OfficeMax 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Environmental Matters

In accounting for landfill closure costs related to the sold paper, forest products and timberland

assets following the guidance is SFAS No. 143, ‘‘Accounting for Asset Retirement Obligations,’’ the

Company records legal obligations associated with the retirement of long-lived assets at their fair

value at the time the obligations are incurred. Upon initial recognition of a liability, that cost is

capitalized as part of the related long-lived asset and depreciated on a straight-line basis over the

remaining estimated useful life of the asset. The asset retirement obligation for estimated closure

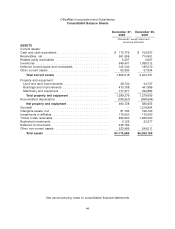

and closed-site monitoring costs recorded on the Company’s Consolidated Balance Sheet was

$4.2 million for both December 27, 2008 and December 29, 2007. These obligations are related to

assets held for sale.

Environmental liabilities that relate to the operation of the sold paper, forest products and

timberland assets prior to the closing of the Sale transaction were retained by the Company. These

environmental obligations are not within the scope of SFAS No. 143, and the Company accrues for

losses associated with these types of environmental remediation obligations when such losses are

probable and reasonably estimable according to the guidance in SOP 96-1, ‘‘Environmental

Remediation Liabilities.’’ The liabilities for environmental obligations are not discounted to their

present value. (See Note 17, Legal Proceedings and Contingencies, for additional information.)

Self-insurance

The Company is self-insured for certain losses related to workers’ compensation and medical

claims as well as general and auto liability. The expected ultimate cost for claims incurred is

recognized as a liability in the Consolidated Balance Sheets. The expected ultimate cost of claims

incurred is estimated based principally on analysis of historical claims data and actuarial estimates

of claims incurred but not reported. Losses are accrued and charged to operations when it is

probable that a loss has been incurred and the amount can be reasonably estimated.

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and

liabilities are recognized for the future tax consequences attributable to differences between the

financial statement carrying amounts of existing assets and liabilities and their respective tax basis

and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable income in the years in which those temporary

differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities

of a change in tax rates is recognized in income in the period that includes the enactment date.

The Company is subject to tax audits in numerous jurisdictions in the U.S. and around the

world. Tax audits by their very nature are often complex and can require several years to complete.

In the normal course of business, the Company is subject to challenges from the IRS and other tax

authorities regarding amounts of taxes due. These challenges may alter the timing or amount of

taxable income or deductions, or the allocation of income among tax jurisdictions. The benefits of

tax positions that are more likely than not of being sustained upon audit based on the technical

merits of the tax position are recognized in the consolidated financial statements; positions that do

not meet this threshold are not recognized. For tax positions that are at least more likely than not of

being sustained upon audit, the largest amount of the benefit that is more likely than not of being

sustained is recognized in the consolidated financial statements. (See ‘‘Note 7, Income Taxes,’’ for

a discussion of the adoption impact of FIN 48.)

Accruals for income tax exposures, including penalties and interest, expected to be settled

within the next year are included in accrued expenses and other current liabilities with the

remainder included in other long-term obligations in the Consolidated Balance Sheets. Interest and

53