OfficeMax 2008 Annual Report Download - page 58

Download and view the complete annual report

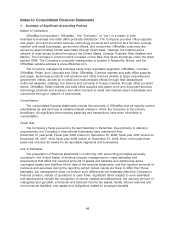

Please find page 58 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.penalties related to income tax exposures are recognized as incurred and included in income tax

expense in the Consolidated Statements of Income (Loss).

Advertising and Catalog Costs

Advertising costs are either expensed the first time the advertising takes place or, in the case of

direct-response advertising, capitalized and charged to expense in the periods in which the related

sales occur. Advertising expense was $232.1 million in 2008, $242.6 million in 2007 and

$240.4 million in 2006, and is recorded in operating and selling expenses in the Consolidated

Statements of Income (Loss). Capitalized catalog costs, which are included in other current assets

in the Consolidated Balance Sheets, totaled $10.4 million at December 27, 2008, and $7.6 million at

December 29, 2007.

Pre-Opening Expenses

The Company incurs certain non-capital expenses prior to the opening of a store. These

pre-opening expenses consist primarily of straight-line rent from the date of possession, store

payroll, and supplies and are expensed as incurred and reflected in operating and selling

expenses. In 2008, 2007 and 2006, the Company recorded approximately $10.0 million,

$10.2 million and $5.6 million in pre-opening costs, respectively.

Leasing Arrangements

The Company conducts a substantial portion of its business in leased properties. Some of the

Company’s leases contain escalation clauses and renewal options. In accordance with SFAS

No. 13, ‘‘Accounting for Leases,’’ as amended by SFAS No. 29, ‘‘Determining Contingent Rentals,’’

and Financial Accounting Standards Board (FASB) Technical Bulletin 85-3, ‘‘Accounting for

Operating Leases with Scheduled Rent Increases,’’ the Company recognizes rental expense for

leases that contain predetermined fixed escalation clauses on a straight-line basis over the

expected term of the lease. The difference between the amounts charged to expense and the

contractual minimum lease payment is recorded in other long-term liabilities in the Consolidated

Balance Sheets. At December 27, 2008 and December 29, 2007, other long-term liabilities included

approximately $74.3 million and $73.7 million, respectively, related to these future escalation

clauses.

The expected term of a lease is calculated from the date the Company first takes possession of

the facility, including any periods of free rent and any option or renewal periods management

believes are probable of exercise. This expected term is used in the determination of whether a

lease is capital or operating and in the calculation of straight-line rent expense. Rent abatements

and escalations are considered in the calculation of minimum lease payments in the Company’s

capital lease tests and in determining straight-line rent expense for operating leases. Straight-line

rent expense is also adjusted to reflect any allowances or reimbursements provided by the lessor.

Derivative Instruments and Hedging Activities

The Company accounts for derivatives and hedging activities in accordance with SFAS

No. 133, ‘‘Accounting for Derivative Instruments and Certain Hedging Activities,’’ as amended,

which requires that all derivative instruments be recorded on the balance sheet at fair value.

Changes in the fair value of derivative instruments are recorded in current earnings or deferred in

accumulated other comprehensive income (loss), depending on whether a derivative is designated

as, and is effective as, a hedge and on the type of hedging transaction. Changes in fair value of

derivatives that are designated as cash flow hedges are deferred in accumulated other

comprehensive income (loss) until the underlying hedged transactions are recognized in earnings,

at which time any deferred hedging gains or losses are also recorded in earnings. If a derivative

54