Nike 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

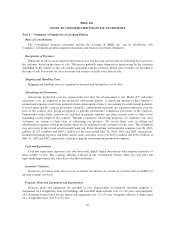

Reclassifications

Certain prior year amounts have been reclassified to conform to fiscal year 2003 presentation. These

changes had no impact on previously reported results of operations or shareholders’ equity.

Recently Issued Accounting Standards

In June 2001, the Financial Accounting Standards Board (FASB) issued SFAS No. 143, “Accounting for

Asset Retirement Obligations” (FAS 143). This statement requires that a liability for an asset retirement

obligation be recognized at fair value in the period the obligation is incurred and the associated retirement costs

be capitalized as part of the carrying amount of the related tangible long-lived asset. All provisions of this

statement will be effective for the Company on June 1, 2003. It is not expected that the adoption of FAS 143 will

have a material impact on the Company’s consolidated financial position or results of operations.

In June 2002, the FASB issued SFAS No. 146 “Accounting for Costs Associated with Exit or Disposal

Activities” (FAS 146). This statement supercedes Emerging Issues Task Force (EITF) Issue No. 94-3 “Liability

Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including Certain

Costs Incurred in a Restructuring).” FAS 146 requires that a liability for a cost associated with an exit or disposal

activity be recognized when the liability is incurred. Under EITF 94-3, a liability was recognized at the date an

entity committed to an exit plan. FAS 146 also establishes that the liability should initially be measured and

recorded at fair value. The provisions of FAS 146 are effective for any exit and disposal activities initiated after

December 31, 2002. We have not entered into any significant exit or disposal activities since the effective date of

this rule. As such, FAS 146 has not had any impact on the Company’s consolidated financial position or results

of operations, and no significant impact is expected in the foreseeable future.

In November 2002, the FASB issued FASB Interpretation No. 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others” (FIN 45). FIN 45

requires that upon issuance of a guarantee, a guarantor must recognize a liability for the fair value of an

obligation assumed under a guarantee. FIN 45 also requires additional disclosures by a guarantor in its interim

and annual financial statements about the obligations associated with guarantees issued. The recognition

provisions of FIN 45 are effective for any guarantees issued or modified after December 31, 2002. The disclosure

requirements of FIN 45 were effective beginning with the third quarter ended February 28, 2003.

In connection with various contracts and agreements, the Company provides routine indemnifications

relating to the enforceability of intellectual property rights, coverage for legal issues that arise, and other items

that fall under the scope of FIN 45. Currently, the Company has several such agreements in place. However,

based on the Company’s historical experience and estimated probability of future loss, the Company has

determined that the fair value of such indemnifications is not material. Hence, the adoption of FIN 45 has not had

an impact on the Company’s consolidated financial position or results of operations, and no significant impact is

expected in the foreseeable future.

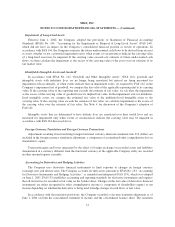

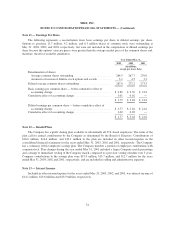

In December 2002, the FASB issued SFAS No. 148 “Accounting for Stock-Based Compensation—

Transition and Disclosure—an amendment of FASB Statement No. 123” (FAS 148). This statement amends

SFAS No. 123 “Accounting for Stock Based Compensation” (FAS 123) to provide alternative methods of

voluntarily transitioning to the fair value based method of accounting for stock-based employee compensation.

FAS 148 also amends the disclosure requirements of FAS 123 to require disclosure of the method used to

account for stock-based employee compensation and the effect of the method on reported results in both annual

and interim financial statements. The disclosure provisions are effective for the Company beginning with this

annual report on Form 10-K. The annual impact of a change to the fair value model prescribed by FAS 123 has

44