OfficeMax 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

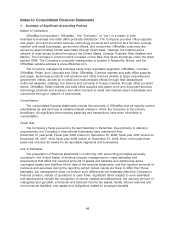

Prior Period Revisions

Certain amounts included in the prior year financial statements have been revised to conform

with the current year presentation. In the current year, amounts for the sub-components of property

and equipment in the Consolidated Balance Sheet were revised to correct the amounts reported

within each sub-component. As a result, land and land improvements and buildings and

improvements increased by $6.5 million and $48.0 million, respectively, while machinery and

equipment decreased by $54.5 million from the amounts previously reported. There was no change

to total property and equipment. Also in the current year, amounts related to earnings from affiliates,

previously recorded as ‘‘Other operating, net’’ in the Consolidated Statements of Income (Loss),

were reclassified into general and administrative expenses due to their immateriality. The effect of

these revisions on the amounts reported for 2007 and 2006 was not material.

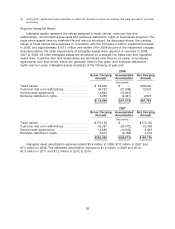

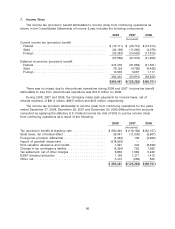

2. Significant Charges and Credits

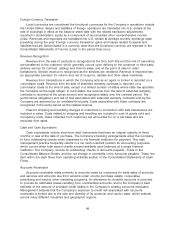

Other Operating, Net

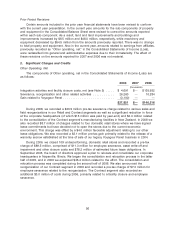

The components of Other operating, net in the Consolidated Statements of Income (Loss) are

as follows:

2008 2007 2006

(thousands)

Integration activities and facility closure costs, net (see Note 5) ..... $ 4,691 $— $ 135,932

Severance, reorganization and other related activities ............ 26,260 — 10,284

Gain related to Voyageur Panel ............................ (3,100) — —

$27,851 $— $146,216

During 2008, we recorded a $23.9 million pre-tax severance charge related to various sales and

field reorganizations in our Retail and Contract segments as well as a significant reduction in force

at the corporate headquarters (of which $15 million was paid by year-end) and $2.4 million related

to the consolidation of the Contract segment’s manufacturing facilities in New Zealand. In 2008 we

also recorded $8.7 million of charges related to four domestic retail stores where we have signed

lease commitments but have decided not to open the stores due to the current economic

environment. This charge was offset by a $4.0 million favorable adjustment relating to our other

lease obligations. We also recorded a $3.1 million pre-tax gain primarily related to the release of a

warranty escrow established at the time of sale of our legacy Voyageur Panel business in 2004.

During 2006, we closed 109 underperforming, domestic retail stores and recorded a pre-tax

charge of $89.5 million, comprised of $11.3 million for employee severance, asset write-off and

impairment and other closure costs and $78.2 million of estimated future lease obligations. In

September 2005, the board of directors approved a plan to relocate and consolidate our corporate

headquarters in Naperville, Illinois. We began the consolidation and relocation process in the latter

half of 2005, and in 2006 we expensed $46.4 million related to the effort. The consolidation and

relocation process was completed during the second half of 2006. We also announced the

reorganization of our Contract segment in 2006 and recorded a pre-tax charge of $7.3 million for

employee severance related to the reorganization. The Contract segment also recorded an

additional $3.0 million of costs during 2006, primarily related to a facility closure and employee

severance.

56