OfficeMax 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

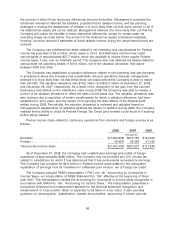

completion of the second quarter impairment test in the fourth quarter, the Company recorded an

additional $5.0 million non-cash, pre-tax impairment charge for the Retail trade names. During the

fourth quarter, the Company performed an additional review of the carrying value of the remaining

Retail trade name and recognized a non-cash, pre-tax impairment charge of $22.1 million.

In addition, as required under SFAS 144, interim impairment tests of the Company’s long-lived

assets were also performed in both the second and fourth quarters. Impairment testing under SFAS

No. 144 is also a two-step process. In the first step (‘‘the recoverability test’’), a determination of

potential impairment is made based on a comparison of the estimated future undiscounted cash

flows derived from the asset to its carrying amount. If estimated future undiscounted cash flows are

less than the carrying value of the asset, then the second step is completed and the impairment

loss is measured as the excess of the carrying value over the fair value of the asset, with fair value

determined based on estimated future discounted cash flows. The Company performed the

recoverability test for all the long-lived assets of each reporting unit, in aggregate. The recoverability

test did not identify potential impairment for these asset groups. The Company also performed the

recoverability test for the assets of individual retail stores (‘‘store assets’’ or ‘‘stores’’), which consist

primarily of leasehold improvements and fixtures. The recoverability test did identify potential

impairment at certain stores. As a result we completed the second step and concluded that

$50.5 million of store assets were required to be written-off.

As a result of these reviews for the full year of 2008, the Company recorded non-cash pre-tax

impairment charges consisting of $1,201.5 million for goodwill, $107.1 million for trade names and

$55.8 million for fixed assets. Of these charges, $548.9 million were recorded in the Retail segment

and $815.5 million were recorded in the Contract segment. The impairment charge included a

portion of goodwill that was not deductible for tax purposes, resulting in a tax benefit of

$63.2 million, or approximately 4.6% of the pre-tax charge amount.

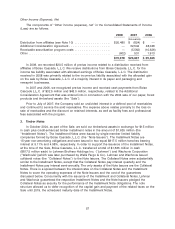

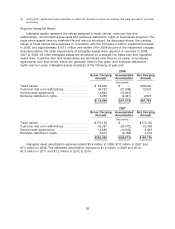

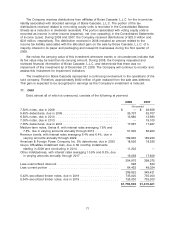

Goodwill

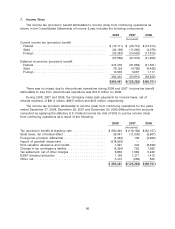

Changes in the carrying amount of goodwill by segment are as follows:

OfficeMax, OfficeMax,

Contract Retail Total

Balance at December 30, 2006(1) .................. $802,009 $ 414,023 $ 1,216,032

Effect of foreign currency translation ................ 28,032 — 28,032

Businesses acquired ........................... 763 — 763

Purchase accounting adjustments(2) ................ — (28,023) (28,023)

Balance at December 29, 2007 .................... 830,804 386,000 1,216,804

Effect of foreign currency translation ................ (15,322) — (15,322)

Impairment charges ............................ (815,482) (386,000) (1,201,482)

Balance at December 27, 2008 .................... $—$—$ —

(1) Through December 29, 2007, the Company disclosed goodwill by segment rather than by reporting unit. The balances

as of December 30, 2006 and December 29, 2007 in the table above have been revised to report goodwill by reporting

unit. As part of the acquisition of OfficeMax in 2003, the Company recorded the entire purchase price (except for the

portion related to a small direct business and its associated goodwill which was immediately transferred to the Contract

segment) within the Retail segment. However, at the time of the acquisition, $274 million of the goodwill was assigned

to the Contract reporting unit relating to the expected synergies in this reporting unit from that acquisition. The

Company included this amount in the carrying value of the Contract reporting unit in all subsequent annual impairment

reviews. The balances as of December 30, 2006 and December 29, 2007 in the table above have been revised to

reflect this amount within the Contract reporting unit.

61