OfficeMax 2008 Annual Report Download - page 59

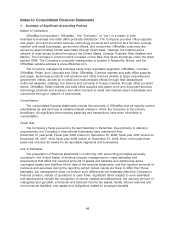

Download and view the complete annual report

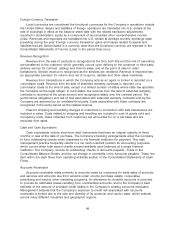

Please find page 59 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.instrument is designated as a fair value hedge, changes in the fair value of the instrument are

reported in current earnings and offset the change in fair value of the hedged assets, liabilities or

firm commitments. The ineffective portion of an instrument’s change in fair value is immediately

recognized in earnings. Instruments that do not meet the criteria for hedge accounting and

contracts for which the Company has not elected hedge accounting, are marked to fair value with

unrealized gains or losses reported in earnings. The Company has no significant outstanding hedge

activity at year-end.

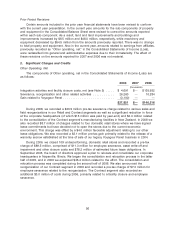

Recently Issued or Newly Adopted Accounting Standards

Following are summaries of recently issued accounting pronouncements that have either been

recently adopted or that may become applicable to the preparation of our consolidated financial

statements in the future.

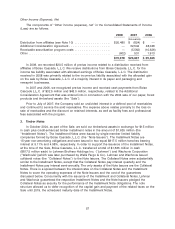

In September 2006, the FASB issued SFAS No. 157, ‘‘Fair Value Measurements’’ (‘‘SFAS 157’’).

This Standard defines fair value, establishes a framework for measuring fair value in generally

accepted accounting principles and expands disclosures about fair value measurements. SFAS 157

is effective for fiscal years beginning after November 15, 2007 for financial assets and liabilities, as

well as for any other assets and liabilities that are carried at fair value on a recurring basis in

financial statements. In November 2007, the FASB provided a one year deferral for the

implementation of SFAS 157 for other nonfinancial assets and liabilities. The Company adopted the

provisions of SFAS 157 for financial assets and liabilities effective at the beginning of fiscal year

2008. The provisions of SFAS 157 had no impact on our financial statements. We do not anticipate

that the adoption of SFAS 157 for non-financial assets and liabilities will have a material impact on

our financial condition, results of operations or cash flows.

In February 2007, the FASB issued SFAS No. 159, ‘‘The Fair Value Option for Financial Assets

and Financial Liabilities—including an amendment of SFAS 115’’ (‘‘SFAS 159’’). SFAS 159 allows

entities to choose, at specific election dates, to measure eligible financial assets and liabilities at fair

value that are not otherwise required to be measured at fair value. If a company elects the fair value

option for an eligible item, changes in that item’s fair value in subsequent reporting periods must be

recognized in current earnings. The Company did not elect to adopt the fair value option provided

under SFAS 159.

In December 2007, the FASB issued SFAS No. 141R, ‘‘Business Combinations’’

(‘‘SFAS 141R’’). This statement amends SFAS 141 and provides revised guidance for recognizing

and measuring assets acquired and liabilities assumed in a business combination. This statement

also requires that transaction costs in a business combination be expensed as incurred. SFAS 141R

applies prospectively to business combinations for which the acquisition date is on or after the

beginning of the first annual reporting period beginning on or after December 15, 2008. SFAS 141R

will impact the accounting for business combinations completed on or after December 28, 2008.

In December 2007, the FASB issued SFAS No. 160, ‘‘Noncontrolling Interests in Consolidated

Financial Statements’’ (‘‘SFAS 160’’). This statement requires noncontrolling interests (previously

referred to as minority interests) to be treated as a separate component of equity, not as a liability

or other item outside of permanent equity. SFAS 160 applies to the accounting for noncontrolling

interests and transactions with noncontrolling interest holders in consolidated financial statements

and is effective for periods beginning on or after December 15, 2008. Earlier application is

prohibited. SFAS 160 will be applied prospectively to all noncontrolling interests, including those

that arose before the effective date, except that comparative prior period information must be recast

to classify noncontrolling interests in equity and provide other disclosures required by SFAS 160.

The Company anticipates that adoption of SFAS 160 will affect the presentation of certain elements

of the Company’s financial statements, but these changes in presentation will not have a material

impact on our financial statements.

55