OfficeMax 2008 Annual Report Download - page 24

Download and view the complete annual report

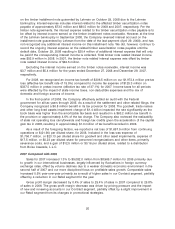

Please find page 24 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.on the timber installment note guaranted by Lehman on October 29, 2008 due to the Lehman

bankruptcy. Interest expense includes interest related to the affected timber securitization notes

payable of approximately $73.5 million and $80.5 million for 2008 and 2007, respectively. Per the

timber note agreements, the interest expense related to the timber securitization notes payable is to

be offset by interest income earned on the timber installment notes receivable. However, at the time

of the Lehman bankruptcy in September 2008, the Company reversed interest accrued on the

installment note guaranteed by Lehman from the date of the last payment (April 29, 2008), and has

not recognized any additional interest income on this installment note. We did, however, continue to

record the ongoing interest expense on the related timber securitization notes payable until the

default date, October 29, 2008 resulting in $20.4 million of additional interest expense that will only

be paid if the corresponding interest income is collected. Total timber note related interest income

was $53.9 million in 2008. In 2007, the timber note related interest expense was offset by timber

note related interest income of $82.5 million.

Excluding the interest income earned on the timber notes receivable, interest income was

$3.7 million and $5.4 million for the years ended December 27, 2008 and December 29, 2007,

respectively.

For 2008, we recognized an income tax benefit of $306.5 million on our $1,972.4 million pre-tax

loss (effective tax benefit rate of 15.5%) compared to income tax expense of $125.3 million on

$337.5 million in pretax income (effective tax rate of 37.1%) for 2007. Income taxes for all periods

were affected by the impact of state income taxes, non-deductible expenses and the mix of

domestic and foreign sources of income.

In the first quarter of 2008, the Company effectively settled an audit with the Federal

government for all tax years through 2005. As a result of the settlement and other related filings, the

Company recognized a $6.8 million benefit in its tax provision for 2008. The goodwill, trade names

and other long-lived assets impairment charge of $1.4 billion impacted the rate significantly as the

book basis was higher than the amortizable tax basis and resulted in a $63.2 million tax benefit in

the provision or approximately 4.6% of the tax charge. The Company also reviewed the realizability

of state net operating loss carryforwards and foreign tax credits given the acceleration of the capital

gain tax in 2008, resulting in approximately $1.3 million of tax benefit recorded in 2008.

As a result of the foregoing factors, we reported a net loss of $1,657.9 million from continuing

operations or $(21.90) per diluted share, for 2008. Included in the loss was expense of

$1,756.7 million, or $23.13 per diluted share for goodwill and other asset impairments, expense of

$17.5 million, or $0.23 per diluted share for personnel reorganizations and other items, primarily

severance costs, and a gain of $12.5 million or $0.16 per diluted share, related to a distribution

from Boise Cascade, L.L.C.

2007 Compared with 2006

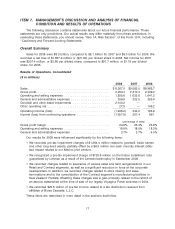

Sales for 2007 increased 1.3% to $9,082.0 million from $8,965.7 million for 2006 primarily due

to growth in our international businesses, largely influenced by fluctuations in foreign currency

exchange rates, offset by volume declines due to a weaker domestic economic environment in the

second half of 2007 and our more disciplined focus on profitable sales growth. Comparable sales

increased 0.5% year-over-year primarily as a result of higher sales in our Contract segment, partially

offset by a reduction in our Retail segment for the year.

Gross profit margin decreased by 0.4% of sales to 25.4% of sales in 2007 compared to 25.8%

of sales in 2006. The gross profit margin decrease was driven by pricing pressure and the impact

of new and renewing accounts in our Contract segment, partially offset by a slight improvement in

our Retail segment from its changes in promotional strategies.

20