OfficeMax 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

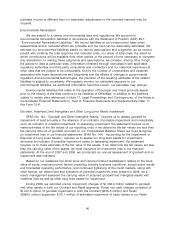

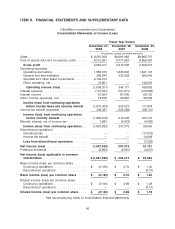

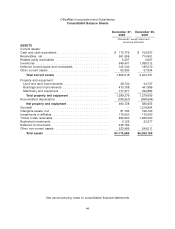

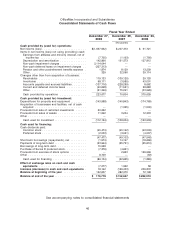

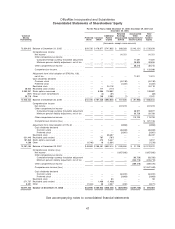

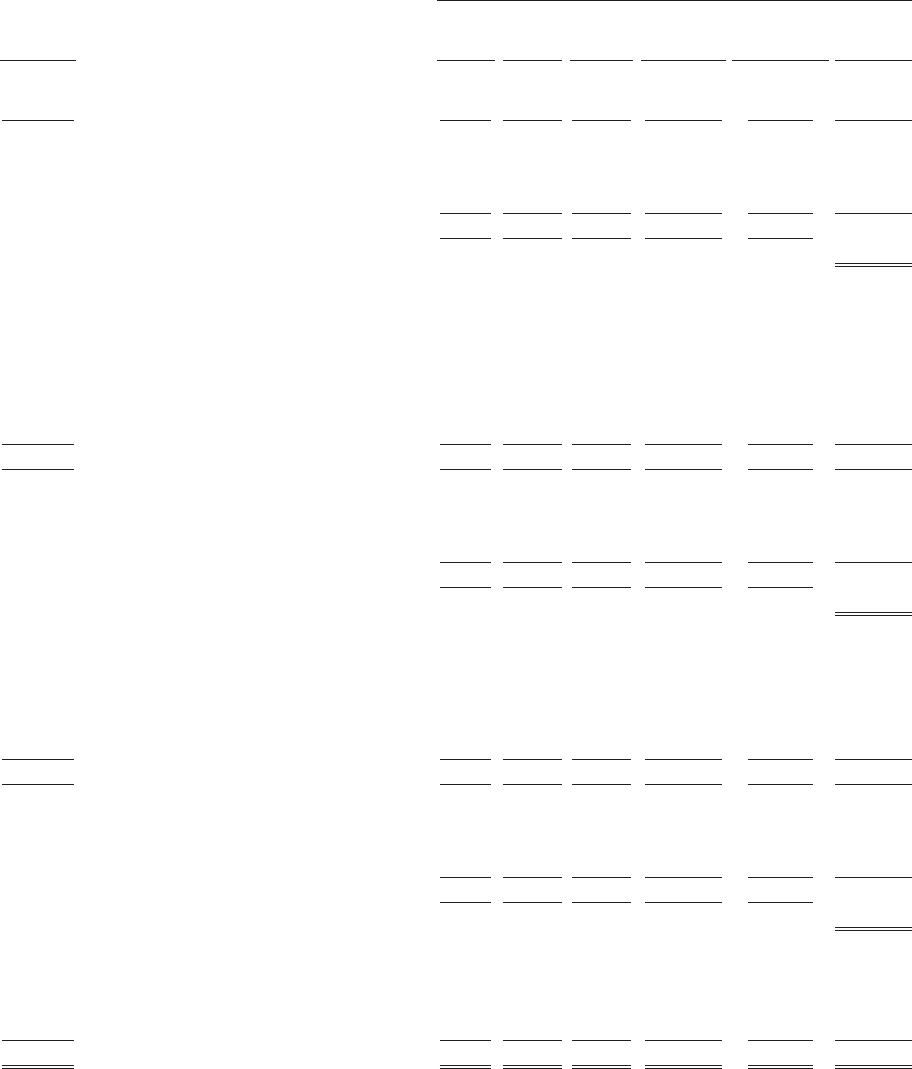

OfficeMax Incorporated and Subsidiaries

Consolidated Statements of Shareholders’ Equity

For the Fiscal Years ended December 27, 2008, December 29, 2007 and

December 30, 2006

Retained Accumulated Total

Common Additional Earnings Other Share-

Shares Preferred Common Paid-In (Accumulated Comprehensive holders’

