OfficeMax 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

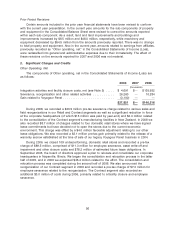

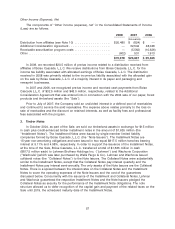

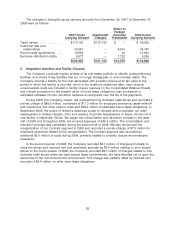

Other Income (Expense), Net

The components of ‘‘Other income (expense), net’’ in the Consolidated Statements of Income

(Loss) are as follows:

2008 2007 2006

(thousands)

Distribution from affiliates (see Note 10) .................... $20,480 $ (824) $ —

Additional Consideration Agreement ....................... — 32,542 48,048

Receivable securitization program costs .................... — (5,562) (10,626)

Other ............................................. (602) 531 1,913

$19,878 $26,687 $ 39,335

In 2008, we recorded $20.5 million of pre-tax income related to a distribution received from

affiliates of Boise Cascade, L.L.C. We receive distributions from Boise Cascade, L.L.C. for the

income tax liability associated with allocated earnings of Boise Cascade, L.L.C. The distribution

received in 2008 was primarily related to the income tax liability associated with the allocated gain

on the sale by Boise Cascade, L.L.C. of a majority interest in its paper and packaging and

newsprint businesses.

In 2007 and 2006, we recognized pre-tax income and received cash payments from Boise

Cascade L.L.C. of $32.5 million and $48.0 million, respectively, related to the Additional

Consideration Agreement that was entered into in connection with the 2004 sale of our paper, forest

products and timberland assets (the ‘‘Sale’’).

Prior to July of 2007, the Company sold an undivided interest in a defined pool of receivables

and continued to service the sold receivables. The expense above relates primarily to the loss on

sale of receivables and the discount on retained interests, as well as facility fees and professional

fees associated with the program.

3. Timber Notes

In October 2004, as part of the Sale, we sold our timberland assets in exchange for $15 million

in cash plus credit-enhanced timber installment notes in the amount of $1,635 million (the

‘‘Installment Notes’’). The Installment Notes were issued by single-member limited liability

companies formed by Boise Cascade, L.L.C. (the ‘‘Note Issuers’’). The Installment Notes are

15-year non-amortizing obligations and were issued in two equal $817.5 million tranches bearing

interest at 5.11% and 4.98%, respectively. In order to support the issuance of the Installment Notes,

at the time of the Sale, Boise Cascade, L.L.C. transferred a total of $1,635 million in cash

($817.5 million each) to Lehman Brothers Holdings Inc. (‘‘Lehman’’) and Wachovia Corporation

(‘‘Wachovia’’)(which was later purchased by Wells Fargo & Co.). Lehman and Wachovia issued

collateral notes (the ‘‘Collateral Notes’’) to the Note Issuers. The Collateral Notes were substantially

similar to the Installment Notes, except that the Collateral Notes pay interest quarterly and the

Installment Notes pay interest semi-annually. The only assets of the Note Issuers are the Collateral

Notes. There is a spread between the interest rates on the Collateral Notes and the Installment

Notes to cover the operating expenses of the Note Issuers and the cost of the guarantees

discussed below. Concurrently with the issuance of the Installment and Collateral Notes, Lehman

and Wachovia guaranteed the respective Installment Notes and the Note Issuers pledged the

Collateral Notes as security for the performance of the Installment Note obligations. The note

structure allowed us to defer recognition of the capital gain and payment of the related taxes on the

Sale until 2019, the scheduled maturity date of the Installment Notes.

57