Nike 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NIKE, INC.

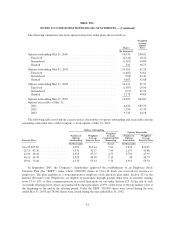

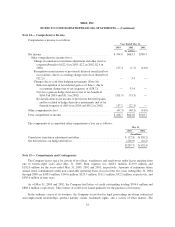

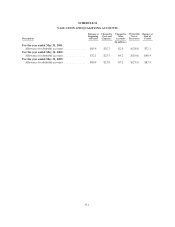

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

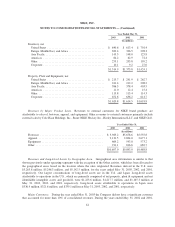

Note 17 — Operating Segments and Related Information

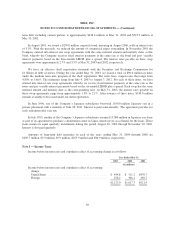

Operating Segments. The Company’s operating segments are evidence of the structure of the Company’s

internal organization. The major segments are defined by geographic regions with operations participating in

NIKE brand sales activity. Each NIKE brand geographic segment operates predominantly in one industry: the

design, production, marketing and selling of sports and fitness footwear, apparel, and equipment. The “Other”

category shown below represents activities of Cole Haan Holdings, Inc., Bauer NIKE Hockey, Inc., Hurley

International LLC, NIKE Golf, and NIKE IHM, Inc., which are considered immaterial for individual disclosure.

In prior years, operating activity for NIKE Golf was classified within each region. Effective June 1, 2002,

NIKE Golf revenues and income from the Company’s largest golf markets have been reclassified to the Other

category, as a result that the Company has begun managing these operations separately from the regional

businesses. Certain NIKE Golf inventories, receivables, and property, plant, and equipment continue to be

managed by the regions, and as a result, no reclassifications for these balances have been made. NIKE Golf

information for the years ended May 31, 2002 and 2001 have been reclassified to conform to the current year

presentation.

Where applicable, “Corporate” represents items necessary to reconcile to the consolidated financial

statements, which generally include corporate activity and corporate eliminations. Certain miscellaneous

operating activities have been reclassified between Corporate and the applicable regional operating segment as of

June 1, 2002, reflecting a change in the management of these activities. With respect to these classifications, the

applicable prior year periods have been reclassified to conform to the current year presentation.

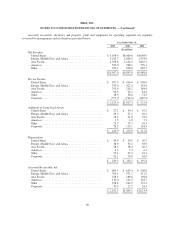

Net revenues as shown below represent sales to external customers for each segment. Intercompany

revenues have been eliminated and are immaterial for separate disclosure. The Company evaluates performance

of individual operating segments based on pre-tax income. On a consolidated basis, this amount represents

Income before income taxes and cumulative effect of accounting change as shown in the Consolidated

Statements of Income. Reconciling items for pre-tax income represent corporate costs that are not allocated to the

operating segments for management reporting including certain currency exchange rate gains and losses on

transactions, amortization of indefinite-lived intangible assets and goodwill, and intercompany eliminations for

specific income statement items in the Consolidated Statements of Income.

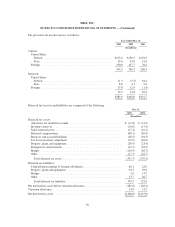

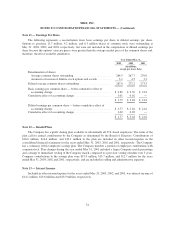

Additions to long-lived assets as presented following represent capital expenditures and additions to

identifiable intangibles and goodwill. Generally, additions to identifiable intangible assets and goodwill are

considered corporate costs and are not attributable to any specific operating segment. See Note 4 for further

discussion on identifiable intangible assets and goodwill. Additions to other long-lived assets are not significant

and are comprised of additions to miscellaneous corporate assets not attributable to any specific operating

segment.

59