OfficeMax 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

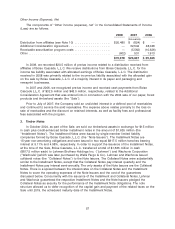

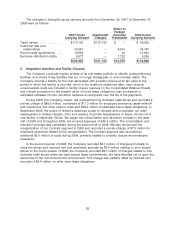

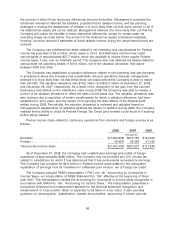

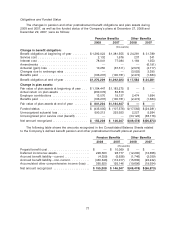

The tax effects of temporary differences that give rise to significant portions of the deferred tax

assets and deferred tax liabilities at year-end are presented below.

2008 2007

(thousands)

Current deferred tax assets (liabilities) attributable to

Accrued expenses ......................................... $ 38,229 $ 50,045

Net operating loss carryforwards ............................... 3,561 7,213

Allowances for receivables and rebates .......................... 18,219 29,605

Compensation and benefits .................................. 7,627 23,397

Inventory ................................................ 11,863 3,780

Property and equipment ..................................... 13,911 16,754

Alternative minimum tax and other credit carryforwards .............. — 53,919

Other .................................................. 5,858 357

Total current net deferred tax assets .......................... $ 99,268 $ 185,070

Noncurrent deferred tax assets (liabilities) attributable to

Timberland installment gain .................................. (266,798) (543,763)

Deferred gain on Boise Cascade, LLC Investment .................. 69,925 69,925

Alternative minimum tax and other credit carryforwards .............. 28,303 188,033

Impaired Lehman note receivable .............................. 286,207 —

Compensation and benefits .................................. 212,418 103,065

Net operating loss carryforwards ............................... 24,239 40,381

Reserves ................................................ 20,734 24,864

Investments .............................................. 23,413 6,399

Goodwill ................................................ 9,774 (30,802)

Other non-current liabilities ................................... 9,938 5,179

Undistributed earnings ...................................... (4,606) (4,955)

Deferred charges .......................................... 2,268 2,086

Property and equipment ..................................... 33,988 15,505

Other temporary differences .................................. 12 21

449,815 (124,062)

Less: Valuation allowance .................................... (13,633) (30,300)

Total noncurrent net deferred tax assets (liabilities) ............... $ 436,182 $(154,362)

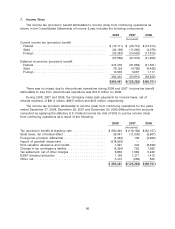

As discussed in Note 3, ‘‘Timber Notes Receivable’’, as part of the Sale, the Company sold its

timberlands for cash and credit enhanced installment notes. The note structure allowed the

Company to defer recognition of the capital gain and payment of the related taxes (approximately

$543 million) on the sale until 2019, the scheduled maturity date of the installment notes. On

September 15, 2008, Lehman, the guarantor of one half of the installment notes, filed a bankruptcy

petition seeking relief under chapter 11 of the United States Bankruptcy Code. Therefore,

approximately half of the deferred tax gain was accelerated and the related taxes became due and

payable in 2008. The Company had available alternative minimum tax credits, a portion which

resulted from tax payments related to the Sale, which were used to reduce the cash taxes triggered

by the Lehman bankruptcy. All cash tax payments due related to the installment note have been

made as of December 27, 2008. The Company has an income tax receivable balance of

$5.9 million as of December 27, 2008.

In assessing the realizability of deferred tax assets, management considers whether it is more

likely than not that some portion or all of the deferred tax assets will not be realized. The ultimate

realization of deferred tax assets is dependent upon the generation of future taxable income during

67