OfficeMax 2008 Annual Report Download - page 64

Download and view the complete annual report

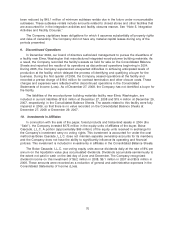

Please find page 64 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and Retail ($386.0 million) segments; $107.1 million of impairment of trade names in our Retail

segment; and $55.8 million of impairment related to fixed assets in our Retail segment. The

impairment charges related to goodwill, intangibles and other long-lived assets are included in the

caption ‘‘Goodwill and other asset impairments’’ in the Consolidated Statements of Income (Loss).

These charges resulted in a full impairment of our goodwill balances and, as a result, there will be

no future annual assessment of goodwill.

In the second quarter of 2008, management concluded that indicators of potential impairment

were present and that an evaluation of the carrying values of goodwill, intangibles and other

long-lived assets was therefore required. Management reached the conclusion that an impairment

test was required to be performed during the second quarter based on its assessment of the

conditions that contributed to the Company’s sustained low stock price and reduced market

capitalization relative to the book value of its equity, including generally weak economic conditions,

macroeconomic factors impacting industry business conditions, recent and forecasted operating

performance, and continued tightening of the credit markets, along with other factors. These

conditions had resulted in lower levels of consumer and business spending, intense competition

and industry consolidation. Weighing all of these factors, management determined that indicators of

potential impairment had occurred and an interim test for impairment was required as of the end of

the second quarter of 2008.

In the fourth quarter of 2008, due to a further decline in our market capitalization in relation to

the book value of equity, a worsening economic environment, increasing unemployment and a

decline in actual results and forecasted operating performance, management concluded that

indicators of potential impairment were again present and that a new interim test for impairment

was required as of the end of the fourth quarter.

Under SFAS 142, the measurement of impairment of goodwill consists of two steps. In the first

step, the Company compares the fair value of each reporting unit to its carrying value. If the results

of the first test indicate that the fair value of the reporting unit is less than the carrying value,

SFAS 142 requires the Company to perform a second step, which is to determine the implied fair

value of each reporting unit’s goodwill, and to compare it to the carrying value of the reporting

unit’s goodwill. An impairment loss is recognized for the excess of carrying value over the implied

fair value of reporting unit goodwill. In the second quarter, the Company determined that the fair

value of both of the Company’s reporting units was less than their corresponding carrying values,

thereby requiring the second step to be performed for both reporting units. The activities in the

second step include hypothetically valuing all of the tangible and intangible assets of the impaired

reporting unit as if the reporting unit had been acquired in a business combination. Due to the

extensive work involved in performing these valuations, management initially recognized an

estimated impairment loss in the second quarter and indicated that the final impairment

measurement would be completed by year-end. As noted above, the Company completed the

second step of the second quarter impairment test and recorded an additional non-cash impairment

change in the fourth quarter. As a result of the final second quarter impairment work, the goodwill

of the Retail reporting unit was fully impaired, while the goodwill of the Contract reporting unit was

partially impaired. During the fourth quarter, the Company performed new impairment tests for the

remaining Contract goodwill, which resulted in the recording of an additional non-cash pre-tax

impairment charge of $252.7 million. As a result of the fourth quarter impairment, the Contract

goodwill was fully impaired.

Under SFAS 142, the measurement of impairment of indefinite-lived intangible assets consists

of calculating the implied fair value and comparing that value to the intangible asset’s carrying

value. The implied fair value is calculated based on the estimated future discounted cash flows

associated with the intangible asset. In the second quarter, the Company recorded estimated

impairment of the trade names in the Retail reporting unit of $80.0 million, before taxes. Upon

60