Nike 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

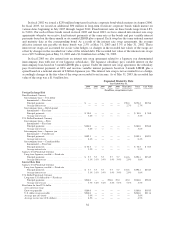

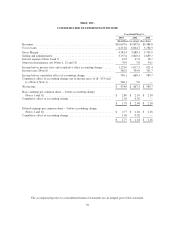

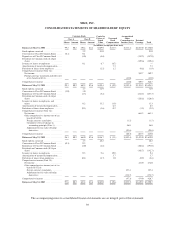

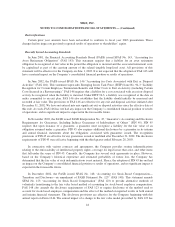

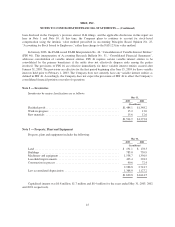

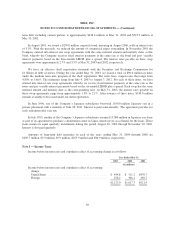

NIKE, INC.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Capital in

Excess of

Stated

Value

Accumulated

Other

Comprehensive

Income (Loss)

Common Stock

Unearned

Stock

Compensation

Class A Class B Retained

EarningsShares Amount Shares Amount Total

(In millions, except per share data)

Balance at May 31, 2000 ............... 99.2 $0.2 170.4 $2.6 $369.0 $(11.7) $(111.1) $2,887.0 $3,136.0

Stock options exercised ................. 2.9 91.0 91.0

Conversion to Class B Common Stock ..... (0.1) 0.1 —

Repurchase of Class B Common Stock ..... (4.0) (4.8) (152.2) (157.0)

Dividends on Common stock ($.48 per

share) ............................. (129.6) (129.6)

Issuance of shares to employees .......... 0.1 6.7 (6.7) —

Amortization of unearned compensation .... 7.3 7.3

Forfeiture of shares from employees ....... (2.5) 1.2 (0.6) (1.9)

Comprehensive income (Note 14):

Net income ......................... 589.7 589.7

Foreign currency translation and other (net

of tax benefit of $2.4) ............... (41.0) (41.0)

Comprehensive income ................. (41.0) 589.7 548.7

Balance at May 31, 2001 ............... 99.1 $0.2 169.5 $2.6 $459.4 $ (9.9) $(152.1) $3,194.3 $3,494.5

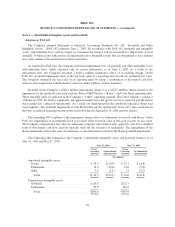

Stock options exercised ................. 1.7 72.9 72.9

Conversion to Class B Common Stock ..... (1.0) 1.0

Repurchase of Class B Common Stock ..... (4.3) (5.2) (232.5) (237.7)

Dividends on Common stock ($.48 per

share) ............................. (128.6) (128.6)

Issuance of shares to employees and

others ............................. 0.2 13.2 (1.9) 11.3

Amortization of unearned compensation .... 6.5 6.5

Forfeiture of shares from employees ....... (0.1) (1.6) 0.2 (1.5) (2.9)

Comprehensive income (Note 14):

Net income ......................... 663.3 663.3

Other comprehensive income (net of tax

benefit of $13.0):

Foreign currency translation ......... (1.5) (1.5)

Cumulative effect of change in

accounting principle (Note 1) ....... 56.8 56.8

Adjustment for fair value of hedge

derivatives ..................... (95.6) (95.6)

Comprehensive income ................. (40.3) 663.3 623.0

Balance at May 31, 2002 ............... 98.1 $0.2 168.0 $2.6 $538.7 $ (5.1) $(192.4) $3,495.0 $3,839.0

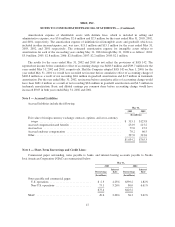

Stock options exercised ................. 1.3 48.2 48.2

Conversion to Class B Common Stock ..... (0.3) 0.3 —

Repurchase of Class B Common Stock ..... (4.0) (4.8) (186.2) (191.0)

Dividends on Common stock ($.54 per

share) ............................. (142.7) (142.7)

Issuance of shares to employees .......... 0.3 9.6 (0.2) 9.4

Amortization of unearned compensation .... 3.7 3.7

Forfeiture of shares from employees ....... (0.1) (2.7) 1.0 (0.9) (2.6)

Comprehensive income (Note 14):

Net income ......................... 474.0 474.0

Other comprehensive income (net of tax

benefit of $72.8):

Foreign currency translation ......... 127.4 127.4

Adjustment for fair value of hedge

derivatives ..................... (174.7) (174.7)

Comprehensive income ................. (47.3) 474.0 426.7

Balance at May 31, 2003 ............... 97.8 $0.2 165.8 $2.6 $589.0 $ (0.6) $(239.7) $3,639.2 $3,990.7

The accompanying notes to consolidated financial statements are an integral part of this statement.

39