OfficeMax 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.debt are not included in the table above because the timing and amount of any required payments

cannot be reasonably estimated. However, the table under the heading Financial Instruments in this

section presents principal cash flows and related weighted average interest rates by expected

maturity dates. For obligations with variable interest rates, the table sets forth payout amounts

based on rates as of December 27, 2008 and does not attempt to project future rates.

The securitized timber notes payable have recourse limited to the applicable pledged

installment note receivable and underlying guarantees. The debt remains outstanding until it is

legally extinguished, which will be when the Installment note and guaranty are transferred to and

accepted by the securitized note holders.

We enter into operating leases in the normal course of business. We lease our retail store

space as well as certain other property and equipment under operating leases. Some of our retail

store leases require percentage rentals on sales above specified minimums and contain escalation

clauses. These minimum lease payments do not include contingent rental expense. Some lease

agreements provide us with the option to renew the lease or purchase the leased property. Our

future operating lease obligations would change if we exercised these renewal options and if we

entered into additional operating lease agreements. For more information, see Note 8, Leases, of

the Notes to Consolidated Financial Statements in ‘‘Item 8. Financial Statements and

Supplementary Data’’ in this Form 10-K. Lease obligations for closed facilities are included in

operating leases and a liability equal to the fair value of these obligations is included in the

Company’s Consolidated Balance Sheets. For more information, see Note 5, Integration Activities

and Facility Closures, of the Notes to Consolidated Financial Statements in ‘‘Item 8. Financial

Statements And Supplementary Data’’ in this Form 10-K.

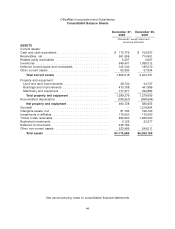

Our Consolidated Balance Sheet as of December 27, 2008 includes $502.4 million of liabilities

associated with our retirement and benefit plans and $222.1 million of other long-term liabilities.

Certain of these amounts have been excluded from the above table as either the amounts are fully

or partially funded, or the timing and/or the amount of any cash payment is uncertain. Actuarially-

determined liabilities related to pension and postretirement benefits are recorded based on

estimates and assumptions. Key factors used in developing estimates of these liabilities include

assumptions related to discount rates, rates of return on investments, future compensation costs,

healthcare cost trends, benefit payment patterns and other factors. Changes in assumptions related

to the measurement of funded status could have a material impact on the amount reported.

In accordance with an amended and restated joint venture agreement, the minority owner of

our subsidiary in Mexico, Grupo OfficeMax, can elect to put its remaining 49% interest in the

subsidiary to OfficeMax if earnings targets are achieved. Earnings targets are calculated quarterly

on a rolling four-quarter basis. Accordingly, the targets can be achieved in one quarter but not in

the next. If the earnings targets are achieved and the minority owner elects to put its ownership

interest, the purchase price would be equal to fair value, calculated based on both the subsidiary’s

earnings for the last four quarters before interest, taxes and depreciation and amortization, and the

current market multiples of similar companies. At December 27, 2008, Grupo OfficeMax did not

meet the earnings targets.

In addition to the contractual obligations quantified in the table above, we have other

obligations for goods and services entered into in the normal course of business. These contracts,

however, are either not enforceable or legally binding or are subject to change based on our

business decisions.

Off-Balance-Sheet Activities and Guarantees

‘‘Note 16, Commitments and Guarantees,’’ of the Notes to Consolidated Financial Statements

in ‘‘Item 8. Financial Statements and Supplementary Data’’ in this Form 10-K describes the nature

34