OfficeMax 2008 Annual Report Download - page 31

Download and view the complete annual report

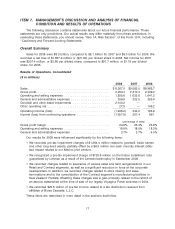

Please find page 31 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Corporate and Other

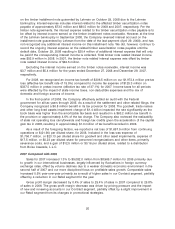

Corporate and Other expenses were $773.6 million for 2008 compared to $37.4 million for

2007. Expenses recorded in 2008 included a $735.8 million charge related to the impairment of the

timber installment note guaranteed by Lehman, a $4.3 million severance charge related to a fourth

quarter reduction in force at our corporate headquarters and a $3.1 million gain, primarily related to

the release of a warranty escrow established at the time of sale of our legacy Voyageur Panel

business in 2004. Reduced bonus expense in 2008 offset growth in corporate spending and

unfavorable impacts from legacy items.

During 2006, total corporate expenses were $118.0 million, which included expenses related to

the headquarters consolidation in the Corporate and Other segment totaling $46.4 million.

Discontinued Operations

In December 2004, our board of directors authorized management to pursue the divestiture of

a facility near Elma, Washington that manufactured integrated wood-polymer building materials. The

Company recorded the facility’s assets as held for sale on the Consolidated Balance Sheets and

reported the results of its operations as discontinued operations in 2004. During 2005, the

Company experienced unexpected difficulties in achieving anticipated levels of production at the

facility, which delayed the process of identifying and qualifying a buyer for the business. We

concluded that we would be unable to attract a buyer in the near term and elected to cease

operations at the facility during the first quarter of 2006, at which time we recorded pre-tax

expenses of $18.0 million for contract termination and other closure costs. These charges and

expenses were reflected within discontinued operations in the Consolidated Statements of Income

(Loss). As of December 27, 2008, the Company has not identified a buyer for the facility.

Goodwill and Other Asset Impairments

During 2008, we recorded non-cash impairment charges associated with goodwill, intangible

assets and other long-lived assets of $1,364.4 million before taxes. After adjusting for taxes and an

impact to minority interest, these charges reduced net income by $1,294.7 million after-tax or

$17.05 per diluted share. These non-cash charges consisted of $1,201.5 million of goodwill

impairment in both the Contract ($815.5 million) and Retail ($386.0 million) segments;

$107.1 million of impairment of trade names in our Retail segment and $55.8 million of impairment

related to fixed assets in our Retail segment. These charges resulted in a full impairment of our

goodwill balances.

We are required for accounting purposes to assess the carrying value of goodwill and other

intangible assets annually or whenever circumstances indicate that a decline in value may have

occurred. For other long-lived assets we are also required to assess the carrying value when

circumstances indicate that a decline in value may have occurred. In the second quarter of 2008,

based on our sustained low stock price and reduced market capitalization relative to the book value

of equity, macroeconomic factors impacting industry business conditions, actual recent results and

forecasted operating performance, and continued tightening of the credit markets, along with other

factors, we determined that indicators of potential impairment were present and that an interim test

for impairment was required as of the end of the second quarter. In the fourth quarter of 2008, due

to a further decline in our market capitalization in relation to the book value of equity, a worsening

economic environment, increasing unemployment and a decline in results and forecasted operating

performance, we concluded that indicators of potential impairment were again present and that a

new interim test for impairment was required as of the end of the fourth quarter.

27