OfficeMax 2008 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of December 27, 2008, we had total debt of $354.4 million, excluding $1,470.0 million of

timber securitization notes, which have recourse limited to the timber installment notes receivable

and related guarantees. As of December 27, 2008, we had $170.8 million in cash and cash

equivalents, and $547 million in available (unused) borrowing capacity under our $700 million

revolving credit facility, which is committed through July 12, 2012. Our unused borrowing capacity

as of December 27, 2008 reflects an available borrowing base of $614 million, no outstanding

borrowings, and $67 million of standby letters of credit issued under the revolving credit facility.

For the full year 2008, we generated $223.7 million of cash from operations reflecting our focus

on working capital management, which yielded reduced collection days outstanding for accounts

receivable, as well as a decrease in inventory per location while maintaining the same accounts

payable leverage as last year.

Outlook

Given the projected weak economic outlook, we are cautious in our expectations for 2009. We

expect sales to decline in 2009 on a year-over-year basis as a result of the difficult economic

environment. As a result, we expect the effects of deleveraging of costs and expenses as a result of

lower sales to continue in 2009.

Despite the challenging economic environment, we remain committed to managing OfficeMax

for the long-term and positioning the Company for growth when the economic environment

improves. We are placing a premium on maintaining positive operating cash flow through tight cost

controls and conservative working capital management in the near term. We expect cash flow from

operations to exceed capital expenditures in 2009. We also believe that our needs to access our

revolving line of credit will be limited to seasonal periods, and expect to have little or no borrowings

outstanding under the facility at year end.

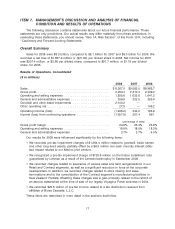

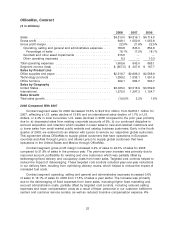

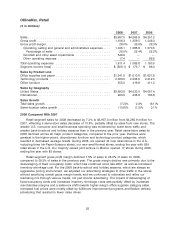

2008 Compared with 2007

Sales for 2008 decreased 9.0% to $8,267.0 million from $9,082.0 million for 2007. The

year-over-year sales decreases were largely influenced by the weaker global economic environment

and by our more disciplined, analysis-driven approach to sales generation and retention. The

year-over-year sales decrease occurred in both our Contract and Retail segments and reflects a

10.7% decrease in comparable sales. The amount of sales percentage decline compared to the

prior year increased in each quarter of 2008. Foreign exchange rate changes late in the year had

an adverse impact on sales. For the year, sales increased $9.4 million due to the impact of foreign

exchange rates, but the trend has reversed and sales were reduced by $81.1 million due to the

effect of foreign exchange rates in the fourth quarter.

Gross profit margin decreased by 0.5% of sales to 24.9% of sales in 2008 compared to 25.4%

of sales in 2007. The gross profit margins declined in our Retail segment compared to the previous

year but improved for our Contract segment. The Retail decline was primarily due to deleveraging

of fixed costs, resulting from the lower sales, as well as new stores which have not ramped up to

mature sales volume and higher inventory shrinkage results. The decline was partially offset by a

sales-mix shift towards higher-margin office supplies category sales. The Contract segment margin

improvement was due primarily to a higher margin customer mix resulting from our more

disciplined approach to contractual sales generation and retention.

Operating and selling expenses increased by 0.8% of sales to 18.8% of sales in 2008 from

18.0% of sales a year earlier. The increases in operating and selling expenses as a percent of sales

were primarily the result of deleveraging fixed costs due to lower sales, which were partially offset

by reduced incentive compensation expense and targeted cost reductions, including reduced

18