Outstanding Stock Stock Capital Deficit) Income (Loss) Equity

(thousands, except share amounts)

70,804,612 Balance at December 31, 2005 ............. $54,735 $ 176,977 $ 747,805 $ 898,283 $ (142,121) $ 1,735,679

Comprehensive income

Net income ........................ — — — 91,721 — 91,721

Other comprehensive income

Cumulative foreign currency translation adjustment — — — — 11,581 11,581

Minimum pension liability adjustment, net of tax . — — — — 26,634 26,634

Other comprehensive income ............. — — — — 38,215 38,215

Comprehensive income ................. $ 129,936

Adjustment from initial adoption of SFAS No. 158,

net of tax ......................... — — — — 11,911 11,911

Cash dividends declared

Common stock ..................... — — — (44,136) — (44,136)

Preferred stock ..................... — — — (4,037) — (4,037)

Restricted stock ...................... — — 24,116 — — 24,116

46,940 Restricted stock vested .................. — 117 (117) — — —

3,993,857 Stock options exercised .................. — 9,985 119,982 — — 129,967

(907) Treasury stock cancellations ............... — (2) (31) — — (33)

58,718 Other ............................ — 149 2,093 (1) — 2,241

74,903,220 Balance at December 30, 2006 ............. $54,735 $ 187,226 $ 893,848 $ 941,830 $ (91,995) $ 1,985,644

Comprehensive income

Net income ........................ — — — 207,373 — 207,373

Other comprehensive income .............

Cumulative foreign currency translation adjustment — — — — 59,977 59,977

Minimum pension liability adjustment, net of tax . — — — — 53,756 53,756

Other comprehensive income ............. — — — — 113,733 113,733

Comprehensive income (loss) ............. $ 321,106

Adjustment from initial adoption of FIN 48 ....... — — — (3,959) — (3,959)

Cash dividends declared

Common stock .................... — — — (45,333) — (45,333)

Preferred stock .................... — — — (3,961) — (3,961)

Restricted stock ...................... — — 26,437 — — 26,437

301,443 Restricted stock vested .................. — 767 (767) — — —

187,843 Stock options exercised .................. — 470 5,447 — — 5,917

4,588 Other ............................ (4,746) 18 (2,551) — — (7,279)

75,397,094 Balance at December 29, 2007 ............. $49,989 $ 188,481 $ 922,414 $ 1,095,950 $ 21,738 $ 2,278,572

Comprehensive income (loss)

Net income ........................ — — — (1,657,932) — (1,657,932)

Other comprehensive income .............

Cumulative foreign currency translation adjustment — — — — (83,758) (83,758)

Minimum pension liability adjustment, net of tax . — — — — (205,718) (205,718)

Other comprehensive income ............. — — — — (289,476) (289,476)

Comprehensive income (loss) ............. $(1,947,408)

Cash dividends declared

Common stock .................... — — — (34,220) — (34,220)

Preferred stock .................... — — — (3,663) — (3,663)

Restricted stock ...................... — — 93 — — 93

571,727 Restricted stock vested .................. — 1,436 (1,436) — — —

8,331 Other ............................ (7,424) 26 4,257 (230) (3,371)

75,977,152 Balance at December 27, 2008 ............. $42,565 $189,943 $925,328 $ (600,095) $(267,738) $ 290,003

See accompanying notes to consolidated financial statements

47