OfficeMax 2008 Annual Report Download - page 36

Download and view the complete annual report

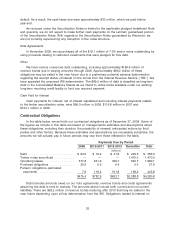

Please find page 36 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As a result of these transactions, we received $1,470 million ($735 million from investors in the

Securitization Notes guaranteed by Lehman) in cash and over 15 years we expected to earn

approximately $82.5 million per year in interest income on the Installment Notes receivable

($41.8 million from interest on the Lehman guaranteed Installment Note) and expected to incur

annual interest expense of approximately $80.5 million on the Securitization Notes ($40.7 million

from interest on the Securitization Notes guaranteed by Lehman). The pledged Installment Notes

receivable and Securitization Notes were scheduled to mature in 2020 and 2019, respectively. The

Securitization Notes have an initial term that is approximately three months shorter than the

Installment Notes. We expected to refinance our ownership of the Installment Notes in 2019 with a

short-term secured borrowing to bridge the period from initial maturity of the Securitization Notes to

the maturity of the Installment Notes.

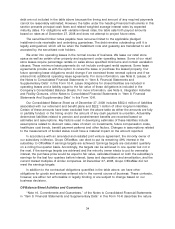

On September 15, 2008, Lehman, the guarantor of half of the Installment Notes and the

Securitization Notes, filed a petition in the United States Bankruptcy Court for the Southern District

of New York seeking relief under chapter 11 of the United States Bankruptcy Code. On

September 17, 2008, the OMXSPE delivered notices to the trustee for the affected Securitization

Note holders, the issuer of the affected Installment Notes and to Lehman, which stated that as a

result of Lehman’s bankruptcy filing, an event of default had occurred under the $817.5 million

Installment Note guaranteed by Lehman (the ‘‘Lehman Guaranteed Installment Note’’).

After evaluating the situation, we concluded in late October 2008 that due to the uncertainty of

collection of the Lehman Guaranteed Installment Note as a result of the Lehman bankruptcy, the

carrying value of the Lehman Guaranteed Installment Note was impaired. Accordingly, we recorded

a non-cash pre-tax impairment charge of $735.8 million in the third quarter of 2008. We are required

for accounting purposes to assess the carrying value of assets whenever circumstances indicate

that a decline in value may have occurred. However, under current generally accepted accounting

principles, we are required to continue to recognize the liability related to the Securitization Notes

guaranteed by Lehman until such time as the liability has been ‘‘extinguished’’, under the guidance

in paragraph 16 of SFAS No. 140, ‘‘Accounting for Transfers and Servicing of Financial Assets and

Extinguishment of Liabilities’’, which will occur when the Lehman Guaranteed Installment Note and

the guaranty are transferred to and accepted by the note holders. We expect that this will occur no

later than the date when the assets of Lehman are distributed and the bankruptcy is finalized.

Accordingly, the non-cash charge is expected to be followed by a non-cash gain in a later period

when the liability is legally extinguished.

On October 29, 2008, Lehman failed to pay the $21.5 million interest payment due to the

Installment Note issuer, which in turn did not make the $20.9 million interest payment due the

OMXSPE. As a result, the OMXSPE did not make the interest payment due to the holders of the

Securitization Notes guaranteed by Lehman because it is only obligated to make interest payments

on the Securitization Notes to the extent it receives interest payments on the related Installment

Notes. We stopped accruing interest income on the Lehman Guaranteed Installment Note as of the

last payment date April 29, 2008. However, we recorded the ongoing interest expense on the

Lehman guaranteed portion of the Securitization Notes until the default date, October 29, 2008. This

resulted in $20.4 million of additional interest expense that will only be paid if the corresponding

interest income is collected.

At the time of the Sale, we generated a tax gain and recognized the related deferred tax

liability. The timber note structure allowed the Company to defer the resulting tax liability of

$543 million until 2019, the maturity date for the Installment Notes. Due to the impairment,

approximately half of this tax gain was accelerated into 2008 and the related taxes were due. We

had available alternative minimum tax credits, a portion of which resulted from prior tax payments

related to the Sale, which were used to reduce the cash tax payment triggered by the Lehman

32