positive evidence, the Company considers various tax planning strategies for generating income sufficient to utilize the deferred tax assets, including the potential sale of real estate and the conversion of the Company's accounting policy for its inventory...

-

Page 119

...affect our annual effective tax rate. NOTE 9-STOCKHOLDERS' EQUITY SHARE REPURCHASE-TREASURY STOCK On September 7, 2006, the Company renewed its share repurchase program and reset the authority back to $100,000 for repurchases to be made from time to time in the open market or in privately negotiated...

-

Page 120

... 111 1,102 $1,213

During fiscal 2009 and 2008, the Company did not close any stores, however, the Company recorded $3,110 and $5,353, respectively, of asset impairment charges, to reflect declines in the commercial real estate market for vacant properties. For fiscal 2009, $2,211 was charged to

62

-

Page 121

...Continued) Years ended January 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data) NOTE 11-STORE CLOSURES AND ASSET IMPAIRMENTS (Continued) merchandise cost of sales, $673 was charged to service cost of sales and $226 (pretax) was charged to...

-

Page 122

... OPERATIONS The Company's discontinued operations reflect the operating results for closed stores where the customer base was lost. Below is a summary of the results of discontinued operations:

Year ended January 30, 2010 January 31, 2009 February 2, 2008

Merchandise sales ...Service revenue...

-

Page 123

... settlement charge. The Company continues to maintain the non-qualified defined contribution portion of the SERP plan (Account Plan) for key employees designated by the Board of Directors. The Company's contribution expense for the Account Plan was $790, $163 and $440 for fiscal 2009, 2008 and 2007...

-

Page 124

...30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 14-BENEFIT PLANS (Continued) The Company has a qualified 401(k) savings plan and a separate savings plan for employees residing in Puerto Rico, which cover all full-time employees who...

-

Page 125

... were used to determine benefit obligation and pension expense:

January 30, 2010 Year Ended January 31, 2009 February 2, 2008

Benefit obligation assumptions: Discount rate ...Rate of compensation increase . Pension expense assumptions: Discount rate ...Expected return on plan assets . Rate of...

-

Page 126

... share data)

NOTE 14-BENEFIT PLANS (Continued) The following table sets forth the reconciliation of the benefit obligation, fair value of plan assets and funded status of the Company's defined benefit plans:

Year ended January 30, 2010 January 31, 2009

Change in benefit Benefit obligation Service...

-

Page 127

... investment strategy changes, market value fluctuations, the length of time it takes to fully implement investment allocation positions (such as private equity and real estate), and the timing of benefit payments and contributions. Short term investments and exchange-traded derivatives are used to...

-

Page 128

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended January 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 14-BENEFIT PLANS (Continued) requires that the asset ...

-

Page 129

..., 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 14-BENEFIT PLANS (Continued) publicly traded. The underlying assets in these funds (equity securities and fixed income securities) are publicly traded on exchanges and price quotes for...

-

Page 130

...applicable to future stock option and RSU grants under the 2009 plan are generally determined by the Board of Directors; provided that the exercise price of stock options must be at least 100% of the quoted market price of the common stock on the grant date. The Company currently satisfies all share...

-

Page 131

... ended January 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 15-EQUITY COMPENSATION PLANS (Continued) The following table summarizes information about options during the last three fiscal years (dollars in thousands except per...

-

Page 132

... of the options, the Company has utilized the ''simplified method'' allowable under the Securities and Exchange Commission, or SEC, Staff Accounting Bulletin No.107, ''Share-Based Payment'' through December 31, 2007 and changed to an actual experience method during fiscal 2008. The risk-free rate is...

-

Page 133

... PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended January 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 16-INTEREST RATE SWAP AGREEMENT (Continued) of February 3, 2007...

-

Page 134

... STATEMENTS (Continued) Years ended January 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 17-FAIR VALUE MEASUREMENTS (Continued) Assets and Liabilities that are Measured at Fair Value on a Recurring Basis: The Company's long-term...

-

Page 135

... as when there is evidence of impairment. In response to a continuing weak real estate market, the Company reduced its prices for certain properties held for disposal and recorded impairment charges of $3,110 and $5,353 for fiscal 2009 and 2008, respectively. The fair values were based on selling...

-

Page 136

... balance sheets as of January 30, 2010 and January 31, 2009 and the related condensed consolidating statements of operations and condensed consolidating statements of cash flows for fiscal 2009, 2008 and 2007 for (i) the Company (''Pep Boys'') on a parent only basis, with its investment in...

-

Page 137

...,171 18,388

Total current assets ...Property and equipment-net . Investment in subsidiaries ...Intercompany receivable ...Deferred income taxes ...Other long-term assets ...

Total assets ...LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable ...Trade payable program liability...

-

Page 138

...,708 18,792

Total current assets ...Property and equipment-net . Investment in subsidiaries ...Intercompany receivable ...Deferred income taxes ...Other long-term assets ...

Total assets ...LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable ...Trade payable program liability...

-

Page 139

...Year ended January 30, 2010

Pep Boys

Consolidated

Merchandise sales ...Service revenue ...Other revenue ...Total revenues ...Costs of merchandise sales ...Costs of service revenue ...Costs of other revenue ...Total costs... . . Income tax (benefit) expenses ...Equity in earnings of subsidiaries ....

-

Page 140

.../ Elimination

Year ended January 31, 2009

Pep Boys

Consolidated

Merchandise sales ...Service revenue ...Other revenue ...Total revenues ...Costs of merchandise sales ...Costs of service revenue ...Costs of other revenue ...Total costs of revenues ...Gross profit from merchandise sales ...Gross...

