Nike 2003 Annual Report Download - page 27

Download and view the complete annual report

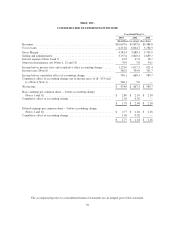

Please find page 27 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our gross margin percentage improved from 39.0% in fiscal 2001 to 39.3% in fiscal 2002. Factors

contributing to the improved gross margin percentage in fiscal 2002 were as follows:

(1) Higher in-line pricing margins in EMEA, due to the effect of higher prices effective at the

beginning of the fiscal year and sourcing and warehousing efficiencies, partially offset by the

effect of weaker euro/U.S. dollar currency hedge rates relative to fiscal 2001.

(2) Higher footwear margins in the U.S. due in part to lower product costs and lower transportation

costs, as a result of both effective negotiations with shippers and lower air freight costs incurred.

Relatively higher air freight costs were incurred in fiscal 2001 due to supply chain system

problems.

(3) A higher mix of in-line sales versus close-out sales of U.S. footwear, reflecting increased demand

for in-line footwear and lower close-out sales as compared to fiscal 2001 as discussed above.

Selling and administrative expense increased as a percentage of revenues from 28.3% in fiscal 2001 to

28.5% in fiscal 2002. Operating overhead increased 6% in fiscal 2002. Significant drivers of the increased

operating overhead included increased investment in our supply chain initiative, additional headcount to support

our golf and European businesses due to business growth, additional expense for compensation programs tied to

our profitability and stock performance, and costs for additional retail stores primarily in our EMEA and Asia

Pacific regions.

Demand creation expense was $1,027.9 million in fiscal 2002 versus $998.2 million in fiscal 2001, which was

consistent between years as a percentage of revenues. Our fiscal 2002 demand creation expense reflected incremental

spending for our World Cup 2002 marketing campaign, which began in the fourth quarter of fiscal 2002.

Interest expense decreased 19%, from $58.7 million in fiscal 2001 to $47.6 million in fiscal 2002. The

decrease reflected both lower interest rates and lower average debt levels, as we used cash flow from operations

to reduce total debt.

Other income/expense was a net expense of $3.0 million in fiscal 2002 versus a net expense of $34.1 million

in fiscal 2001. Significant amounts included in other income/expense included interest income, profit sharing

expense, goodwill amortization, certain foreign currency gains and losses, and asset disposal gains/losses. Net

other expense decreased between years as the fiscal 2001 amount included charges for contractual settlements

that did not recur in fiscal 2002. In addition, fiscal 2002 other income/expense included credits related to the

favorable resolution of some outstanding claims.

Our fiscal 2002 effective tax rate was 34.3% as compared to 36.0% in fiscal 2001. As required by U.S.

generally accepted accounting principles, we do not accrue a U.S. tax liability on foreign earnings permanently

invested offshore. The lower effective tax rate in fiscal 2002 is primarily the result of a larger amount of foreign

earnings permanently invested offshore in fiscal 2002 than in fiscal 2001.

Recently Issued Accounting Standards

In June 2001, the Financial Accounting Standards Board (FASB) issued SFAS No. 143, “Accounting for

Asset Retirement Obligations” (FAS 143). This statement requires that a liability for an asset retirement

obligation be recognized at fair value in the period the obligation is incurred and the associated retirement costs

be capitalized as part of the carrying amount of the related tangible long-lived asset. All provisions of this

statement will be effective for the Company on June 1, 2003. We do not expect that the adoption of FAS 143 will

have a material impact on our consolidated financial position or results of operations.

In June 2002, the FASB issued SFAS No. 146 “Accounting for Costs Associated with Exit or Disposal

Activities” (FAS 146). This statement supercedes Emerging Issues Task Force (EITF) Issue No. 94-3 “Liability

Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including Certain

Costs Incurred in a Restructuring),” FAS 146 requires that a liability for a cost associated with an exit or disposal

activity be recognized when the liability is incurred. Under EITF 94-3, a liability was recognized at the date an

entity committed to an exit plan. FAS 146 also establishes that the liability should initially be measured and

recorded at fair value. The provisions of FAS 146 are effective for any exit and disposal activities initiated after

26