OfficeMax 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

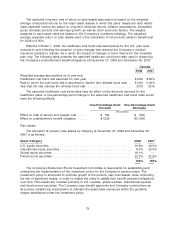

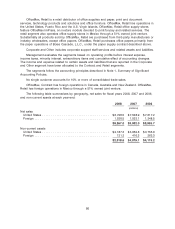

The expected long-term rate of return on plan assets assumption is based on the weighted

average of expected returns for the major asset classes in which the plans’ assets are held. Asset-

class expected returns are based on long-term historical returns, inflation expectations, forecasted

gross domestic product and earnings growth, as well as other economic factors. The weights

assigned to each asset class are based on the Company’s investment strategy. The weighted-

average expected return on plan assets used in the calculation of net periodic pension benefit cost

for 2008 is 8.00%.

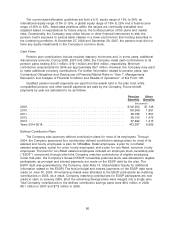

Effective October 1, 2005, the healthcare cost trend rate assumptions for the U.S. plan were

reduced to zero following the adoption of plan changes that reduced the Company’s medical

insurance subsidy to retirees. As a result, the impact of changes in trend rates is for the Canadian

plan only. The following table presents the assumed healthcare cost trend rates used in measuring

the Company’s postretirement benefit obligations at December 27, 2008 and December 29, 2007:

Canada

2008 2007

Weighted average assumptions as of year-end:

Healthcare cost trend rate assumed for next year ........................ 8.00% 8.50%

Rate to which the cost trend rate is assumed to decline (the ultimate trend rate) . . 5.00% 5.00%

Year that the rate reaches the ultimate trend rate ......................... 2015 2015

The assumed healthcare cost trend rates have an effect on the amounts reported for the

healthcare plans. A one-percentage-point change in the assumed healthcare cost trend rates would

have the following effects:

One-Percentage-Point One-Percentage-Point

Increase Decrease

(thousands)

Effect on total of service and interest cost ..... $ 164 $ (130)

Effect on postretirement benefit obligation ..... $1,539 $(1,254)

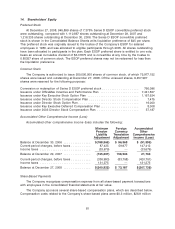

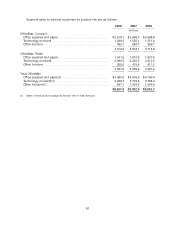

Plan Assets

The allocation of pension plan assets by category at December 27, 2008 and December 29,

2007 is as follows:

Asset Category 2008 2007

U.S. equity securities ............................................. 19.8% 44.5%

International equity securities ....................................... 8.9% 23.0%

Global equity securities ........................................... 18.1% —

Fixed-income securities ........................................... 53.2% 32.5%

100% 100%

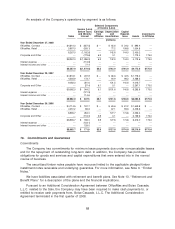

The Company’s Retirement Funds Investment Committee is responsible for establishing and

overseeing the implementation of the investment policy for the Company’s pension plans. The

investment policy is structured to optimize growth of the pension plan trust assets, while minimizing

the risk of significant losses, in order to enable the plans to satisfy their benefit payment obligations

over time. Plan assets are invested primarily in U.S. equities, global equities, international equities

and fixed-income securities. The Company uses benefit payments and Company contributions as

its primary rebalancing mechanisms to maintain the asset class exposures within the guideline

ranges established under the investment policy.

79