OfficeMax 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of our guarantees, including the approximate terms of the guarantees, how the guarantees arose,

the events or circumstances that would require us to perform under the guarantees and the

maximum potential undiscounted amounts of future payments we could be required to make.

Seasonal Influences

Our business is seasonal, with OfficeMax, Retail showing a more pronounced seasonal trend

than OfficeMax, Contract. Sales in the second quarter and summer months are historically the

slowest of the year. Sales are stronger during the first, third and fourth quarters that include the

important new-year office supply restocking month of January, the back-to-school period and the

holiday selling season, respectively.

Disclosures of Financial Market Risks

Financial Instruments

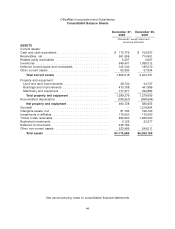

Our debt is predominantly fixed-rate. At December 27, 2008, the estimated current fair value of

our debt, based on quoted market prices when available or then-current interest rates for similar

obligations with like maturities, including the timber notes, was approximately $769.7 million less

than the amount of debt reported in the Consolidated Balance Sheet. Our timber notes receivable

also bear interest at a fixed rate. At December 27, 2008, the estimated fair value of these

instruments was $15.6 million lower than their carrying amount.

The securitized timber notes payable have recourse limited to the applicable pledged

installment notes receivable and underlying guarantees. The Lehman portion of the debt remains

outstanding until it is legally extinguished, which will be when the installment note and guaranty are

transferred to and accepted by the securitized note holders. The Company expects that this will

occur no later than the date when the assets of Lehman are distributed and the bankruptcy is

finalized. The estimated fair values of our other financial instruments, including cash and cash

equivalents and receivables are the same as their carrying values. In the opinion of management,

we do not have any significant concentration of credit risks. Concentration of credit risks with

respect to trade receivables is limited due to the wide variety of vendors, customers and channels

to and through which our products are sourced and sold, as well as their dispersion across many

geographic areas.

Changes in interest and currency rates expose us to financial market risk. In the past we have

used derivative financial instruments, such as interest rate swaps, rate hedge agreements, forward

purchase contracts and forward exchange contracts, to hedge underlying debt obligations or

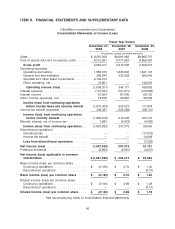

anticipated transactions. We do not use them for trading purposes. The table below provides

information about our financial instruments outstanding at December 27, 2008 that are sensitive to

changes in interest rates. For debt obligations, the table presents principal cash flows and related

weighted average interest rates by expected maturity dates. There are $69.2 million of revenue

bonds maturing after 2013 that may be called in the near future, depending upon a final

determination from the IRS. For obligations with variable interest rates, the table sets forth payout

amounts based on rates as of December 27, 2008 and does not attempt to project future rates.

The table below does not include our obligations for pension plans and other post retirement

benefits, although market risk also arises within our defined benefit pension plans to the extent that

the obligations of the pension plans are not fully matched by assets with determinable cash flows.

We sponsor noncontributory defined benefit pension plans covering certain terminated employees,

vested employees, retirees, and some active OfficeMax employees. As our plans were frozen in

2003, our active employees and all inactive participants who are covered by the plans are no

longer accruing additional benefits. However, the pension plan obligations are still subject to

change due to fluctuations in long-term interest rates as well as factors impacting actuarial

35