OfficeMax 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

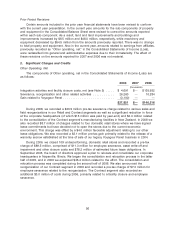

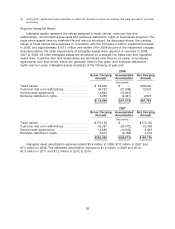

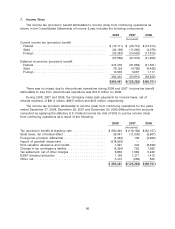

7. Income Taxes

The income tax (provision) benefit attributable to income (loss) from continuing operations as

shown in the Consolidated Statements of Income (Loss) includes the following components:

2008 2007 2006

(thousands)

Current income tax (provision) benefit

Federal ....................................... $(10,111) $ (25,710) $ (10,014)

State ......................................... (24,166) (11,380) (4,079)

Foreign ....................................... (23,282) (24,582) (17,816)

(57,559) (61,672) (31,909)

Deferred income tax (provision) benefit

Federal ....................................... 274,376 (61,882) (31,521)

State ......................................... 76,129 (4,785) (6,428)

Foreign ....................................... 13,535 3,057 1,117

364,040 (63,610) (36,832)

$306,481 $(125,282) $(68,741)

There was no impact due to discontinued operations during 2008 and 2007. Income tax benefit

attributable to loss from discontinued operations was $10.6 million for 2006.

During 2008, 2007 and 2006, the Company made cash payments for income taxes, net of

refunds received, of $91.5 million, $89.5 million and $0.6 million, respectively.

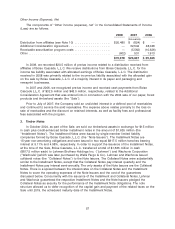

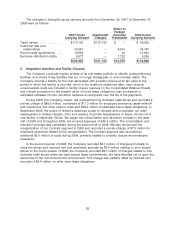

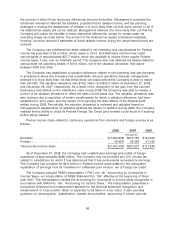

The income tax provision attributable to income (loss) from continuing operations for the years

ended December 27, 2008, December 29, 2007 and December 30, 2006 differed from the amounts

computed by applying the statutory U.S. Federal income tax rate of 35% to pre-tax income (loss)

from continuing operations as a result of the following:

2008 2007 2006

(thousands)

Tax (provision) benefit at statutory rate .................. $ 690,340 $ (118,184) $ (60,157)

State taxes, net of federal effect ....................... 29,041 (11,030) (5,907)

Foreign tax provision differential ....................... (3,283) 106 (5,262)

Impact of goodwill impairment ........................ (418,920) — —

NOL valuation allowance and credits ................... 1,291 434 (6,498)

Change in tax contingency liability ..................... (3,394) 755 1,925

Tax settlement, net of other charges .................... 6,830 1,582 5,240

ESOP dividend deduction ........................... 1,166 1,317 1,413

Other, net ....................................... 3,410 (262) 505

$ 306,481 $(125,282) $(68,741)

66