Nike 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in goodwill and other indefinite-lived intangible asset tests may be based upon a number of factors, including our

assumptions about the expected future operating performance of our reporting units. Our estimates may change

in future periods due to, among other things, technological change, economic conditions, changes to our business

operations or inability to meet business plans. Such changes may result in impairment charges recorded in future

periods.

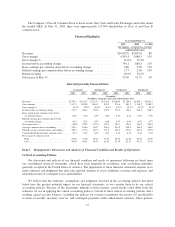

As discussed further below, upon adoption of FAS 142, we recorded an impairment charge related to

goodwill and other indefinite-lived intangible assets of $266.1 million. This charge is shown on our consolidated

statement of income as the cumulative effect of accounting change. In future periods, any goodwill impairment

charges would be classified as a separate line item on our consolidated statement of income as part of income

before income taxes and cumulative effect of accounting change. Other indefinite-lived intangible asset

impairment charges would be classified as other expense.

Intangible assets that are determined to have definite lives will continue to be amortized over their useful

lives and are measured for impairment only when events or circumstances indicate the carrying value may be

impaired. In these cases, we estimate the future undiscounted cash flows to be derived from the asset to

determine whether or not a potential impairment exists. If the carrying value exceeds our estimate of future

undiscounted cash flows, we then calculate the impairment as the excess of the carrying value of the asset over

our estimate of its fair value. Any impairment charges would be classified as other expense.

Hedge Accounting for Derivatives

We use forward exchange contracts and option contracts to hedge certain anticipated foreign currency

exchange transactions, as well as any resulting receivable or payable balance. When specific criteria required by

SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,” have been met, changes in fair

values of hedge contracts relating to anticipated transactions are recorded in other comprehensive income rather

than net income until the underlying hedged transaction affects net income. In most cases, this results in gains

and losses on hedge derivatives being released from other comprehensive income into net income some time

after the maturity of the derivative. One of the criteria for this accounting treatment is that the forward exchange

contract amount should not be in excess of specifically identified anticipated transactions. By their very nature,

our estimates of anticipated transactions may fluctuate over time and may ultimately vary from actual

transactions. When anticipated transaction estimates or actual transaction amounts decrease below hedged levels,

or when the timing of transactions changes significantly, we are required to reclassify at least a portion of the

cumulative changes in fair values of the related hedge contracts from other comprehensive income to other

income/expense during the quarter in which such changes occur. Once an anticipated transaction estimate or

actual transaction amount decreases below hedged levels, we make adjustments to the related hedge contract in

order to reduce the amount of the hedge contract to that of the revised anticipated transaction.

Taxes

We record valuation allowances against our deferred tax assets, when necessary, in accordance with SFAS

No. 109, “Accounting for Income Taxes.” Realization of deferred tax assets (such as net operating loss

carryforwards) is dependent on future taxable earnings and is therefore uncertain. At least quarterly, we assess

the likelihood that our deferred tax asset balance will be recovered from future taxable income. To the extent we

believe that recovery is not likely, we establish a valuation allowance against our deferred tax asset, increasing

our income tax expense in the year such determination is made.

In addition, we have not recorded U.S. income tax expense for foreign earnings that we have declared as

indefinitely reinvested offshore, thus reducing our overall income tax expense. The amount of earnings

designated as indefinitely reinvested offshore is based upon the actual deployment of such earnings in our

offshore assets and our expectations of the future cash needs of our U.S. and foreign entities. Income tax

considerations are also a factor in determining the amount of foreign earnings to be indefinitely

reinvested offshore.

18