OfficeMax 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

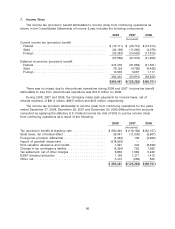

(2) During 2007, adjustments were necessary to reflect the reversal of income tax reserves that were recorded in purchase

accounting.

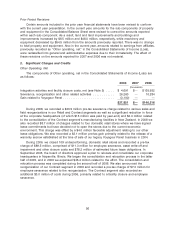

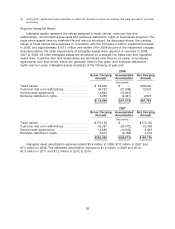

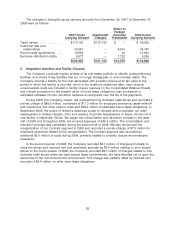

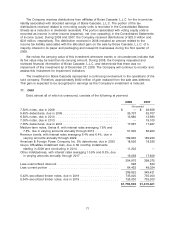

Acquired Intangible Assets

Intangible assets represent the values assigned to trade names, customer lists and

relationships, noncompete agreements and exclusive distribution rights of businesses acquired. The

trade name assets have an indefinite life and are not amortized. As discussed above, the carrying

values of trade names were reviewed in connection with the Company’s interim impairment reviews

in 2008, and approximately $107.1 million was written off in 2008 as part of the impairment charges

described above. No other impairments of intangible assets were required or recorded in 2008,

2007 or 2006. All other intangible assets are amortized on a straight-line basis over their expected

useful lives. Customer lists and relationships are amortized over three to 20 years, noncompete

agreements over their terms, which are generally three to five years, and exclusive distribution

rights over ten years. Intangible assets consisted of the following at year-end:

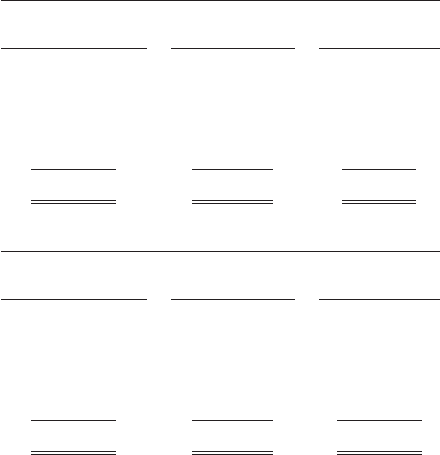

2008

Gross Carrying Accumulated Net Carrying

Amount Amortization Amount

(thousands)

Trade names .......................... $ 66,000 $ — $ 66,000

Customer lists and relationships ............ 34,767 (21,848) 12,919

Noncompete agreements ................. 12,844 (12,844) —

Exclusive distribution rights ................ 5,255 (2,381) 2,874

$118,866 $(37,073) $81,793

2007

Gross Carrying Accumulated Net Carrying

Amount Amortization Amount

(thousands)

Trade names .......................... $173,150 $ — $ 173,150

Customer lists and relationships ............ 43,381 (23,072) 20,309

Noncompete agreements ................. 12,884 (10,842) 2,042

Exclusive distribution rights ................ 6,977 (2,758) 4,219

$236,392 $(36,672) $199,720

Intangible asset amortization expense totaled $5.4 million in 2008, $7.0 million in 2007 and

$7.3 million in 2006. The estimated amortization expense is $1.6 million in 2009 and 2010,

$1.3 million in 2011 and $1.2 million in 2012 to 2014.

62