-

Page 141

.../ Elimination

Year ended February 2, 2008

Pep Boys

Consolidated

Merchandise sales ...Service revenue ...Other revenue ...Total revenues ...Costs of merchandise sales ...Costs of service revenue ...Costs of other revenue ...Total costs of revenues ...Gross profit from merchandise sales ...Gross...

-

Page 142

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended January 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 20-SUPPLEMENTAL GUARANTOR INFORMATION (Continued) CONDENSED ...

-

Page 143

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended January 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 20-SUPPLEMENTAL GUARANTOR INFORMATION (Continued) CONDENSED ...

-

Page 144

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended January 30, 2010, January 31, 2009 and February 2, 2008 (dollar amounts in thousands, except share and per share data)

NOTE 20-SUPPLEMENTAL GUARANTOR INFORMATION (Continued) CONDENSED ...

-

Page 145

... management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures. Based upon the evaluation of the Company's disclosure controls and procedures, as of the end of the period covered by this report, the Company's principal executive officer...

-

Page 146

... of The Pep Boys-Manny, Moe and Jack (the Company) is responsible for establishing and maintaining adequate internal control over financial reporting. The Company's internal control over financial reporting is a process designed under the supervision of the Company's principal executive officer and...

-

Page 147

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of The Pep Boys-Manny, Moe & Jack Philadelphia, Pennsylvania We have audited the internal control over financial reporting of The Pep Boys-Manny, Moe & Jack and subsidiaries (the ''Company'') as of January 30, 2010, based...

-

Page 148

... with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements and financial statement schedule as of and for the year ended January 30, 2010 of the Company and our report dated April 12, 2010 expressed an unqualified opinion on those...

-

Page 149

... audit, human resources and nominating and governance committees may also be found under the ''Investor Relations-Corporate Governance'' section of our website. As required by the New York Stock Exchange (''NYSE''), promptly following our 2009 Annual Meeting, our Chief Executive Officer certified to...

-

Page 150

... statements of The Pep Boys-Manny, Moe & Jack are included in Item 8 Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets-January 30, 2010 and January 31, 2009 ...Consolidated Statements of Operations-Years ended January 30, 2010, January 31, 2009 and February...

-

Page 151

... The Pep Boys Savings Plan Amendment 2007-1 Amendment and restatement as of September 3, 2002 of The Pep Boys Savings Plan-Puerto Rico. The Pep Boys Deferred Compensation Plan, as amended and restated The Pep Boys Annual Incentive Bonus Plan (amended and restated as of January 31, 2009) Account Plan...

-

Page 152

(10.17)* (10.18)*

Flexible Employee Benefits Trust The Pep Boys Grantor Trust Agreement

Incorporated by reference from the Company's Form 8-K filed May 6, 1994. Incorporated by reference from the Company's Form 10-K for the fiscal year ended February 3, 2007. Incorporated by reference from the ...

-

Page 153

... Securities Exchange Act of 1934, the Registrant has duly caused this Annual Report of Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized. THE PEP BOYS-MANNY, MOE & JACK (REGISTRANT)

Dated: April 12 , 2010

By:

/s/ RAYMOND L. ARTHUR Raymond L. Arthur Executive Vice...

-

Page 154

...REID Dr. Irvin D. Reid

Director

April 12, 2010

/s/ JANE SCACCETTI Jane Scaccetti

Director

April 12, 2010

/s/ JOHN T. SWEETWOOD John T. Sweetwood

Director

April 12, 2010

/s/ NICK WHITE Nick White

Director

April 12, 2010

/s/ JAMES A. WILLIAMS James A. Williams

Director

April 12, 2010

96

-

Page 155

... E Additions Charged Additions Charged Balance at to Costs to Other Balance at Beginning of Period and Expenses Accounts(2) Deductions(2) End of Period (in thousands)

Column B

SALES RETURNS AND ALLOWANCES: Year ended January 30, 2010 ...Year ended January 31, 2009 ...Year ended February 2, 2008...

-

Page 156

Exhibit 12

Fiscal Year Ended January 30, 2010 January 31, February 2, February 3, 2009 2008 2007 (in thousands, except ratios) January 28, 2006

Interest ...Interest factor in rental expense ...Capitalized interest ...(a) Fixed charges, as defined ...Earnings (loss) from continuing operations before...

-

Page 157

...Pep Boys-Manny, Moe & Jack and subsidiaries (the ''Company'') and the effectiveness of the Company's internal control over financial reporting appearing in this Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack for the fiscal year ended January 30, 2010. DELOITTE & TOUCHE LLP Philadelphia...

-

Page 158

...-14(a) UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 I, Michael R. Odell, certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack; Based on my knowledge, this report does not contain any...

-

Page 159

...management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: April 12, 2010 by: /s/ RAYMOND L. ARTHUR Raymond L. Arthur Executive Vice President and Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer...

-

Page 160

... with this Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack (the ''Company'') for the year ended January 30, 2010, as filed with the Securities and Exchange Commission on the date hereof (the ''Report''), I, Michael R. Odell, Principal Executive Officer of the Company, certify, pursuant...

-

Page 161

... with this Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack (the ''Company'') for the year ended January 30, 2010, as filed with the Securities and Exchange Commission on the date hereof (the ''Report''), I, Raymond L. Arthur, Executive Vice President and Chief Financial Officer of the...

-

Page 162

-

Page 163

-

Page 164