Nike 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

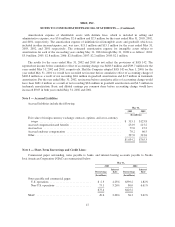

term debt, including current portion, is approximately $818.4 million at May 31, 2003 and $723.9 million at

May 31, 2002.

In August 2001, we issued a $250.0 million corporate bond, maturing in August 2006, with an interest rate

of 5.5%. With the proceeds, we reduced the amount of commercial paper outstanding. In November 2001 the

Company entered into interest rate swap agreements with the same notional amount and maturity dates as this

bond, whereby the Company receives fixed interest payments at the same rate as the bond and pays variable

interest payments based on the three-month LIBOR plus a spread. The interest rates payable on these swap

agreements were approximately 2.7% and 3.3% at May 31, 2003 and 2002, respectively.

We have an effective shelf registration statement with the Securities and Exchange Commission for

$1 billion of debt securities. During the year ended May 31, 2003, we issued a total of $90.0 million in notes

under the medium term note program of the shelf registration. The notes have coupon rates that range from

4.80% to 5.66%. The maturities range from July 9, 2007 to August 7, 2012. For each of these notes, we have

entered into interest rate swap agreements whereby we receive fixed interest payments at the same rate as the

notes and pay variable interest payments based on the six-month LIBOR plus a spread. Each swap has the same

notional amount and maturity date as the corresponding note. At May 31, 2003, the interest rates payable on

these swap agreements range from approximately 1.8% to 2.1%. After issuance of these notes, $910.0 million

remains available to be issued under our shelf registration.

In June 1996, one of the Company’s Japanese subsidiaries borrowed 10,500 million Japanese yen in a

private placement with a maturity of June 26, 2011. Interest is paid semi-annually. The agreement provides for

early retirement after year ten.

In July 1999, another of the Company’s Japanese subsidiaries assumed 13,000 million in Japanese yen loans

as part of its agreement to purchase a distribution center in Japan, which serves as collateral for the loans. These

loans mature in equal quarterly installments during the period August 20, 2001 through November 20, 2020.

Interest is also paid quarterly.

Amounts of long-term debt maturities in each of the years ending May 31, 2004 through 2008 are

$205.7 million, $5.9 million, $5.9 million, $255.9 million and $30.9 million, respectively.

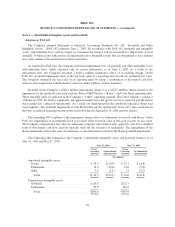

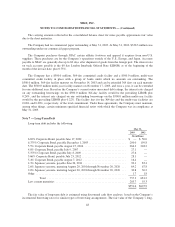

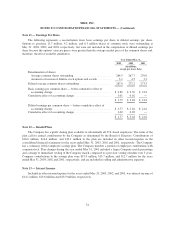

Note 8 — Income Taxes

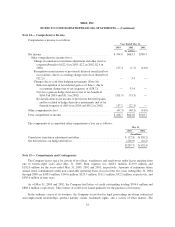

Income before income taxes and cumulative effect of accounting change is as follows:

Year Ended May 31,

2003 2002 2001

(In millions)

Income before income taxes and cumulative effect of accounting

change:

United States ......................................... $ 444.8 $ 511.2 $470.7

Foreign .............................................. 678.2 506.1 450.7

$1,123.0 $1,017.3 $921.4

49