OfficeMax 2008 Annual Report Download - page 62

Download and view the complete annual report

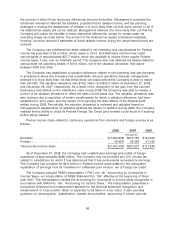

Please find page 62 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In December 2004, we completed a securitization transaction in which the Company’s interests

in the Installment Notes and related guarantees were transferred to wholly-owned bankruptcy

remote subsidiaries, OMX Timber Finance Investments I, L.L.C. (‘‘OMX Timber I’’) and OMX Timber

Finance Investments II, L.L.C. (‘‘OMX Timber II’’) (collectively the ‘‘OMXSPEs’’) that were originally

intended to be qualifying special purpose entities. The OMXSPEs subsequently failed to qualify and

are currently variable interest entities. The OMXSPEs pledged the Installment Notes and related

guarantees and issued Securitization Notes in the amount of $1,470 million ($735 million through

the structure supported by the Lehman guaranty and $735 million through the structure supported

by the Wachovia guaranty). Recourse on the Securitization Notes is limited to the applicable

pledged Installment Notes and underlying Lehman and Wachovia guarantees. The Securitization

Notes are 15-year non-amortizing, and were issued in two equal $735 million tranches paying

interest of 5.54% and 5.42%, respectively.

As a result of these transactions, we received $1,470 million ($735 million from investors in the

Securitization Notes guaranteed by Lehman) in cash from the OMXSPEs, and over 15 years the

OMXSPEs were expected to earn approximately $82.5 million per year in interest income on the

Installment Notes receivable ($41.8 million from interest on the Lehman guaranteed Installment

Note) and expected to incur annual interest expense of approximately $80.5 million on the

Securitization Notes ($40.7 million from interest on the Securitization Notes guaranteed by Lehman).

The pledged Installment Notes receivable and Securitization Notes payable were scheduled to

mature in 2020 and 2019, respectively. The Securitization Notes have an initial term that is

approximately three months shorter than the Installment Notes. We expected to refinance our

ownership of the Installment Notes in 2019 with a short-term secured borrowing to bridge the

period from initial maturity of the Securitization Notes to the maturity of the Installment Notes.

The Note Issuers are variable-interest entities (the ‘‘VIEs’’) under FASB Interpretation 46R,

‘‘Consolidation of Variable Interest Entities.’’ The OMXSPEs are considered to be the primary

beneficiary of the Note Issuers, and therefore, the VIEs are required to be consolidated with the

OMXSPEs, which are also the issuers of the Securitization Notes. The accounts of the OMXSPEs

have been consolidated into those of their ultimate parent, OfficeMax. The effect of our

consolidation of the OMXSPEs is that the securitization transaction is treated as a financing, and

both the Installment Notes receivable and the Securitization Notes payable are reflected in our

Consolidated Balance Sheets.

On September 15, 2008, Lehman, guarantor of half of the Installment Notes and the

Securitization Notes, filed a petition in the United States Bankruptcy Court for the Southern District

of New York seeking relief under chapter 11 of the United States Bankruptcy Code. On

September 17, 2008, attorneys for OMX Timber II delivered notices to the trustee under the

indenture applicable to the Securitization Notes guaranteed by Lehman, to the issuer of the

Installment Notes and to Lehman, which stated that as a result of Lehman’s bankruptcy filing, an

event of default had occurred under the $817.5 million in Installment Note guaranteed by Lehman

(the ‘‘Lehman Guaranteed Installment Note’’). These notices stated that OMX Timber II was

assessing all rights and remedies available to it, was not waiving or agreeing to forbear in the

exercise of any of its rights, and reserved the right to exercise any rights available to it in the future.

OMX Timber II does not believe the events described in its notices constituted an event of default

under the indenture.

We concluded in late October that due to the uncertainty of collection of the Lehman

Guaranteed Installment Note as a result of the Lehman bankruptcy, the carrying value of the

Lehman Guaranteed Installment Note was impaired. Accordingly, we recorded a non-cash

impairment charge of $735.8 million in the third quarter of 2008. We are required for accounting

purposes to assess the carrying value of assets whenever circumstances indicate that a decline in

value may have occurred. However, under current generally accepted accounting principles, we are

58