OfficeMax 2008 Annual Report Download - page 32

Download and view the complete annual report

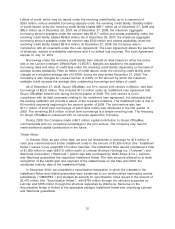

Please find page 32 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As a result of these tests, impairment charges were recorded in both the second and fourth

quarters. In the second quarter, we recorded an estimated impairment charge of $935.3 million,

before taxes, and reported that the final analysis of the second quarter impairment would be

completed by year-end. The $935.3 million in second quarter impairment charges included

$850.0 million related to goodwill, $80.0 million related to trade names and $5.3 million related to

fixed assets. During the fourth quarter, we completed the final analysis of the second quarter

impairment and recorded an additional non-cash pre-tax impairment charge of $103.8 million

($98.8 million related to goodwill and $5.0 million related to trade names) to adjust the estimate we

recorded in the second quarter. Also during the fourth quarter, we recorded non-cash pre-tax

charges of $325.3 million associated with the test for impairment that we completed in the fourth

quarter. This consisted of $252.7 million of goodwill, $22.1 million of trade names, and $50.5 million

of fixed assets that were impaired. There is no goodwill remaining on the Company’s consolidated

balance sheet and therefore there will be no future annual assessment of goodwill. The impairment

charges related to goodwill, intangibles and other long-lived assets are included in the caption

‘‘Goodwill and other asset impairments’’ in the Consolidated Statements of Income (Loss).

Also during 2008, due to the Lehman bankruptcy, we recorded a pre-tax impairment charge of

$735.8 million on the timber installment note guaranteed by Lehman in the Corporate and Other

segment. This impairment charge is also included in the caption ‘‘Goodwill and other asset

impairments’’ in the Consolidated Statements of Income. For more information regarding the timber

note impairment, see the discussion of timber notes under the heading ‘‘Timber Notes’’ in this

section.

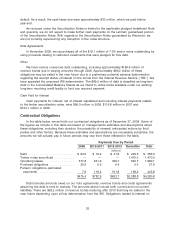

Integration Activities and Facility Closure

In September 2005, the board of directors approved a plan to relocate and consolidate our

retail headquarters in Shaker Heights, Ohio and existing corporate headquarters in Itasca, Illinois

into a new facility in Naperville, Illinois. We began the consolidation and relocation process in the

latter half of 2005 and completed it during the second half of 2006. In 2006, we recognized

$46.4 million related to this effort. We also announced the reorganization of our Contract segment

in 2006 and recorded a pre-tax charge of $7.3 million for employee severance related to the

reorganization. The Contract segment also recorded an additional $3.0 million of costs during 2006,

primarily related to a facility closure and employee severance.

We conduct regular reviews of our real estate portfolio to identify underperforming facilities, and

close those facilities that are no longer strategically or economically viable. We record a liability for

the cost associated with a facility closure at its estimated fair value in the period in which the

liability is incurred, which is the location’s cease-use date. Upon closure, unrecoverable costs are

included in facility closure reserves on the Consolidated Balance Sheets, and include provisions for

the present value of future lease obligations, less contractual or estimated sublease income.

Accretion expense is recognized over the life of the payments.

During 2006, we closed 109 underperforming, domestic retail stores and recorded a pre-tax

charge of $89.5 million, comprised of $11.3 million for employee severance, asset write-off and

impairment and other closure costs and $78.2 million of estimated future lease obligations.

In the second quarter of 2008, we recorded $3.1 million of charges principally to close five

stores and reduced rent and severance accruals by $3.4 million relating to prior closed stores. In

the fourth quarter of 2008, we recorded $8.7 million of charges related to four domestic retail stores

where we have signed lease commitments, but have decided not to open the stores due to the

current economic environment. This charge was partially offset by reduced rent accruals of

$4.0 million on other store lease obligations.

28