OfficeMax 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

is the amount at which the instrument could be exchanged in a current transaction between willing

parties.

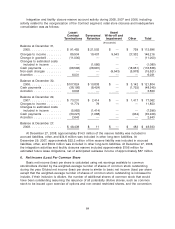

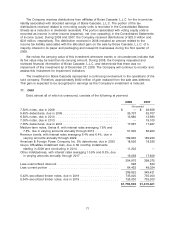

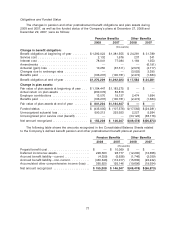

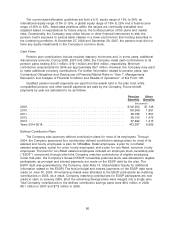

2008 2007

Carrying amount Fair value Carrying amount Fair value

(thousands)

Financial assets:

Timber notes receivable

Wachovia— ........... $817.5 $801.9 $817.5 $881.8

Lehman— ............ 81.8 81.8 817.5 881.8

Restricted investments ....... 2.1 2.1 22.4 21.8

Financial liabilities:

Debt .................... $355.0 $236.7 $398.4 $396.6

Securitization notes payable

Wachovia— ........... $735.0 $736.8 $735.0 $790.9

Lehman— ............ 735.0 81.8 735.0 790.9

The carrying amounts shown in the table are included in the Consolidated Balance Sheets

under the indicated captions. The following methods and assumptions were used to estimate the

fair value of each class of financial instruments:

• Timber notes receivable: The fair value is determined as the present value of expected future

cash flows discounted at the current interest rate for loans of similar terms with comparable

credit risk.

• Restricted investments: The fair values of debt securities are based on quoted market prices

at the reporting date for those or similar investments.

• Debt: The fair value of the Company’s debt is estimated based on quoted market prices

when available or by discounting the future cash flows of each instrument at rates currently

offered to the Company for similar debt instruments of comparable maturities.

• Securitization notes payable: The fair value of the Company’s securitization notes is

estimated by discounting the future cash flows of each instrument at rates currently available

to the Company for similar instruments of comparable maturities.

The Company adopted SFAS No. 157, ‘‘Fair Value Measurements,’’ at the beginning of fiscal

year 2008 for financial assets and liabilities measured at fair value on a recurring basis. The

adoption of SFAS No. 157 on December 30, 2007 did not have a significant impact on the

consolidated financial statements. The Company applied the fair value measurement guidance of

SFAS No. 157 in the valuation of its financial instruments.

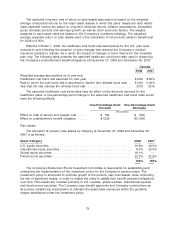

In establishing a fair value, SFAS No. 157 sets a fair value hierarchy that prioritizes the inputs to

valuation techniques used to measure fair value. The basis of the fair value measurement is

categorized in three levels, in order of priority, as described below:

Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement

date for identical, unrestricted assets or liabilities.

Level 2: Quoted prices in markets that are not active, or financial instruments for which all

significant inputs are observable; either directly or indirectly.

Level 3: Prices or valuation techniques that require inputs that are both significant to the fair

value measurement and unobservable; thus, reflecting assumptions about the market participants.

74