OfficeMax 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

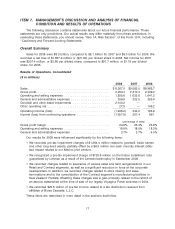

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following discussion contains statements about our future financial performance. These

statements are only predictions. Our actual results may differ materially from these predictions. In

evaluating these statements, you should review ‘‘Item 1A. Risk Factors’’ of this Form 10-K, including

‘‘Cautionary and Forward-Looking Statements.’’

Overall Summary

Sales for 2008 were $8.3 billion, compared to $9.1 billion for 2007 and $9.0 billion for 2006. We

recorded a net loss of $1,657.9 million or ($21.90) per diluted share in 2008. Net income for 2007

was $207.4 million, or $2.66 per diluted share, compared to $91.7 million, or $1.19 per diluted

share, for 2006.

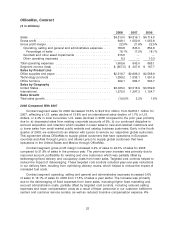

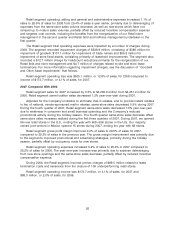

Results of Operations, Consolidated

($ in millions)

2008 2007 2006

Sales ............................................ $8,267.0 $9,082.0 $8,965.7

Gross profit ........................................ 2,054.4 2,310.3 2,309.2

Operating and selling expenses ......................... 1,555.6 1,633.6 1,641.2

General and administrative expenses ..................... 306.9 332.5 355.9

Goodwill and other asset impairments .................... 2,100.2 — —

Other operating net .................................. 27.9 — 146.2

Operating income (loss) ............................... (1,936.2) 344.2 165.9

Income (loss) from continuing operations .................. (1,657.9) 207.4 99.1

(percentage of sales)

Gross profit margin .................................. 24.9% 25.4% 25.8%

Operating and selling expenses ......................... 18.8% 18.0% 18.3%

General and administrative expenses ..................... 3.7% 3.7% 4.0%

Our results for 2008 were influenced significantly by the following items:

• We recorded pre-tax impairment charges of $1,364.4 million related to goodwill, trade names

and other long-lived assets, partially offset by a $6.5 million non-cash minority interest (after-

tax) impact related to our Mexico joint venture.

• We recognized a pre-tax impairment charge of $735.8 million on the timber installment note

guaranteed by Lehman as a result of the Lehman bankruptcy in September 2008.

• We recorded charges related to severance of various sales and field reorganizations in our

Retail and Contract segments, as well as a significant reduction in force at the corporate

headquarters. In addition, we recorded charges related to store closing and lease

terminations and to the consolidation of the Contract segment’s manufacturing facilities in

New Zealand. Partially offsetting these charges was a gain primarily related to the refund of

an escrow established at the time of sale of our legacy Voyageur Panel business in 2004.

• We recorded $20.5 million of pre-tax income related to a tax distribution received from

affiliates of Boise Cascade, L.L.C.

These items are described in more detail in the sections that follow.

17