OfficeMax 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

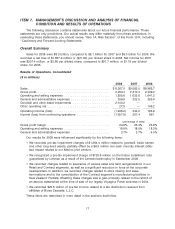

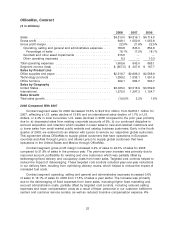

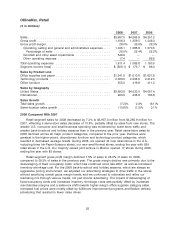

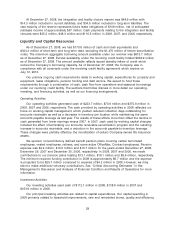

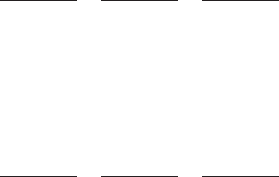

OfficeMax, Retail

($ in millions)

2008 2007 2006

Sales ............................................. $3,957.0 $4,265.9 $4,251.2

Gross profit ........................................ 1,106.3 1,259.5 1,246.3

Gross profit margin ................................... 28.0% 29.5% 29.3%

Operating, selling and general and administrative expenses .... 1,045.1 1,085.8 1,070.5

Percentage of sales ............................... 26.5% 25.4% 25.2%

Goodwill and other asset impairments ................... 548.9 — —

Other operating expense ............................. 17.4 — 89.5

Total operating expenses .............................. 1,611.4 1,085.8 1,160.0

Segment income (loss) ................................ $ (505.1) $ 173.7 $ 86.3

Sales by Product Line

Office supplies and paper .............................. $1,541.5 $1,610.6 $1,627.5

Technology products ................................. 2,060.5 2,235.5 2,212.5

Office furniture ...................................... 355.0 419.8 411.2

Sales by Geography

United States ....................................... $3,693.5 $4,030.0 $4,057.4

International ........................................ 263.5 235.9 193.8

Sales Growth

Total sales growth .................................... (7.2)% 0.3% (6.1)%

Same-location sales growth ............................. (10.8)% (1.2)% 0.1%

2008 Compared With 2007

Retail segment sales for 2008 decreased by 7.2% to $3,957.0 million from $4,265.9 million for

2007, reflecting a same-store sales decrease of 10.8%, partially offset by sales from new stores. The

weaker U.S. consumer and small business spending was evidenced by lower store traffic and

weaker back-to-school and holiday seasons than in the previous year. Retail same-store sales for

2008 declined across all major product categories, compared to the prior year. Declines were

greatest in the higher-priced, discretionary furniture and technology product categories, which

resulted in decreased average tickets. During 2008, we opened 43 new retail stores in the U.S.,

including three Ink-Paper-Scissors stores, our new small-format stores, ending the year with 939

retail stores in the U.S. Our majority owned joint-venture in Mexico opened 17 stores during 2008,

ending the year with 83 stores.

Retail segment gross profit margin declined 1.5% of sales to 28.0% of sales for 2008,

compared to 29.5% of sales in the previous year. The gross margin decline was primarily due to the

deleveraging of fixed occupancy costs, which has continued since late-2007, as well as increased

inventory shrinkage cost. For the 2008 back-to-school and holiday seasons, which are always an

aggressive pricing environment, we adjusted our advertising strategies to drive traffic in the stores

without sacrificing overall gross margin levels, and we continued to rationalize and refine our

marketing mix through various media, not just circular advertising. The impact of deleveraging of

fixed-occupancy costs and increased inventory shrinkage costs was partially offset by increased

merchandise margins and a sales-mix shift towards higher-margin office supplies category sales.

Increased fuel prices were mostly offset by fulfillment improvement programs and flexible delivery

scheduling that resulted in fewer miles driven.

25