OfficeMax 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

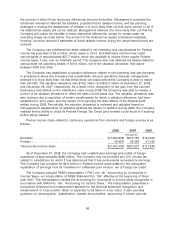

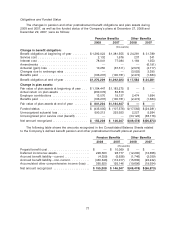

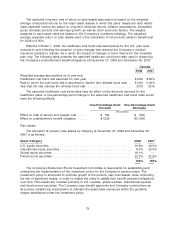

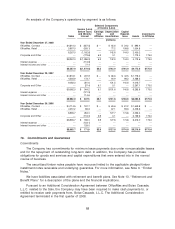

Components of Net Periodic Benefit Cost (Income)

The components of net periodic benefit cost (income) are as follows:

Pension Benefits Other Benefits

2008 2007 2006 2008 2007 2006

(thousands)

Service cost ................. $ 2,132 $ 1,676 $ 1,600 $ 237 $ 341 $ 870

Interest cost ................. 78,041 77,084 74,679 1,164 1,353 1,583

Expected return on plan assets . . . (90,078) (89,018) (87,353) — — —

Recognized actuarial loss ....... 11,775 20,220 23,159 269 512 692

Plan settlement/curtailment/closures

expense .................. 2,331 — 1,580 — — —

Amortization of prior service costs

and other .................———(3,997) (4,009) (3,571)

Net periodic benefit cost (income) . $ 4,201 $ 9,962 $ 13,665 $(2,327) $(1,803) $ (426)

The estimated net actuarial loss for the defined benefit pension plans that will be amortized

from accumulated other comprehensive loss into net periodic benefit cost over the next fiscal year

is $21.9 million.

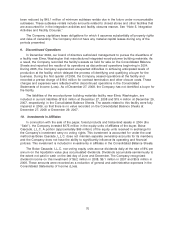

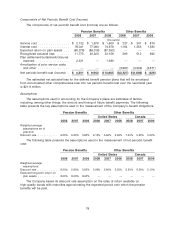

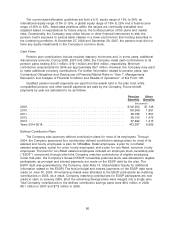

Assumptions

The assumptions used in accounting for the Company’s plans are estimates of factors

including, among other things, the amount and timing of future benefit payments. The following

table presents the key assumptions used in the measurement of the Company’s benefit obligations:

Pension Benefits Other Benefits

United States Canada

2008 2007 2006 2008 2007 2006 2008 2007 2006

Weighted average

assumptions as of

year-end:

Discount rate ............ 6.20% 6.30% 5.80% 6.10% 5.90% 5.60% 7.30% 5.50% 5.00%

The following table presents the assumptions used in the measurement of net periodic benefit

cost:

Pension Benefits Other Benefits

United States Canada

2008 2007 2006 2008 2007 2006 2008 2007 2006

Weighted average

assumptions:

Discount rate ............ 6.30% 5.80% 5.60% 5.90% 5.60% 5.20% 5.50% 5.00% 5.10%

Expected long-term return on

plan assets ........... 8.00% 8.00% 8.00% ——————

The Company bases its discount rate assumption on the rates of return available on

high-quality bonds with maturities approximating the expected period over which the pension

benefits will be paid.

78