OfficeMax 2008 Annual Report Download - page 45

Download and view the complete annual report

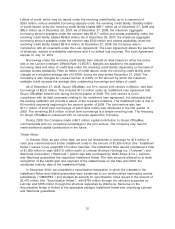

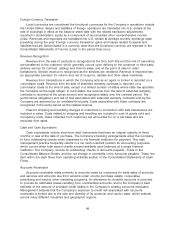

Please find page 45 of the 2008 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.segment and $55.8 million of impairment related to fixed assets in our Retail segment. The

measurement of impairment of goodwill and indefinite life intangibles includes estimates and

assumptions which are inherently subject to significant uncertainties. In testing for impairment, we

measured the estimated fair value of our reporting units, intangibles and fixed assets based upon

discounted future operating cash flows using a discount rate reflecting a market-based, weighted

average cost of capital. In estimating future cash flows, we used our internal budgets and operating

plans, which include assumptions about retail store openings and closures, the consolidation of our

distribution networks and improvements in our supply chain, and future growth prospects.

Differences in assumptions used in projecting future operating cash flows and in selecting an

appropriate discount rate could have a significant impact on the determination of fair value and

impairment amounts. As a result of these impairment charges, there is no goodwill remaining in the

Company’s consolidated financial statements at December 27, 2008.

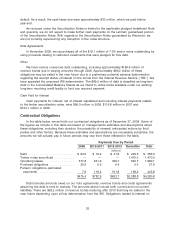

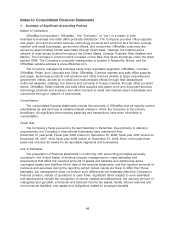

Recently Issued or Newly Adopted Accounting Standards

Following are summaries of recently issued accounting pronouncements that have either been

recently adopted or that may become applicable to the preparation of our consolidated financial

statements in the future.

In September 2006, the Financial Accounting Standards Board (FASB) issued SFAS No. 157,

‘‘Fair Value Measurements’’ (‘‘SFAS 157’’). This Standard defines fair value, establishes a framework

for measuring fair value in generally accepted accounting principles and expands disclosures about

fair value measurements. SFAS 157 is effective for fiscal years beginning after November 15, 2007

for financial assets and liabilities, as well as for any other assets and liabilities that are carried at fair

value on a recurring basis in financial statements. In November 2007, the FASB provided a one

year deferral for the implementation of SFAS 157 for other nonfinancial assets and liabilities. The

Company adopted the provisions of SFAS 157 for financial assets and liabilities effective at the

beginning of fiscal year 2008. The provisions of SFAS 157 had no impact on our financial

statements. We do not anticipate that adoption of SFAS 157 for non-financial assets and liabilities

will have a material impact on our financial condition, results of operations or cash flows.

In February 2007, the FASB issued SFAS No. 159, ‘‘The Fair Value Option for Financial Assets

and Financial Liabilities—including an amendment of SFAS 115’’ (‘‘SFAS 159’’). SFAS 159 allows

entities to choose, at specific election dates, to measure eligible financial assets and liabilities at fair

value that are not otherwise required to be measured at fair value. If a company elects the fair value

option for an eligible item, changes in that item’s fair value in subsequent reporting periods must be

recognized in current earnings. The Company did not elect to adopt the fair value option provided

under SFAS 159.

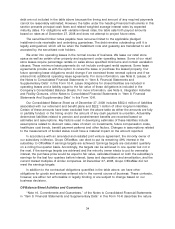

In December 2007, the FASB issued SFAS No. 141R, ‘‘Business Combinations’’ (‘‘SFAS 141R’’).

This statement amends SFAS 141 and provides revised guidance for recognizing and measuring

assets acquired and liabilities assumed in a business combination. This statement also requires that

transaction costs in a business combination be expensed as incurred. SFAS 141R applies

prospectively to business combinations for which the acquisition date is on or after the beginning of

the first annual reporting period beginning on or after December 15, 2008. SFAS 141R will impact

the accounting for business combinations completed on or after December 28, 2008.

In December 2007, the FASB issued SFAS No. 160, ‘‘Noncontrolling Interests in Consolidated

Financial Statements’’ (‘‘SFAS 160’’). This statement requires noncontrolling interests (previously

referred to as minority interests) to be treated as a separate component of equity, not as a liability

or other item outside of permanent equity. SFAS 160 applies to the accounting for noncontrolling

interests and transactions with noncontrolling interest holders in consolidated financial statements

and is effective for periods beginning on or after December 15, 2008. Earlier application is

41