Nike 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

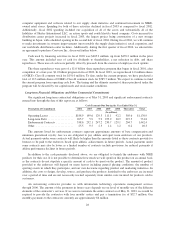

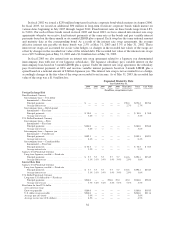

We also have the following outstanding short-term debt obligations as of May 31, 2003. Please refer to the

accompanying Notes to Consolidated Financial Statements (Note 6 — Short-term Borrowings and Credit Lines)

for further description and interest rates related to the short-term debt obligations listed below.

Outstanding as of

May 31, 2003

(In millions)

Notes payable, due at mutually agreed-upon dates, generally ninety days from

issuance or on demand ............................................... $75.4

Payable to Nissho Iwai American Company (NIAC) for the purchase of inventories,

generally due sixty days after shipment of goods from a foreign port ........... $49.6

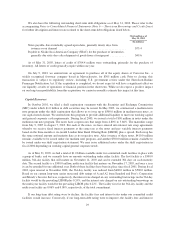

As of May 31, 2003, letters of credit of $704.4 million were outstanding, primarily for the purchase of

inventory. All letters of credit generally expire within one year.

On July 9, 2003, we entered into an agreement to purchase all of the equity shares of Converse Inc., a

widely recognized footwear company based in Massachusetts, for $305 million cash. Prior to closing, this

transaction is subject to regulatory review, including U.S. government review under the Hart-Scott-Rodino

Premerger Notification Act. If the acquisition is completed, we do not expect it will have a significant effect on

our liquidity, results of operations or financial position in the short term. While we do expect a positive impact

on our long-term profitability from this acquisition, we cannot reasonably estimate this impact at this time.

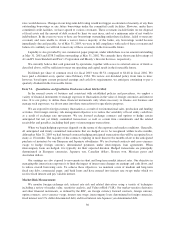

Capital Resources

In October 2001, we filed a shelf registration statement with the Securities and Exchange Commission

(SEC) under which $1.0 billion in debt securities may be issued. In May 2002, we commenced a medium-term

note program under the shelf registration that allows us to issue up to $500.0 million in medium-term notes, as

our capital needs dictate. We entered into this program to provide additional liquidity to meet our working capital

and general corporate cash requirements. During fiscal 2003, we issued a total of $90 million in notes under the

medium-term note program. The notes have coupon rates that range from 4.80% to 5.66%. The maturities range

from July 9, 2007 to August 7, 2012. For each of the notes, we have entered into interest rate swap agreements

whereby we receive fixed interest payments at the same rate as the notes and pay variable interest payments

based on the three-month or six-month London Inter Bank Offering Rate (LIBOR) plus a spread. Each swap has

the same notional amount and maturity date as its respective note. After issuance of these notes, $410.0 million

remains available to be issued under our medium note program, and another $500.0 million remains available to

be issued under our shelf registration statement. We may issue additional notes under the shelf registration in

fiscal 2004 depending on working capital general corporate needs.

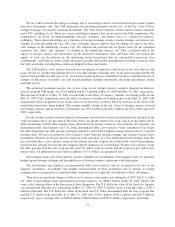

As of May 31, 2003, we had a total of $1.0 billion available under two committed credit facilities in place with

a group of banks, and we currently have no amounts outstanding under either facility. The first facility is a $500.0

million, 364-day facility that will mature on November 14, 2003 and can be extended 364 days on each maturity

date. The second facility is a $500.0 million, multi-year facility that matures on November 17, 2005, and once a year

it can be extended for one additional year. Both of these facilities have been in place since fiscal 2001. During fiscal

2003, upon renewal in November 2002, the 364-day facility was reduced from $600.0 million to $500.0 million.

Based on our current long-term senior unsecured debt ratings of A and A2 from Standard and Poor’s Corporation

and Moody’s Investor Services, respectively, the interest rate charged on any outstanding borrowings on the 364-day

facility would be the prevailing LIBOR plus 0.24%, and the interest rate charged on any outstanding borrowings on

the multi-year facility would be the prevailing LIBOR plus 0.22%. The facility fees for the 364-day facility and the

multi-year facility are 0.06% and 0.08%, respectively, of the total commitment.

If our long-term debt rating were to decline, the facility fees and interest rates under our committed credit

facilities would increase. Conversely, if our long-term debt rating were to improve, the facility fees and interest

29