OfficeMax 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

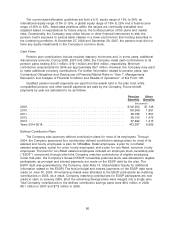

We have been notified that we are a ‘‘potentially responsible party’’ under the Comprehensive

Environmental Response Compensation and Liability Act (‘‘CERCLA’’) or similar federal and state

laws, or have received a claim from a private party, with respect to certain sites where hazardous

substances or other contaminants are or may be located. These sites relate to operations either no

longer owned by the Company or unrelated to its ongoing operations. For sites where a range of

potential liability can be determined, we have established appropriate reserves. We cannot predict

with certainty the total response and remedial costs, our share of the total costs, the extent to

which contributions will be available from other parties or the amount of time necessary to complete

the cleanups. Based on our investigations; our experience with respect to cleanup of hazardous

substances; the fact that expenditures will, in many cases, be incurred over extended periods of

time; and in some cases, the number of solvent potentially responsible parties, we do not believe

that the known actual and potential response costs will, in the aggregate, materially affect our

financial position, results of operations or cash flows.

Over the past several years and continuing in 2009, we have been named a defendant in a

number of cases where the plaintiffs allege asbestos-related injuries from exposure to asbestos

products or exposure to asbestos while working at job sites. The claims vary widely and often are

not specific about the plaintiffs’ contacts with the Company. None of the claimants seeks damages

from us individually, and we are generally one of numerous defendants. Many of the cases filed

against us have been voluntarily dismissed, although we have settled some cases. The settlements

we have paid have been covered mostly by insurance, and we believe any future settlements or

judgments in these cases would be similarly covered. To date, no asbestos case against us has

gone to trial, and the nature of these cases makes any prediction as to the outcome of pending

litigation inherently subjective. At this time, however, we believe our involvement in asbestos

litigation is not material to either our financial position or our results of operations.

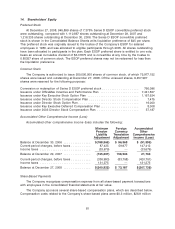

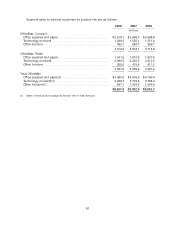

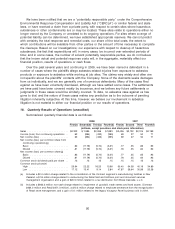

18. Quarterly Results of Operations (unaudited)

Summarized quarterly financial data is as follows:

2008 2007

First(a) Second(b) Third(c) Fourth(d) First(e) Second Third Fourth(f)

(millions, except per-share and stock price information)

Sales ......................... $2,303 $ 1,985 $2,096 $1,883 $2,436 $2,132 $2,315 $2,199

Income (loss) from continuing operations . . 63 (894) (432) (395) 59 27 50 71

Net income (loss) ................. 63 (894) (432) (395) 59 27 50 71

Net income (loss) per common share from

continuing operations(g)

Basic ....................... .82 (11.79) (5.70) (5.21) .77 .35 .65 .93

Diluted ...................... .81 (11.79) (5.70) (5.21) .76 .35 .64 .92

Net income (loss) per common share(g)

Basic ....................... .82 (11.79) (5.70) (5.21) .77 .35 .65 .93

Diluted ...................... .81 (11.79) (5.70) (5.21) .76 .35 .64 .92

Common stock dividends paid per share . . .15 .15 .15 .15 .15 .15 .15 .15

Common stock prices(h)

High ........................ 25.64 22.22 16.23 10.96 55.40 54.38 40.16 34.89

Low ........................ 17.12 13.41 9.14 2.84 47.87 38.64 30.96 20.38

(a) Includes a $2.4 million charge related to the consolidation of the Contract segment’s manufacturing facilities in New

Zealand, a $1.8 million charge related to restructuring the Retail field and ImPress print and document services

management organization and a gain of $20.5 million related to a tax distribution from Boise Cascade, L.L.C.

(b) Includes a $935.3 million non-cash charge related to impairment of goodwill, trade names and fixed assets. (Contract

$464.0 million and Retail $471.3 million), a $10.2 million charge related to employee severance from the reorganization

of Retail store management, and a gain of 3.1 million related to the legacy Voyageur Panel business sold in 2004.

90