OfficeMax 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

default. As a result, the cash taxes due were approximately $30 million, which we paid before

year-end.

As recourse under the Securitization Notes is limited to the applicable pledged Installment Note

and guaranty, we do not expect to make further cash payments on the Lehman guaranteed portion

of the Securitization Notes. With regards to the Securitization Notes guaranteed by Wachovia, we

are not currently experiencing any disruption in the notes structure.

Note Agreements

In November 2008, we repurchased all of the $19.1 million of 7.0% senior notes outstanding by

using proceeds relating to restricted investments that were pledged for this debt.

Other

We have various unsecured debt outstanding, including approximately $189.9 million of

revenue bonds due in varying amounts through 2029. Approximately $69.2 million of these

obligations may be called in the near future due to a preliminary potential adverse determination

regarding the exempt status of interest on the bonds from the Internal Revenue Service (‘‘IRS’’). We

have appealed the proposed IRS determination. The $69.2 million of debt is classified as long-term

debt in the Consolidated Balance Sheets as we intend to utilize funds available under our existing

long-term revolving credit facility to fund any required payment.

Cash Paid for Interest

Cash payments for interest, net of interest capitalized and including interest payments related

to the timber securitization notes, were $90.0 million in 2008, $116.6 million in 2007 and

$124.1 million in 2006.

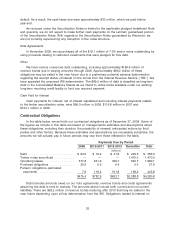

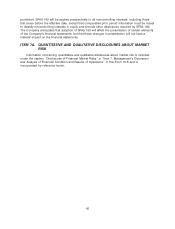

Contractual Obligations

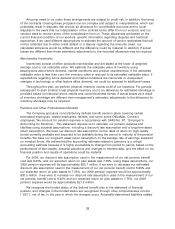

In the table below, we set forth our contractual obligations as of December 27, 2008. Some of

the figures we include in this table are based on management’s estimates and assumptions about

these obligations, including their duration, the possibility of renewal, anticipated actions by third

parties and other factors. Because these estimates and assumptions are necessarily subjective, the

amounts we will actually pay in future periods may vary from those reflected in the table.

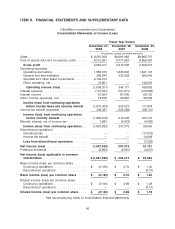

Payments Due by Period

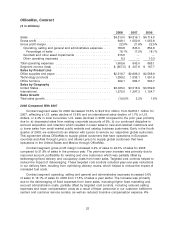

2009 2010-2011 2012-2013 Thereafter Total

(millions)

Debt ......................... $ 64.5 $ 19.2 $ 41.8 $ 229.5 $ 355.0

Timber notes securitized ........... — — — 1,470.0 1,470.0

Operating leases ................. 377.8 641.9 439.7 520.7 1,980.1

Purchase obligations .............. 25.5 5.6 0.4 0.4 31.9

Pension obligations (estimated

payments) .................... 7.6 116.2 151.8 168.2 443.8

$475.4 $782.9 $633.7 $2,388.8 $4,280.8

Debt includes amounts owed on our note agreements, revenue bonds and credit agreements

assuming the debt is held to maturity. The amounts above include both current and non-current

liabilities. There are $69.2 million of revenue bonds maturing after 2013 that may be called in the

near future depending upon a final determination from the IRS. Obligations related to interest on

33