OfficeMax 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.sublease income is different than our estimates, adjustments to the recorded reserves may be

required.

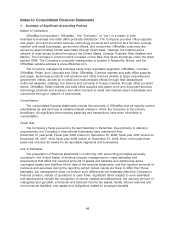

Environmental Remediation

We are subject to a variety of environmental laws and regulations. We account for

environmental remediation liabilities in accordance with the Statement of Position (SOP) 96-1,

‘‘Environmental Remediation Liabilities.’’ We record liabilities on an undiscounted basis when

assessments and/or remedial efforts are probable and the cost can be reasonably estimated. We

estimate our environmental liabilities based on various assumptions and judgments, as we cannot

predict with certainty the total response and remedial costs, our share of total costs, the extent to

which contributions will be available from other parties or the amount of time necessary to complete

any remediation. In making these judgments and assumptions, we consider, among other things,

the activity to date at particular sites, information obtained through consultation with applicable

regulatory authorities and third-party consultants and contractors and our historical experience at

other sites that are judged to be comparable. Due to the number of uncertainties and variables

associated with these assumptions and judgments and the effects of changes in governmental

regulation and environmental technologies, the precision of the resulting estimates of the related

liabilities is subject to uncertainty. We regularly monitor our estimated exposure to our

environmental liabilities. As additional information becomes known, our estimates may change.

Environmental liabilities that relate to the operation of the paper and forest products assets

prior to the closing of the Sale continue to be liabilities of OfficeMax, in addition to the liabilities

related to certain sites referenced in Note 17, Legal Proceedings and Contingencies, of the Notes to

Consolidated Financial Statements in ‘‘Item 8. Financial Statements and Supplementary Data’’ in

this Form 10-K.

Goodwill, Indefinite-Lived Intangibles and Other Long-Lived Assets Impairment

SFAS No. 142, ‘‘Goodwill and Other Intangible Assets,’’ requires us to assess goodwill for

impairment at least annually in the absence of an indicator of possible impairment and immediately

upon an indicator of possible impairment. In assessing impairment, the statement requires us to

make estimates of the fair values of our reporting units. If we determine the fair values are less than

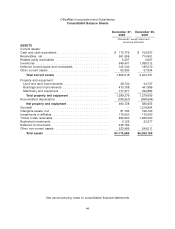

the carrying amount of goodwill recorded on our Consolidated Balance Sheet, we must recognize

an impairment loss in our financial statements. SFAS No. 144, ‘‘Accounting for the Impairment or

Disposal of Long-Lived Assets,’’ requires us to assess our long-lived assets for impairment

whenever an indicator of possible impairment exists. In assessing impairment, the statement

requires us to make estimates of the fair value of the assets. If we determine the fair values are less

than the carrying value of the assets, we must recognize an impairment loss in our financial

statements. At the end of 2007 and 2006, we conducted our annual assessment of goodwill and no

impairment was indicated.

Based on our sustained low stock price and reduced market capitalization relative to the book

value of equity, macroeconomic factors impacting industry business conditions, actual recent results

and forecasted operating performance, and continued tightening of the credit markets, along with

other factors, we determined that indicators of potential impairment were present in 2008. As a

result, management assessed the carrying value of acquired goodwill and intangible assets with

indefinite lives as well as other long-lived assets for impairment.

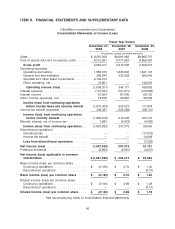

During 2008, we recorded pre-tax impairment charges of $1,364.4 million related to goodwill

and other assets in both our Contract and Retail segments. These non-cash charges consisted of

$1,201.5 million of goodwill impairment in both the Contract ($815.5 million) and Retail

($386.0 million) segments; $107.1 million of estimated impairment of trade names in our Retail

40