OfficeMax 2008 Annual Report Download - page 33

Download and view the complete annual report

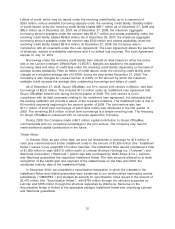

Please find page 33 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 27, 2008, the integration and facility closure reserve was $48.9 million with

$14.3 million included in current liabilities, and $34.6 million included in long-term liabilities. The

vast majority of the reserve represents future lease obligations of $106 million, net of anticipated

sublease income of approximately $57 million. Cash payments relating to the integration and facility

closures were $35.2 million, $48.3 million and $116.5 million in 2008, 2007, and 2006, respectively.

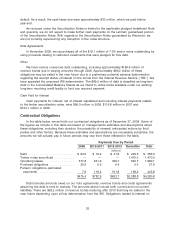

Liquidity and Capital Resources

As of December 27, 2008, we had $170.8 million of cash and cash equivalents and

$354.4 million of short-term and long-term debt, excluding the $1,470 million of timber securitization

notes. The maximum aggregate borrowing amount available under our revolver was $613.7 million

as of December 27, 2008. Excess availability under the revolving credit facility totaled $546.9 million

as of December 27, 2008. The amount available reflects issued standby letters of credit which

reduce the Company’s borrowing capacity. As of December 27, 2008, the Company was in

compliance with all covenants under the revolving credit facility agreement which expires on

July 12, 2012.

Our primary ongoing cash requirements relate to working capital, expenditures for property and

equipment, lease obligations, pension funding and debt service. We expect to fund these

requirements through a combination of cash, cash flow from operations and seasonal borrowings

under our revolving credit facility. The sections that follow discuss in more detail our operating,

investing, and financing activities, as well as our financing arrangements.

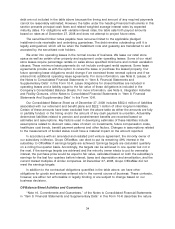

Operating Activities

Our operating activities generated cash of $223.7 million, $70.6 million and $375.6 million in

2008, 2007 and 2006, respectively. The cash provided by operating activities in 2008 reflected our

focus on working capital management, which yielded reduced collection days outstanding for

accounts receivable as well as a decrease in inventory per location while maintaining the same

accounts payable leverage as last year. The results of these efforts more than offset the decline in

cash generated from lower earnings versus 2007. In 2007, cash used by working capital changes

included the effect of terminating our accounts receivable securitization program and the resulting

increase in accounts receivable, and a reduction in the accounts payable-to-inventory leverage.

These changes were partially offset by the monetization of certain Company-owned life insurance

assets.

We sponsor noncontributory defined benefit pension plans covering certain terminated

employees, vested employees, retirees, and some active OfficeMax, Contract employees. Pension

expense was $4.2 million, $10.0 million and $13.7 million for the years ended December 27, 2008,

December 29, 2007 and December 30, 2006, respectively. In 2008, 2007 and 2006, we made

contributions to our pension plans totaling $13.1 million, $19.1 million and $9.6 million, respectively.

The minimum required funding contribution in 2009 is approximately $6.7 million and the expense

is projected to be $25.7 million compared to expense of $4.2 million in 2008. However, we may

elect to make additional voluntary contributions. See ‘‘Critical Accounting Estimates’’ in this

Management’s Discussion and Analysis of Financial Condition and Results of Operations for more

information.

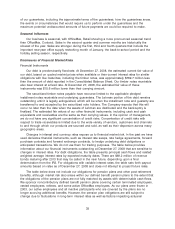

Investment Activities

Our investing activities used cash of $112.1 million in 2008, $138.9 million in 2007 and

$163.9 million in 2006.

Our principal investing activities are related to capital expenditures. Our capital spending in

2008 primarily related to leasehold improvements, new and remodeled stores, quality and efficiency

29