OfficeMax 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

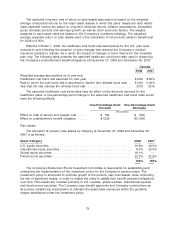

The Company receives distributions from affiliates of Boise Cascade, L.L.C. for the income tax

liability associated with allocated earnings of Boise Cascade, L.L.C. The portion of the tax

distributions received related to non-voting equity units is recorded in the Consolidated Balance

Sheets as a reduction in dividends receivable. The portion associated with voting equity units is

recorded as income in other income (expense), net (non-operating) in the Consolidated Statements

of Income (Loss). During 2008 and 2007, the Company received distributions of $23.0 million and

$2.8 million, respectively. The distribution received in 2008 included an amount related to the

income tax liability associated with the allocated gain on the sale by Boise Cascade, L.L.C. of a

majority interest in its paper and packaging and newsprint businesses during the first quarter of

2008.

We review the carrying value of this investment whenever events or circumstances indicate that

its fair value may be less than its carrying amount. During 2008, the Company requested and

reviewed financial information of Boise Cascade, L.L.C. and determined that there was no

impairment of this investment as of December 27, 2008. The Company will continue to monitor and

assess this investment for impairment indicators.

The investment in Boise Cascade represented a continuing involvement in the operations of the

sold company. Therefore, approximately $180 million of gain realized from the sale was deferred.

This gain is expected to be recognized in earnings as the Company’s investment is reduced.

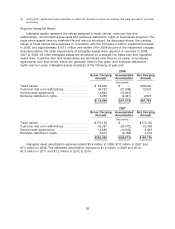

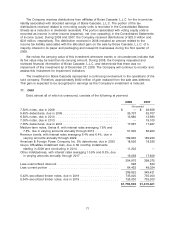

11. Debt

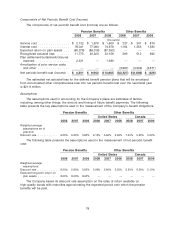

Debt, almost all of which is unsecured, consists of the following at year-end:

2008 2007

(thousands)

7.50% notes, due in 2008 .................................. $ — $ 29,656

9.45% debentures, due in 2009 .............................. 35,707 35,707

6.50% notes, due in 2010 .................................. 13,680 13,680

7.00% notes, due in 2013 .................................. — 19,100

7.35% debentures, due in 2016 .............................. 17,967 17,967

Medium-term notes, Series A, with interest rates averaging 7.8% and

7.8%, due in varying amounts annually through 2013 ............. 51,900 56,900

Revenue bonds, with interest rates averaging 6.4% and 6.4%, due in

varying amounts annually through 2029 ...................... 189,930 189,930

American & Foreign Power Company Inc. 5% debentures, due in 2030 . 18,526 18,526

Grupo OfficeMax installment loan, due in 60 monthly installments

starting in 2009 and concluding in 2014 ...................... 11,202 —

Other indebtedness, with interest rates averaging 10.9% and 8.3%, due

in varying amounts annually through 2017 .................... 16,058 17,609

354,970 399,075

Less unamortized discount ................................. 596 630

Less current portion ...................................... 64,452 49,024

289,922 349,421

5.42% securitized timber notes, due in 2019 ..................... 735,000 735,000

5.54% securitized timber notes, due in 2019 ..................... 735,000 735,000

$1,759,922 $1,819,421

71