OfficeMax 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

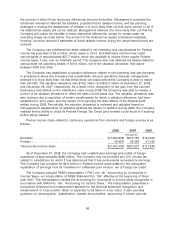

the periods in which those temporary differences become deductible. Management considers the

scheduled reversal of deferred tax liabilities, projected future taxable income, and tax planning

strategies in making the assessment of whether it is more likely than not that some portion or all of

the deferred tax assets will not be realized. Management believes it is more likely than not that the

Company will realize the benefits of these deductible differences, except for certain state net

operating losses as noted below. The amount of the deferred tax assets considered realizable,

however, could be reduced if estimates of future taxable income during the carryforward period are

reduced.

The Company has a deferred tax asset related to net operating loss carryforwards for Federal

income tax purposes of $3.5 million which expire in 2014, and alternative minimum tax credit

carryforwards of approximately $27.7 million, which are available to reduce future regular Federal

income taxes, if any, over an indefinite period. The Company also has deferred tax assets related to

various state net operating losses of $10.6 million, net of the valuation allowance, that expire

between 2009 and 2025.

The Company has established a valuation allowance related to net operating loss carryforwards

in jurisdictions where the Company has substantially reduced operations because management

believes it is more likely than not that these items will expire before the Company is able to realize

their benefits. The valuation allowance was $13.6 million and $30.3 million at December 27, 2008

and December 29, 2007, respectively. As a result of the recognition of the gain from the Lehman

bankruptcy and default on the installment notes during 2008, the Company was able to release a

portion of its valuation allowance to offset the state income taxes due. The valuation allowance was

also reduced due to expiration of certain carryforwards for which a valuation allowance had been

established in prior years, and the impact of recognizing the state effects of the Federal audit

settled during 2008. Periodically, the valuation allowance is reviewed and adjusted based on

management’s assessments of realizable deferred tax assets. In addition during 2008, the Company

realized that its ability to utilize its Federal Foreign Tax Credit carry forward could result in it expiring

before being realized.

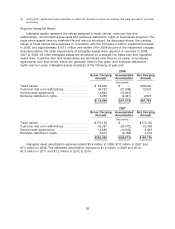

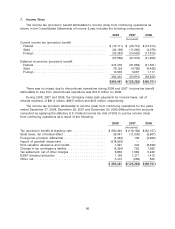

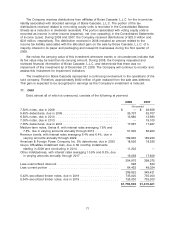

Pre-tax income (loss) related to continuing operations from domestic and foreign sources is as

follows:

2008 2007 2006

(thousands)

Domestic ....................................... $(1,953,946) $272,169 $124,643

Foreign ........................................ (18,454) 65,358 47,235

Total pre-tax income (loss) .......................... $(1,972,400) $337,527 $171,878

As of December 27, 2008, the Company had undistributed earnings and profits of foreign

operations of approximately $269 million. The Company has not provided any U.S. income tax

related to jurisdictions for which it has determined that it has permanently reinvested its earnings.

The Company has provided for $4.6 million in Federal income taxes related to the anticipated

repatriation of earnings from its investment in a Mexican joint venture, net of foreign tax credit.

The Company adopted FASB Interpretation (‘‘FIN’’) No. 48, ‘‘Accounting for Uncertainty in

Income Taxes—an interpretation of FASB Statement No. 109’’ effective at the beginning of fiscal

year 2007. This Interpretation clarifies the accounting for uncertainty in income taxes recognized in

accordance with SFAS No. 109, ‘‘Accounting for Income Taxes.’’ The Interpretation prescribes a

recognition threshold and measurement attribute for the financial statement recognition and

measurement of a tax position taken or expected to be taken in a tax return. It also provides

guidance on derecognition, classification, interest and penalties, accounting in interim periods,

68