OfficeMax 2008 Annual Report Download - page 63

Download and view the complete annual report

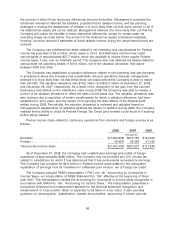

Please find page 63 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.required to continue to recognize the liability related to the Securitization Notes guaranteed by

Lehman (the ‘‘Lehman Guaranteed Securitization Notes’’) until such time as the liability has been

‘‘extinguished’’, under the guidance in paragraph 16 of SFAS No. 140, ‘‘Accounting for Transfers

and Servicing of Financial Assets and Extinguishment of Liabilities,’’ which will be when the Lehman

Guaranteed Installment Note and the guaranty are transferred to and accepted by the note holders.

We expect that this will occur no later than the date when the assets of Lehman are distributed and

the bankruptcy is finalized. Accordingly, the non-cash charge is expected to be followed by a non-

cash gain in a later period when the liability is legally extinguished.

On October 29, 2008, Lehman failed to pay the $21.5 million interest payment due to the Note

Issuer. The Note Issuer did not make the $20.9 million interest payment due to OMX Timber II, and,

in turn, OMX Timber II did not make its $20.4 million interest payment due to the holders of the

Securitization Notes guaranteed by Lehman because OMX Timber II is only obligated to make such

payments to the extent it receives payments on the related Installment Notes. We stopped accruing

interest income on the Lehman Guaranteed Installment Notes as of the last payment date, April 29,

2008. However, we recorded the ongoing interest expense on the Securitization Notes guaranteed

by Lehman, as required until the default date, October 29, 2008. This resulted in $20.4 million of

additional interest expense that will only be paid if the corresponding interest income is collected.

At the time of the Sale, we generated a tax gain and recognized the related deferred tax

liability. The timber note structure allowed the Company to defer the resulting tax liability of

$543 million until 2019, the maturity date for the Installment Notes. Due to the impairment,

approximately half of this tax gain was accelerated into 2008 and the related taxes were due. We

had available alternative minimum tax credits, a portion of which resulted from prior tax payments

related to the Sale, which were used to reduce the cash tax payment triggered by the Lehman

default. As a result, the net cash taxes due relating to the accelerated recognition of the triggered

gain was approximately $30 million, which we paid prior to year-end.

Finally, per the timber note agreements, the OMXSPE was expected to receive approximately

$41 million in interest annually under the Lehman Guaranteed Installment Note. This interest income

was to fund approximately $40 million in interest payable annually to holders of the Securitization

Notes guaranteed by Lehman, which would have resulted in net interest income to us of

approximately $1 million. Continued nonpayment under the installment note guaranteed by Lehman

or the related Lehman guaranty will result in a loss of this $1 million of annual net interest income.

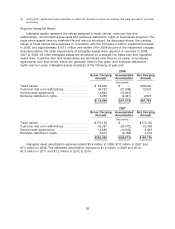

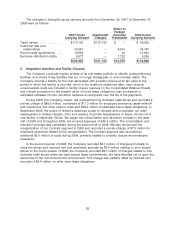

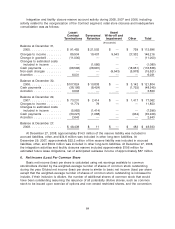

4. Goodwill, Intangible Assets and Other Long-lived Assets

Impairment

During 2008, the Company recorded non-cash impairment charges associated with goodwill,

intangible assets and other long-lived assets of $1,364.4 million before taxes. After adjusting for

taxes and a favorable impact to minority interest, the reduction in net income was $1,294.7 million

after-tax or $17.05 per diluted share. These charges were recognized in the second and fourth

quarters, and were measured and recognized following the guidance in SFAS No. 142, ‘‘Goodwill

and Other Intangible Assets,’’ (‘‘SFAS 142’’) and SFAS No. 144, ‘‘Accounting for the Impairment or

Disposal of Long-Lived Assets,’’ (‘‘SFAS 144’’) which require that the carrying value of long-lived

assets be tested for impairment whenever circumstances indicate that impairment may exist. During

the second quarter, the Company recorded an estimated impairment charge of $935.3 million,

before taxes, and reported that the final analysis of second quarter impairment would be completed

by year-end. During the fourth quarter, the Company completed the final analysis of the second

quarter impairment and recorded an additional non-cash pre-tax impairment charge of

$103.8 million. During the fourth quarter, the Company recorded non-cash pre-tax charges of

$325.3 million, associated with the interim impairment test performed in that period. These non-cash

charges consisted of $1,201.5 million of goodwill impairment in both the Contract ($815.5 million)

59