Nike 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December 31, 2002. We have not entered into any significant exit or disposal activities since the effective date of

this rule. As such, FAS 146 has not had an impact on our consolidated financial position or results of operations,

and no significant impact is expected in the foreseeable future.

In November 2002, the FASB issued FASB Interpretation No. 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others” (FIN 45). FIN 45

requires that upon issuance of a guarantee, a guarantor must recognize a liability for the fair value of an

obligation assumed under a guarantee. FIN 45 also requires additional disclosures by a guarantor in its interim

and annual financial statements about the obligations associated with guarantees issued. The recognition

provisions of FIN 45 are effective for any guarantees issued or modified after December 31, 2002. The disclosure

requirements of FIN 45 were effective beginning with the third quarter of fiscal 2003.

In connection with various contracts and agreements, we provide routine indemnifications relating to the

enforceability of intellectual property rights, coverage for legal issues that arise, and other items that fall under

the scope of FIN 45. Currently, we have several such agreements in place. However, based on our historical

experience and estimated probability of future loss, we have determined that the fair value of such

indemnifications is not material. Hence, the adoption of FIN 45 has not had an impact on our consolidated

financial position or results of operations, and no significant impact is expected in the foreseeable future.

In December 2002, the FASB issued SFAS No. 148 “Accounting for Stock-Based Compensation—

Transition and Disclosure—an amendment of FASB Statement No. 123” (FAS 148). This statement amends

SFAS No. 123 “Accounting for Stock Based Compensation” (FAS 123) to provide alternative methods of

voluntarily transitioning to the fair value based method of accounting for stock-based employee compensation.

FAS 148 also amends the disclosure requirements of FAS 123 to require disclosure of the method used to

account for stock-based employee compensation and the effect of the method on reported results in both annual

and interim financial statements. The disclosure provisions are effective for us beginning with this fiscal 2003

annual report on Form 10-K. The annual impact of a change to the fair value model prescribed by FAS 123 has

been disclosed in our previous 10-K filings, and the applicable disclosures in this report are in Note 1 and

Note 10 of the Notes to Consolidated Financial Statements. At this time, we plan to continue to account for

stock-based compensation using the intrinsic method prescribed in Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees,” rather than change to the FAS 123 fair value method.

In January 2003, the FASB issued FASB Interpretation No. 46, “Consolidation of Variable Interest Entities”

(FIN 46). This interpretation of Accounting Research Bulletin No. 51, “Consolidated Financial Statements,”

addresses consolidation of variable interest entities. FIN 46 requires certain variable interest entities to be

consolidated by the primary beneficiary if the entity does not effectively disperse risks among the parties

involved. The provisions of FIN 46 are effective immediately for those variable interest entities created after

January 31, 2003. The provisions are effective for the first period beginning after June 15, 2003 for those variable

interests held prior to February 1, 2003. We do not currently have any variable interest entities as defined in

FIN 46. Accordingly, we do not expect the provisions of FIN 46 to affect our consolidated financial position or

results of operations.

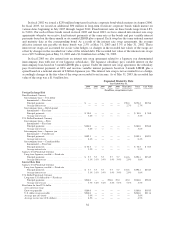

Liquidity and Capital Resources

Fiscal 2003 Cash Flow Activity

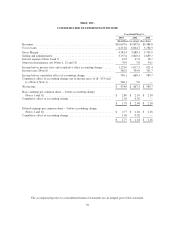

Cash provided by operations was $917.4 million in fiscal 2003, compared to $1,081.5 million in fiscal 2002.

Our primary source of operating cash flow was income before the cumulative effect of an accounting change of

$740.1 million. Operating cash flow decreased compared to the prior year due to increased investment in certain

working capital components during fiscal 2003, including inventories. While a decline in inventory levels

provided a source of cash during fiscal 2002, an increase in inventory levels during fiscal 2003 resulted in a use

of cash, primarily due to our decision to purchase product for the U.S. “back-to-school” selling season earlier

than we did last year in order to improve the timeliness of shipments to customers.

Cash used by investing activities during fiscal 2003 was $215.6 million, compared to $302.8 million

invested during fiscal 2002. The most significant investing activities in both periods were expenditures for

27