Nike 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

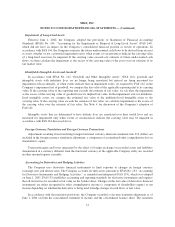

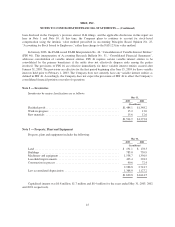

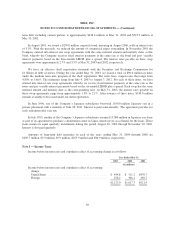

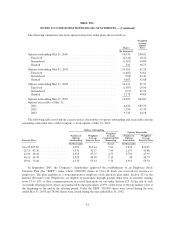

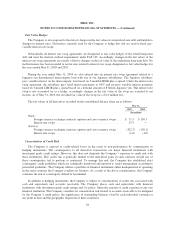

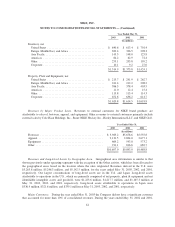

A reconciliation from the U.S. statutory federal income tax rate to the effective income tax rate follows:

Year Ended May 31,

2003 2002 2001

Federal income tax rate ............................................ 35.0% 35.0% 35.0%

State taxes, net of federal benefit ..................................... 2.5 2.2 2.4

Foreign earnings .................................................. (2.7) (3.1) (1.8)

Other,net ....................................................... (0.7) 0.2 0.4

Effective income tax rate ........................................... 34.1% 34.3% 36.0%

The Company has indefinitely reinvested approximately $526.1 million of the cumulative undistributed

earnings of certain foreign subsidiaries, of which $165.0 million was earned during the year ended May 31, 2003.

Such earnings would be subject to U.S. taxation if repatriated to the U.S. The amount of unrecognized deferred

tax liability associated with the permanently reinvested cumulative undistributed earnings was approximately

$126.7 million.

Deferred tax assets at May 31, 2003 and 2002 were reduced by a valuation allowance relating to tax benefits

attributable to net operating losses of certain foreign subsidiaries where local tax laws limit the utilization of such

net operating losses.

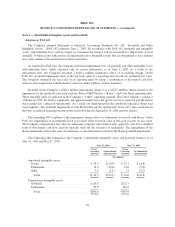

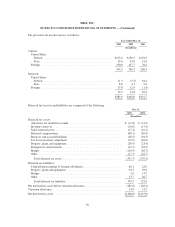

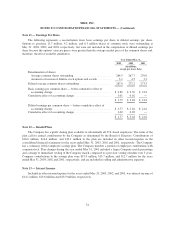

A benefit was recognized for foreign loss carryforwards of $65.0 million at May 31, 2003. Such losses

expire as follows (millions):

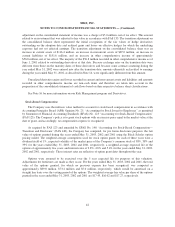

Year Ended May 31, 2004 2005 2006 2007 2008 Indefinite

Expiration Amount ........................... 1.2 1.4 0.0 8.3 9.9 44.2

During the years ended May 31, 2003, 2002, and 2001 income tax benefits attributable to employee stock

option transactions of $12.5 million, $13.9 million, and $32.4 million, respectively, were allocated to

shareholders’ equity.

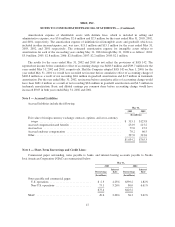

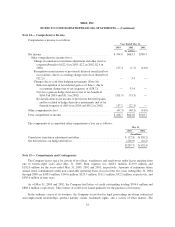

Note 9 — Redeemable Preferred Stock

NIAC is the sole owner of the Company’s authorized Redeemable Preferred Stock, $1 par value, which is

redeemable at the option of NIAC or the Company at par value aggregating $0.3 million. A cumulative dividend

of $0.10 per share is payable annually on May 31 and no dividends may be declared or paid on the common

stock of the Company unless dividends on the Redeemable Preferred Stock have been declared and paid in full.

There have been no changes in the Redeemable Preferred Stock in the three years ended May 31, 2003. As the

holder of the Redeemable Preferred Stock, NIAC does not have general voting rights but does have the right to

vote as a separate class on the sale of all or substantially all of the assets of the Company and its subsidiaries, on

merger, consolidation, liquidation or dissolution of the Company or on the sale or assignment of the NIKE

trademark for athletic footwear sold in the United States.

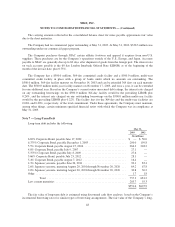

Note 10 — Common Stock

The authorized number of shares of Class A Common Stock, no par value, and Class B Common Stock, no

par value, are 110 million and 350 million, respectively. Each share of Class A Common Stock is convertible into

one share of Class B Common Stock. Voting rights of Class B Common Stock are limited in certain

circumstances with respect to the election of directors.

51