Nike 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NIKE, INC.

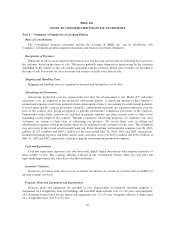

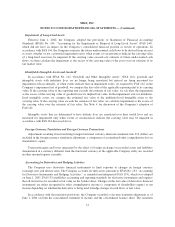

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1 — Summary of Significant Accounting Policies

Basis of Consolidation

The consolidated financial statements include the accounts of NIKE, Inc. and its subsidiaries (the

Company). All significant intercompany transactions and balances have been eliminated.

Recognition of Revenues

Wholesale revenues are recognized when title passes and the risks and rewards of ownership have passed to

the customer, based on the terms of sale. Title passes generally upon shipment or upon receipt by the customer

depending on the country of the sale and the agreement with the customer. Retail store revenues are recorded at

the time of sale. Provisions for sales discounts and returns are made at the time of sale.

Shipping and Handling Costs

Shipping and handling costs are expensed as incurred and included in cost of sales.

Advertising and Promotion

Advertising production costs are expensed the first time the advertisement is run. Media (TV and print)

placement costs are expensed in the month the advertising appears. A significant amount of the Company’s

promotional expenses result from payments under endorsement contracts. Accounting for endorsement payments

is based upon specific contract provisions. Generally, endorsement payments are expensed uniformly over the

term of the contract after giving recognition to periodic performance compliance provisions of the contracts.

Prepayments made under contracts are included in prepaid expenses and other current assets or other assets

depending on the length of the contract. Through cooperative advertising programs, we reimburse our retail

customers for certain of their costs of advertising our products. We record these costs in selling and

administrative expense at the point in time when we are obligated to our customers for the costs. This obligation

may arise prior to the related advertisement being run. Total advertising and promotion expenses were $1,168.6

million, $1,027.9 million and $998.2 million for the years ended May 31, 2003, 2002 and 2001, respectively.

Included in prepaid expenses and other current assets and other assets was $135.2 million and $113.2 million at

May 31, 2003 and 2002, respectively, relating to prepaid advertising and promotion expenses.

Cash and Equivalents

Cash and equivalents represent cash and short-term, highly liquid investments with original maturities of

three months or less. The carrying amounts reflected in the consolidated balance sheet for cash and cash

equivalents approximate fair value due to the short maturities.

Inventory Valuation

Inventories are stated at the lower of cost or market. Inventories are valued on a first-in, first-out (FIFO) or

moving-average cost basis.

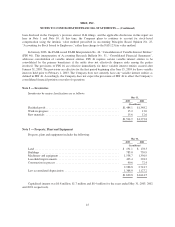

Property, Plant and Equipment and Depreciation

Property, plant and equipment are recorded at cost. Depreciation for financial reporting purposes is

determined on a straight-line basis for buildings and leasehold improvements over 2 to 40 years and principally

on a declining balance basis for machinery and equipment over 2 to 15 years. Computer software is depreciated

on a straight-line basis over 3 to 10 years.

40