OfficeMax 2008 Annual Report Download - page 74

Download and view the complete annual report

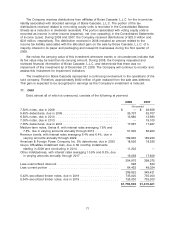

Please find page 74 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.been reduced by $45.1 million of minimum sublease rentals due in the future under noncancelable

subleases. These sublease rentals include amounts related to closed stores and other facilities that

are accounted for in the integration activities and facility closures reserve. See ‘‘Note 5, Integration

Activities and Facility Closures.’’

The Company capitalizes lease obligations for which it assumes substantially all property rights

and risks of ownership. The Company did not have any material capital leases during any of the

periods presented.

9. Discontinued Operations

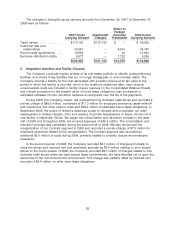

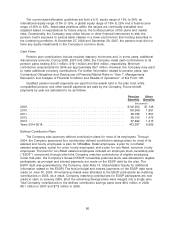

In December 2004, our board of directors authorized management to pursue the divestiture of

a facility near Elma, Washington that manufactured integrated wood-polymer building materials. As

a result, the Company recorded the facility’s assets as held for sale on the Consolidated Balance

Sheets and reported the results of its operations as discontinued operations beginning in 2004.

During 2005, the Company experienced unexpected difficulties in achieving anticipated levels of

production at the facility, which delayed the process of identifying and qualifying a buyer for the

business. During the first quarter of 2006, the Company ceased operations at the facility and

recorded a pre-tax charge of $18.0 million for contract termination and other closure costs. These

charges and expenses were reflected within discontinued operations in the Consolidated

Statements of Income (Loss). As of December 27, 2008, the Company has not identified a buyer for

the facility.

The liabilities of the wood-polymer building materials facility near Elma, Washington, are

included in current liabilities ($15.6 million at December 27, 2008 and $15.4 million at December 29,

2007, respectively) in the Consolidated Balance Sheets. The assets related to this facility were fully

impaired in 2006, so that there is no value recorded on the Consolidated Balance Sheets at

December 27, 2008 or December 29, 2007.

10. Investments in Affiliates

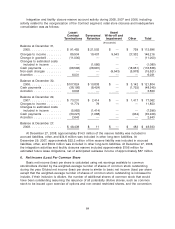

In connection with the sale of the paper, forest products and timberland assets in 2004 (the

‘‘Sale’’), the Company invested $175 million in the equity units of affiliates of the buyer, Boise

Cascade, L.L.C. A portion (approximately $66 million) of the equity units received in exchange for

the Company’s investment carry no voting rights. This investment is accounted for under the cost

method as Boise Cascade, L.L.C. does not maintain separate ownership accounts for its members,

and the Company does not have the ability to significantly influence its operating and financial

policies. This investment is included in investments in affiliates in the Consolidated Balance Sheets.

The Boise Cascade, L.L.C. non-voting equity units accrue dividends daily at the rate of 8% per

annum on the liquidation value plus accumulated dividends. Dividends accumulate semiannually to

the extent not paid in cash on the last day of June and December. The Company recognized

dividend income on this investment of $6.2 million in 2008, $6.1 million in 2007 and $5.9 million in

2006. These amounts were recorded as a reduction of general and administrative expenses in the

Consolidated Statements of Income (Loss).

70