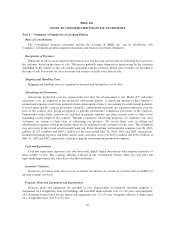

Nike 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.rates would decrease. Changes in our long-term debt rating would not trigger acceleration of maturity of any then

outstanding borrowings or any future borrowings under the committed credit facilities. However, under these

committed credit facilities, we have agreed to various covenants. These covenants include limits on our disposal

of fixed assets and the amount of debt secured by liens we may incur, and set a minimum ratio of net worth to

indebtedness. In the event we were to have any borrowings outstanding under these facilities, failed to meet any

covenant, and were unable to obtain a waiver from a majority of the banks, any borrowings would become

immediately due and payable. As of May 31, 2003, we were in full compliance with each of these covenants and

believe it is unlikely we will fail to meet any of these covenants in the foreseeable future.

Liquidity is also provided by our commercial paper program, under which there was no amount outstanding

at May 31, 2003 and $338.3 million outstanding at May 31, 2002. We currently have short-term debt ratings of

A1 and P1 from Standard and Poor’s Corporation and Moody’s Investor Services, respectively.

We currently believe that cash generated by operations, together with access to external sources of funds as

described above, will be sufficient to meet our operating and capital needs in the foreseeable future.

Dividends per share of common stock for fiscal 2003 were $0.54, compared to $0.48 in fiscal 2002. We

have paid a dividend every quarter since February 1984. We review our dividend policy from time to time;

however, based upon current projected earnings and cash flow requirements, we anticipate continuing to pay a

quarterly dividend in the foreseeable future.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

In the normal course of business and consistent with established policies and procedures, we employ a

variety of financial instruments to manage exposure to fluctuations in the value of foreign currencies and interest

rates. It is our policy to utilize these financial instruments only where necessary to finance our business and

manage such exposures; we do not enter into these transactions for speculative purposes.

We are exposed to foreign currency fluctuation as a result of our international sales, production and funding

activities. Our foreign currency risk management objective is to reduce the variability of local entity cash flows

as a result of exchange rate movements. We use forward exchange contracts and options to hedge certain

anticipated but not yet firmly committed transactions as well as certain firm commitments and the related

receivables and payables, including third party or intercompany transactions.

When we begin hedging exposures depends on the nature of the exposure and market conditions. Generally,

all anticipated and firmly committed transactions that are hedged are to be recognized within twelve months,

although at May 31, 2003 we had forward contracts hedging anticipated transactions that will be recognized in as

many as 18 months. The majority of the contracts expiring in more than twelve months relate to the anticipated

purchase of inventory by our European and Japanese subsidiaries. We use forward contracts and cross-currency

swaps to hedge foreign currency denominated payments under intercompany loan agreements. When

intercompany loans are hedged, it is typically for their expected duration. Hedged transactions are principally

denominated in European currencies, Japanese yen, Canadian dollars, Korean won, Mexican pesos and

Australian dollars.

Our earnings are also exposed to movements in short and long-term market interest rates. Our objective in

managing this interest rate exposure is to limit the impact of interest rate changes on earnings and cash flows, and

to reduce overall borrowing costs. To achieve these objectives, we maintain a mix of medium and long-term

fixed rate debt, commercial paper, and bank loans and have entered into interest rate swaps under which we

receive fixed interest and pay variable interest.

Market Risk Measurement

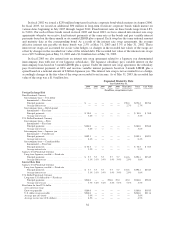

We monitor foreign exchange risk, interest rate risk and related derivatives using a variety of techniques

including a review of market value, sensitivity analysis, and Value-at-Risk (VaR). Our market-sensitive derivative

and other financial instruments, as defined by the SEC, are foreign currency forward contracts, foreign currency

option contracts, cross-currency swaps, interest rate swaps, intercompany loans denominated in foreign currencies,

fixed interest rate U.S. dollar denominated debt, and fixed interest rate Japanese yen denominated debt.

30