OfficeMax 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

valuations, such as retirement rates and pension members living longer. In addition to changes in

pension plan obligations, the amount of plan assets available to pay benefits, contribution levels

and expense are also impacted by the return on the pension plan assets. The pension plan assets

include U.S. equities, international equities, global equities and fixed-income securities, the cash

flows of which change as equity prices and interest rates vary. The risk is that market movements in

equity prices and interest rates could result in assets that are insufficient over time to cover the

level of projected obligations. This in turn could result in significant changes in pension expense

and funded status, further impacting future required contributions. Management, together with the

trustees who act on behalf of the pension plan beneficiaries, assess the level of this risk using

reports prepared by independent external actuaries and take action, where appropriate, in terms of

setting investment strategy and agreed contribution levels.

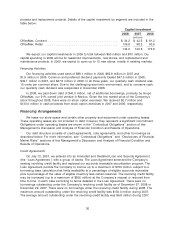

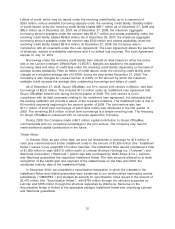

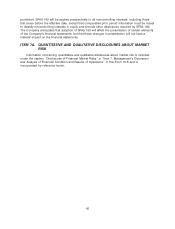

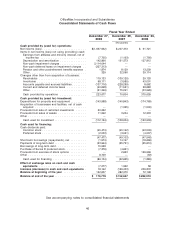

(in millions except rates)

Year Ended

2008 2007

Expected Payments There- Fair Fair

2009 2010 2011 2012 2013 after Total Value Total Value

Debt

Fixed-rate debt payments .......... $51.1 $14.0 $0.8 $35.4 $1.9 $228.9 $332.1 $214.6 $384.2 $382.4

Average interest rates ........... 8.9% 6.5% 8.0% 7.9% 8.4% 6.4% 6.9% —% 6.9% —%

Variable-rate debt payments ........ $13.4 $ 2.2 $2.2 $ 2.2 $2.3 $ 0.6 $ 22.9 $ 22.1 $ 14.2 $ 14.2

Average interest rates ........... 11.9% 9.5% 9.5% 9.5% 9.5% 9.5% 10.9% —% 9.0% —%

Timber notes securitized

Wachovia ................. $ — $ — $— $ — $— $735.0 $735.0 $736.8 $735.0 $790.9

Average interest rates ......... —% —% —% —% —% 5.4% 5.4% —% 5.4% —%

Lehman .................. $ — $ — $— $ — $— $735.0 $735.0 $ 81.8 $735.0 $790.9

Average interest rates ......... —% —% —% —% —% 5.5% 5.5% —% 5.5% —%

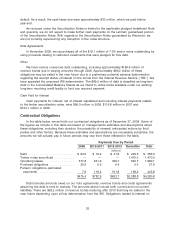

2008 2007

Carrying amount Fair value Carrying amount Fair value

(millions)

Financial assets:

Timber notes receivable

Wachovia— ............. $817.5 $801.9 $817.5 $881.8

Lehman— .............. 81.8 81.8 817.5 881.8

Restricted investments ....... 2.1 2.1 22.4 21.8

Additional Consideration Agreement

Pursuant to an Additional Consideration Agreement between OfficeMax and Boise

Cascade, L.L.C. entered into in connection with the Sale, we may have been required to make

substantial cash payments to, or entitled to receive substantial cash payments from, Boise

Cascade, L.L.C. In February 2008, Boise Cascade, L.L.C. sold a majority interest in its paper and

packaging and newsprint businesses to Aldabra 2 Acquisition Corp. As a result of this transaction,

the Additional Consideration Agreement terminated and no further payments will be required of

either party. Prior to the termination of the Additional Consideration Agreement, we recorded

changes in the fair value of the Additional Consideration Agreement in net income (loss) in the

period they occurred; however, any potential payments from Boise Cascade, L.L.C. to us were not

recorded in net income (loss) until all contingencies had been satisfied, which was generally at the

end of a 12-month measurement period ending on September 30. Due to increases in actual and

projected paper prices, the change in the estimated fair value of this agreement resulted in the

recognition of non-operating income in our Consolidated Statement of Income (Loss) of

$32.5 million in 2007 and $48.0 million in 2006.

36