OfficeMax 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

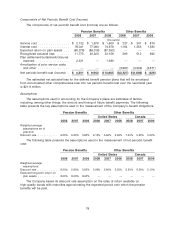

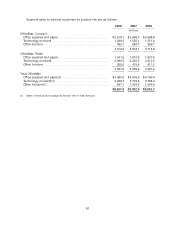

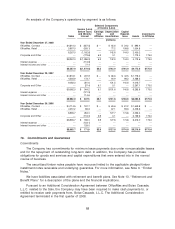

An analysis of the Company’s operations by segment is as follows:

Selected Components

of Income (Loss)

Income (Loss)

Before Taxes Earnings Depreciation Capital

and Minority from and Expendi- Investments

Sales Interest Affiliates Amortization tures Assets In Affiliates

(millions)

Year Ended December 27, 2008

OfficeMax, Contract ............... $4,310.0 $ (657.5) $ — $ 65.6 $ 34.2 $ 895.4 —

OfficeMax, Retail ................. 3,957.0 (505.1) — 77.2 109.8 1,504.8 —

8,267.0 (1,162.6) — 142.8 144.0 2,400.2 —

Corporate and Other .............. — (773.6) 6.2 0.1 — 1,773.4 175.0

$ 8,267.0 $ (1,936.2) 6.2 142.9 144.0 4,173.6 175.0

Interest expense ................. — (113.6) — — — — —

Interest Income and other ........... — 77.4 — — — — —

$8,267.0 $(1,972.4) $6.2 $142.9 $144.0 $4,173.6 $175.0

Year Ended December 29, 2007

OfficeMax, Contract ............... $4,816.1 $ 207.9 $ — $ 66.6 $ 42.5 $ 1,778.2 —

OfficeMax, Retail ................. 4,265.9 173.7 — 64.9 98.3 2,238.5 —

9,082.0 381.6 — 131.5 140.8 4,016.7 —

Corporate and Other .............. — (37.4) 6.1 0.1 — 2,267.1 175.0

$ 9,082.0 $ 344.2 6.1 $ 131.6 140.8 6,283.8 175.0

Interest expense ................. — (121.3) — — — — —

Interest income and other ........... — 114.6 — — — — —

$9,082.0 $ 337.5 $6.1 $131.6 $140.8 $6,283.8 $175.0

Year Ended December 30, 2006

OfficeMax, Contract ............... $4,714.5 $ 197.7 $ — $ 60.6 $ 81.2 $ 1,649.8 $ —

OfficeMax, Retail ................. 4,251.2 86.3 — 67.1 93.6 2,406.6 —

8,965.7 284.0 — 127.7 174.8 4,056.4 —

Corporate and Other .............. — (118.0) 5.9 0.1 — 2,159.6 175.0

$ 8,965.7 $ 166.0 5.9 127.8 174.8 6,216.0 175.0

Interest expense ................. — (123.1) — — — — —

Interest income and other ........... — 129.0 — — — — —

$8,965.7 $ 171.9 $5.9 $127.8 $174.8 $6,216.0 $175.0

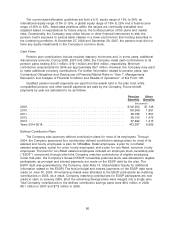

16. Commitments and Guarantees

Commitments

The Company has commitments for minimum lease payments due under noncancelable leases

and for the repayment of outstanding long-term debt. In addition, the Company has purchase

obligations for goods and services and capital expenditures that were entered into in the normal

course of business.

The securitized timber notes payable have recourse limited to the applicable pledged timber

installment notes receivable and underlying guaranties. For more information, see Note 3. ‘‘Timber

Notes.’’

We have liabilities associated with retirement and benefit plans. See Note 13. ‘‘Retirement and

Benefit Plans’’ for a description of the plans and the financial implications.

Pursuant to an Additional Consideration Agreement between OfficeMax and Boise Cascade,

L.L.C. related to the Sale, the Company may have been required to make cash payments to, or

entitled to receive cash payments from, Boise Cascade, L.L.C. The Additional Consideration

Agreement terminated in the first quarter of 2008.

88