OfficeMax 2008 Annual Report Download - page 86

Download and view the complete annual report

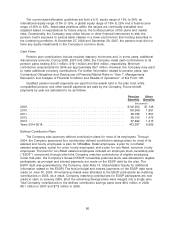

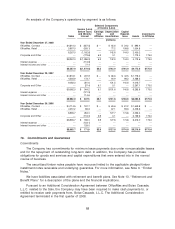

Please find page 86 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and $24.7 million for 2008, 2007 and 2006, respectively. Compensation expense is generally

recognized on a straight-line basis over the vesting period of grants. The total income tax benefit

recognized in the income statement for share-based compensation arrangements was $0.1 million,

$10.5 million and $9.6 million for 2008, 2007 and 2006, respectively.

2003 Director Stock Compensation Plan and OfficeMax Incentive and Performance Plan

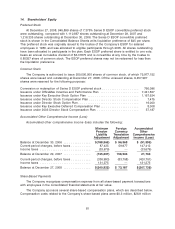

In February 2003, the Company’s Board of Directors adopted the 2003 Director Stock

Compensation Plan (the ‘‘2003 DSCP’’) and the 2003 OfficeMax Incentive and Performance Plan

(the ‘‘2003 Plan’’), formerly named the 2003 Boise Incentive and Performance Plan, which were

approved by shareholders in April 2003.

A total of 57,187 shares of common stock are reserved for issuance under the 2003 DSCP.

Prior to December 8, 2005, the 2003 DSCP permitted non-employee directors to elect to receive

some or all of their annual retainer and meeting fees in the form of options to purchase shares of

the Company’s common stock. Non-employee directors who elected to receive a portion of their

compensation in the form of stock options did not receive cash for that portion of their

compensation. The difference between the exercise price of the options and the market value of the

common stock on the date of grant was equal to the cash compensation that participating directors

elected to forego and was recognized as compensation expense in the Consolidated Statements of

Income (Loss). On December 8, 2005, the Board of Directors amended the 2003 DSCP to eliminate

the choice to receive discounted stock options. All options granted under the 2003 DSCP expire

three years after the holder ceases to be a director.

The 2003 Plan was effective January 1, 2003, and replaced the Key Executive Performance

Plan for Executive Officers, Key Executive Performance Plan for Key Executives/Key Managers, 1984

Key Executive Stock Option Plan (‘‘KESOP’’), Key Executive Performance Unit Plan (‘‘KEPUP’’) and

Director Stock Option Plan (‘‘DSOP’’). No further grants or awards have been made under the Key

Executive Performance Plans, KESOP, KEPUP, or DSOP since 2003. A total of 7,441,607 shares of

common stock are reserved for issuance under the 2003 Plan. The Company’s executive officers,

key employees and nonemployee directors are eligible to receive awards under the 2003 Plan at

the discretion of the Executive Compensation Committee of the Board of Directors. Eight types of

awards may be granted under the 2003 Plan, including stock options, stock appreciation rights,

restricted stock, restricted stock units, performance units, performance shares, annual incentive

awards and stock bonus awards.

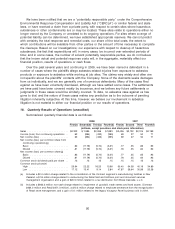

Restricted Stock and Restricted Stock Units

In 2008, the Company granted to employees and nonemployee directors 1,261,404 restricted

stock units (‘‘RSUs’’). The weighted-average grant-date fair value of the RSUs was $23.00. As of

December 27, 2008, 1,109,453 of these RSUs were unvested, and vest after defined service periods

as follows: 35,784 units in 2009, 257,444 in 2010 and 816,225 in 2011. Nearly half of the RSUs

granted to employees in 2008 also require certain performance criteria to be met. During 2008,

management concluded that these performance criteria would not be met for the 2008 plan.

82